$500 Million Flowed Into Bitcoin Etfs In A Single Day.

- Posted on June 7, 2024 11:46 AM

- Cryipto News

- 686 Views

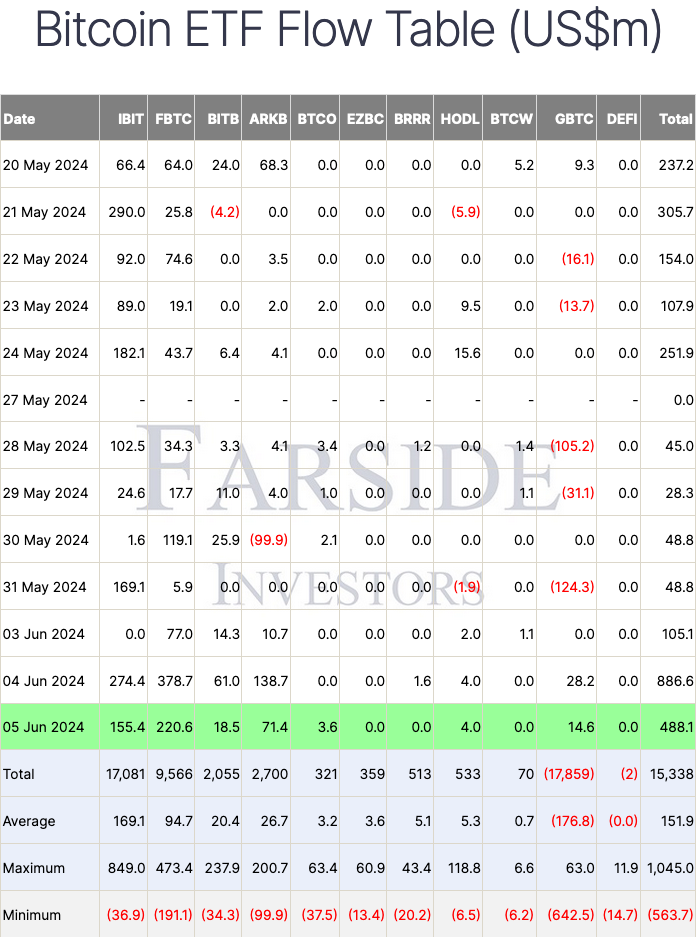

Over $488 million was invested in U.S. Bitcoin ETFs in one day, yet Google Trends data shows that searches related to Bitcoin and cryptocurrencies are still significantly lower than the peak levels of 2021.

U.S. spot Bitcoin exchange-traded funds (ETFs) experienced a capital inflow of $488.1 million on June 5th, but Google data indicates that search volume is significantly lower compared to the bull run in 2021. This suggests that individual investors may not have entered this space yet.

Among the ETFs, Fidelity Wise Origin Bitcoin Fund (FBTC) attracted the most capital with a record inflow of $220.6 million on June 4th.

BlackRock's iShares Bitcoin Trust (IBIT) ranked second with $155.4 million, while Grayscale Bitcoin Trust (GBTC), which has seen net outflows of $17.8 billion since January, drew attention with a net capital inflow of $14.6 million.

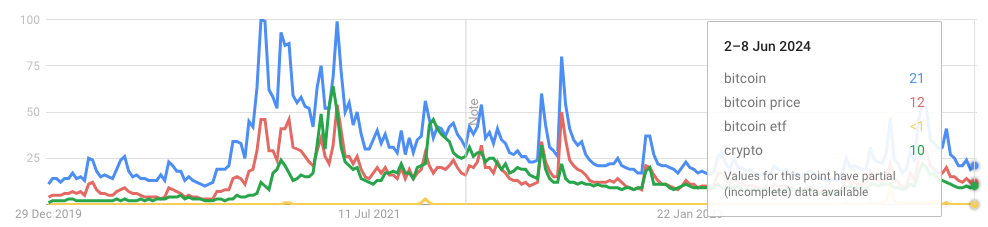

Despite the price of Bitcoin surpassing $71,000 and strong inflows into ETFs, Google Trends data reveals that compared to 2021, Americans are hardly searching for Bitcoin, Bitcoin ETFs, their prices, or cryptocurrencies in general.

Google Trends evaluates search interest on a scale of up to 100 points. As of June 5th, searches for "Bitcoin" from the U.S. scored 31, while searches for "Bitcoin ETF" scored only 1 point. This suggests a low level of general interest and indicates that investors may not yet be actively engaging with the topic.

Despite higher index scores such as 18 for "Bitcoin price" and 13 for "crypto" searches, these scores still remain significantly below the levels seen during the individual investor-focused bull market period of 2021.

Days like January 11th, when the U.S. approved ten spot Bitcoin ETFs, and March 5th, when Bitcoin first surpassed $69,000 since 2021, witnessed increased overall interest. However, search volumes for crypto declined throughout the year.

Search interest for "Bitcoin" peaked in May 2021, during which BTC had recently surpassed $50,000 for the first time and reached approximately $69,000 in November 2021, its all-time high.

Crypto analyst Miles Deutscher shared in a post on June 6th that despite Bitcoin surpassing its previous peak, viewership of crypto content on YouTube has significantly decreased compared to 2021.

During the peak of Bitcoin in 2021, daily views of crypto videos on YouTube were around 4 million, but with BTC reaching new highs, this number dropped to around 800,000 daily in 2024.

Deutscher stated, "Individual investors have not yet returned. There is no better indicator of the current state of the market in the world than crypto [YouTube] views."

You can stay up to date with the latest developments and news in the cryptocurrency markets at Kriptospot.com.