A Well-Known Analyst Has Stated That The Risky Period For Bitcoin Has Ended.

- Posted on May 15, 2024 6:16 AM

- Cryipto News

- 654 Views

Bitcoin may enter an accumulation phase again following a 23% decline after the halving.

A cryptocurrency analyst suggested that Bitcoin may have exited the "danger zone" after the halving.

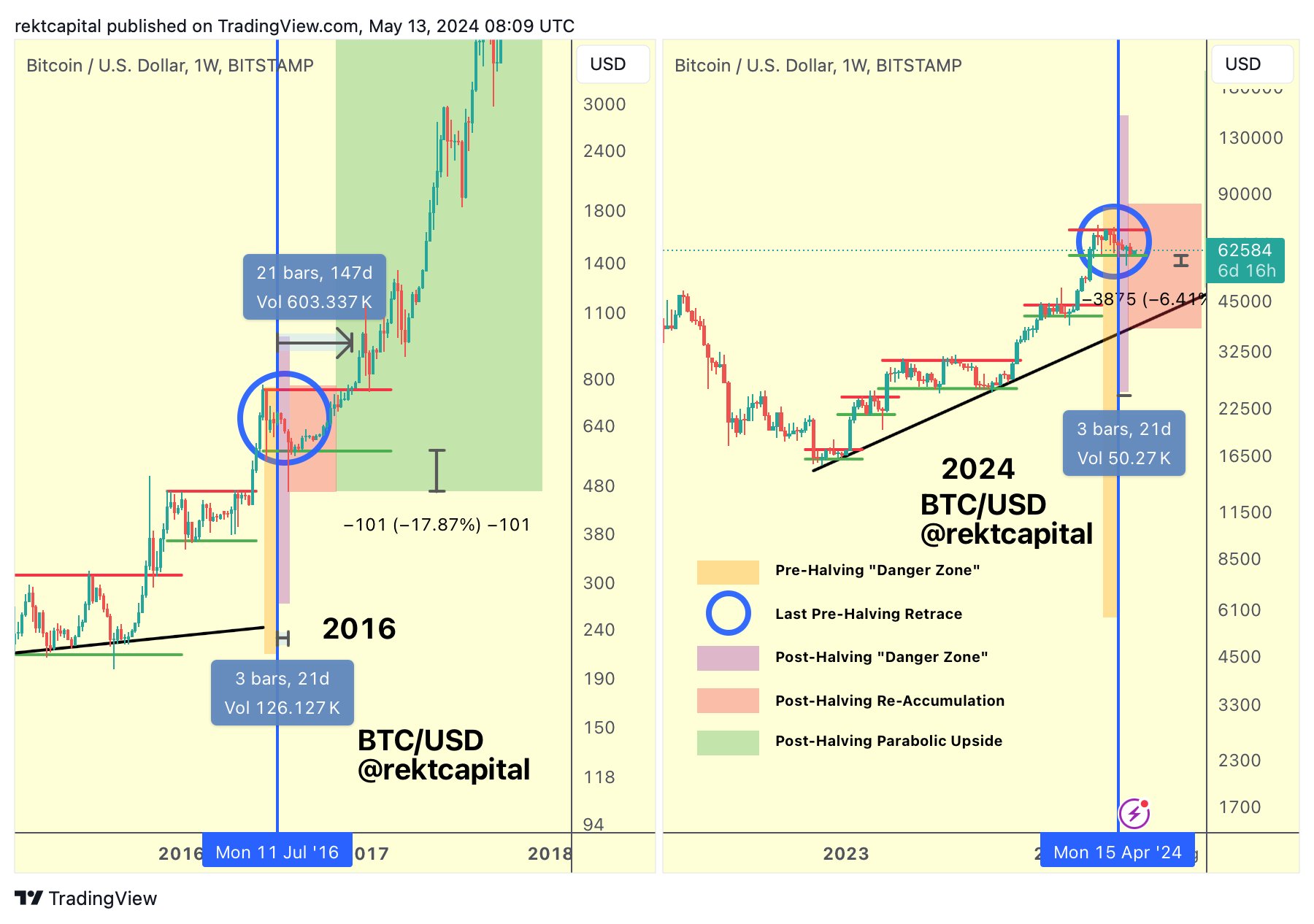

"Rekt Capital," a crypto analyst, updated on May 13, stating that the post-halving correction phase has ended, leaving the danger zone behind.

The analyst remarked, "Bitcoin is now celebrating with a strong rise due to accumulation and solid bottom support."

Periods of danger zones before and after halving have corresponded with declines in Bitcoin in past years.

Currently, Bitcoin has fallen 23% from its mid-March peak, reaching $56,800 on May 1. According to the analyst, if $56,000 is not the bottom, this could extend to 63 days, making it the longest withdrawal period in this cycle.

Historical data suggested that such a pullback was expected to end at $56,000 within 47 days.

BTC's current position, rising above $63,000, supports the re-accumulation zone analysis.

Past cycle movements may not always be a definitive indicator of future movements. In the post-halving period, prices might face further pullbacks.

However, the analyst is confident that the current support levels will hold:

"Bitcoin is showing signs of slowing selling pressure and is trading around $60,000."

For BTC's rise, maintaining this level is crucial. Rekt Capital believes the price will reach $68,000 in the short term.

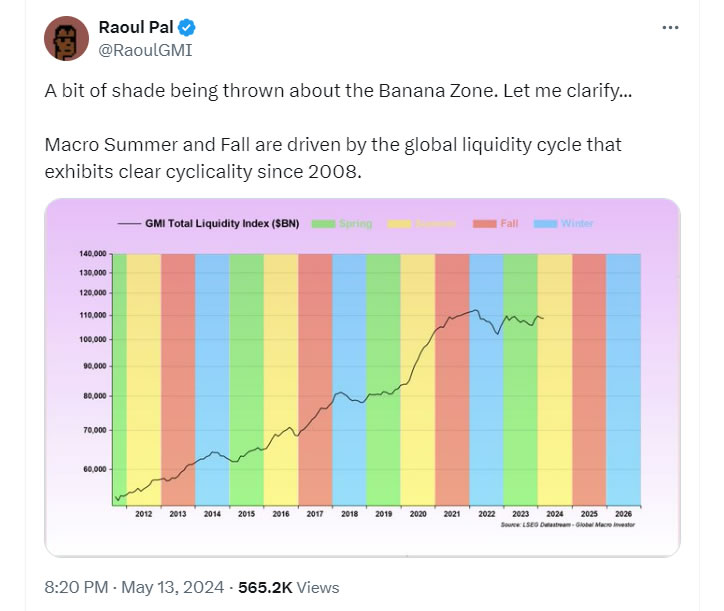

Raoul Pal, founder of Global Macro Investor, stated in a May 13 post on X, "The global liquidity cycle will define the summer and autumn."

In early May, former BitMEX CEO Arthur Hayes believed that the markets would likely undergo a period of consolidation before picking up momentum again towards the end of 2024.

Hayes suggested the possibility of a liquidity injection from the Fed's monetary policy towards riskier assets like cryptocurrencies.

You can stay up to date with developments and the latest news in the cryptocurrency markets by following Kriptospot.com in real time.