After The Release Of Macroeconomic Data In The Us, Bitcoin (Btc) Surpasses $41,000.

- Posted on December 13, 2023 8:37 PM

- Cryipto News

- 521 Views

The US Producer Price Index (PPI) Reveals Falling Inflation, While Investor Interest in Bitcoin Persists.

Bitcoin Surpasses $41,000 on December 13th, Shifting Investor Focus to the Federal Reserve at Wall Street's Opening.

The Producer Price Index (PPI) Target is Reached, and the data obtained shows that Bitcoin gained value alongside the latest macroeconomic data from the United States.

November PPI data came in below expectations, further strengthening the narrative of decreasing inflation. While the Consumer Price Index (CPI) pressure has been somewhat subdued, it hasn't caused any trouble for risky assets.

According to trading source The Kobeissi Letter, 'This is the lowest PPI inflation seen since December 2021.'

'Since the last Fed meeting, we have witnessed numerous positive inflation pressures. All eyes are on the Fed today, with a potential 'Fed pivot' signal.'

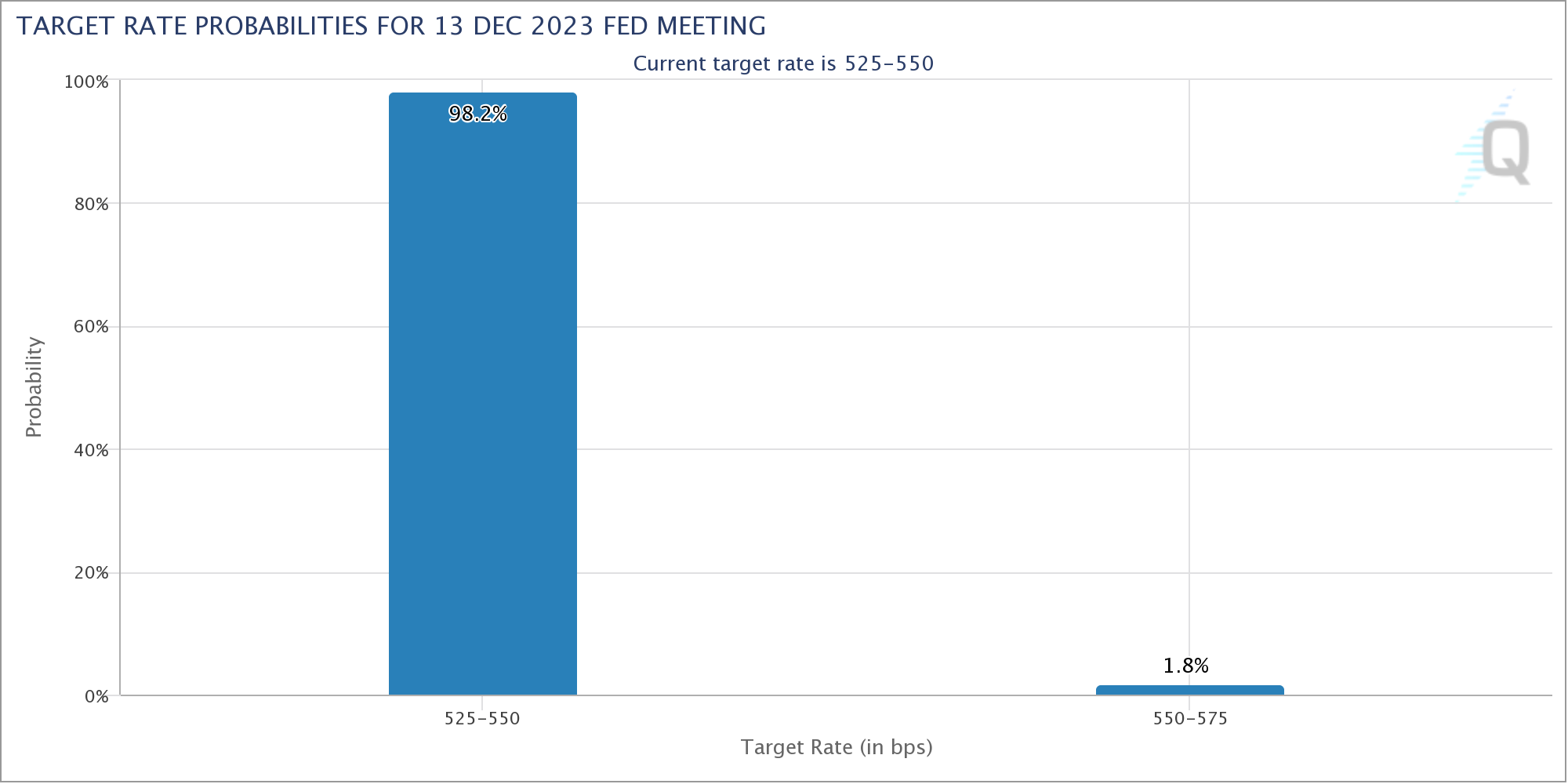

Kobeissi referred to the most significant macro event of the week, the FOMC meeting, and the decision on interest rate changes. The decision will be announced at 21:00 UTC, and Fed Chairman Jerome Powell will hold a press conference at 21:30 UTC.

While both events tend to trigger temporary volatility in the crypto sector, Bitcoin did not show a significant reaction to the macroeconomic data.

According to data from CME Group's FedWatch Tool, as of the time of writing, markets are convinced that there will be no interest rate changes as a result of the FOMC meeting.

Investors continue to monitor crucial BTC price levels. The price movement of Bitcoin has not yet formed a clear trend.

With popular trader Jelle emphasizing the importance of the $48,000 overall resistance, current support and resistance levels seem to remain unchanged.

"There may be a volatile appearance on lower timeframes, but Bitcoin seems to be changing the mid-level. The $48,000 level is still a resistance level that needs to be overcome, and new price discoveries may be very close after that." he said.

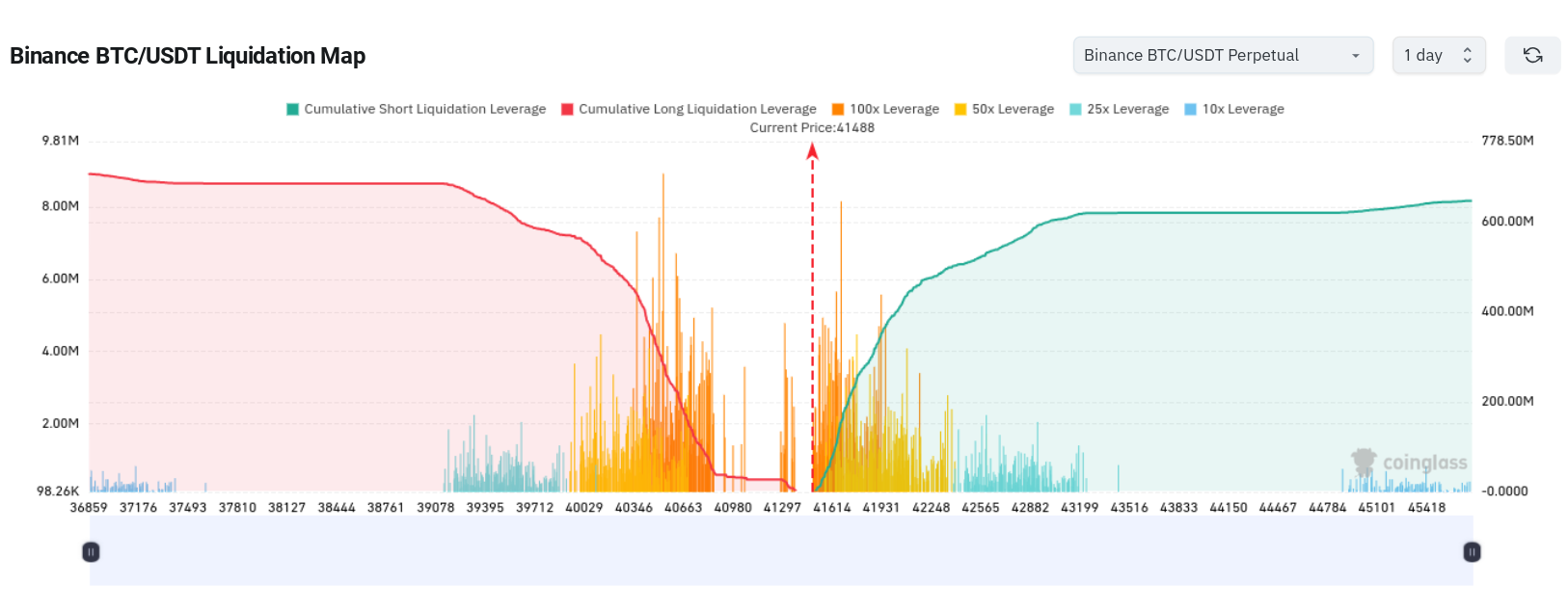

Another trader, Daan Crypto Trades, mentioned that the spot price is currently undergoing a consolidation process, and leveraged bets are increasing.

The trader also noted the formation of significant liquidation clusters.

"Most importantly, the $40,500 and $41,400 levels. We expect some movement around these levels."