"Aftermath Of The Collapse: Allegations Of A 'Planned Attack' On The Crashed Altcoin"

- Posted on November 20, 2023 1:46 AM

- Cryipto News

- 578 Views

Antonio Juliano, the founder of dYdX, stated that both the decentralized exchange and the Yearn.Finance token were victims of a planned attack.

Decentralized exchange dYdX had to use its insurance fund to cover a $9 million user liquidation on November 17th. According to dYdX founder Antonio Juliano, the losses were a result of a planned attack on the exchange.

According to the dYdX team's report, the v3 insurance fund was used to "fill gaps in the liquidation processes in the YFI market." Yearn.Finance (YFI) token experienced a drop of over 43% on November 17th after gaining approximately 170% in value in the previous weeks, leading to concerns of a "rug pull" within the crypto community.

The attack targeted long positions in YFI tokens on the exchange, resulting in the liquidation of positions worth around $38 million. Juliano believes that the sharp drop in YFI, along with the commercial losses affecting dYdX, originated from market manipulation:

"This was clearly a planned attack on dYdX. YFI manipulation was included in this plan. We are conducting research with several partners, and we will be transparent about our findings."

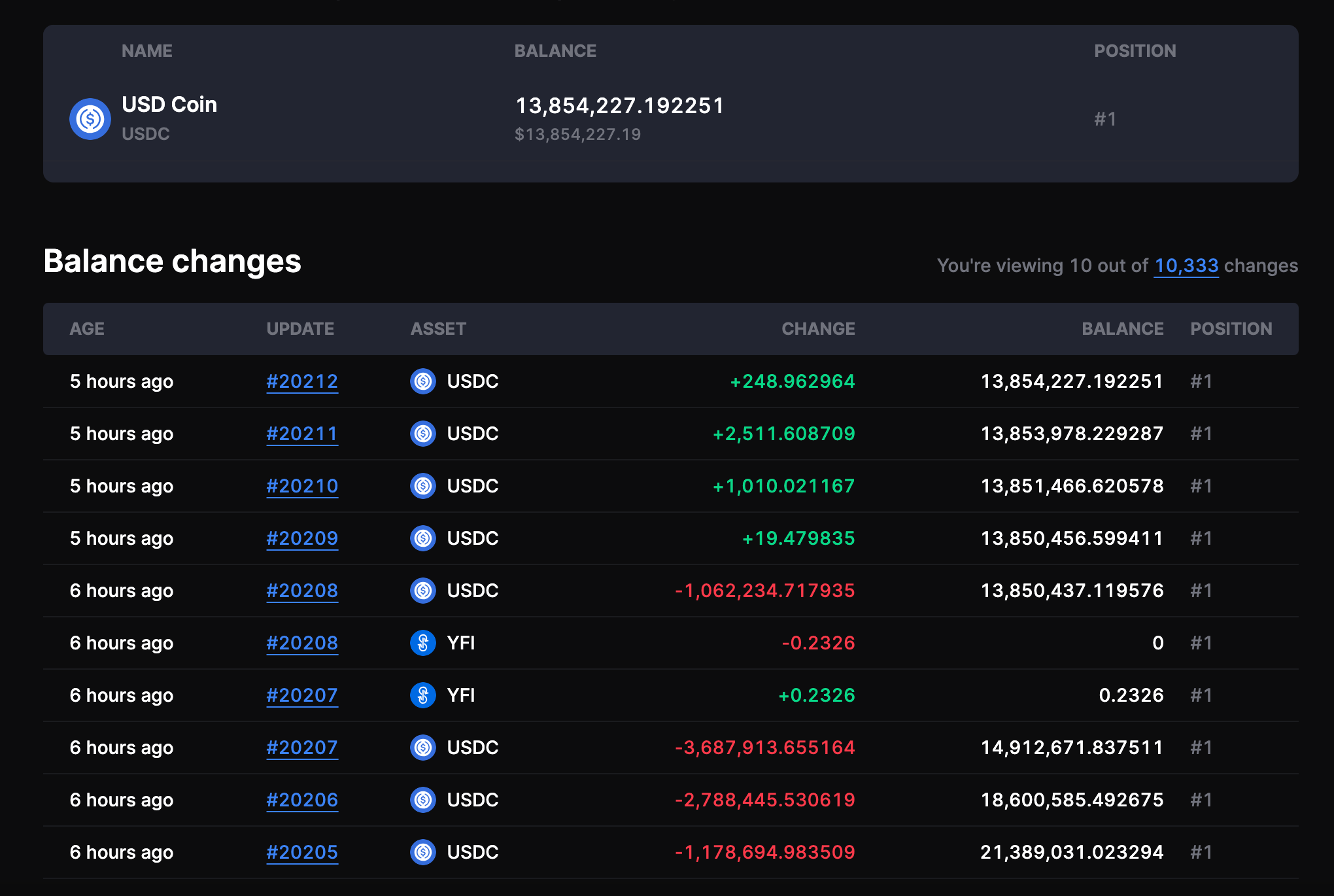

According to Juliano, there is still $13.5 million in the v3 insurance fund, and user funds were not affected by the situation. He stated, "While no user funds were affected, we will thoroughly review our risk parameters and make appropriate changes both in v3 and potentially on the dYdX Chain if necessary."