Approval Granted For The Sale Of $873 Million To Ftx

- Posted on December 1, 2023 12:32 AM

- Cryptocurrency Exchanges News

- 561 Views

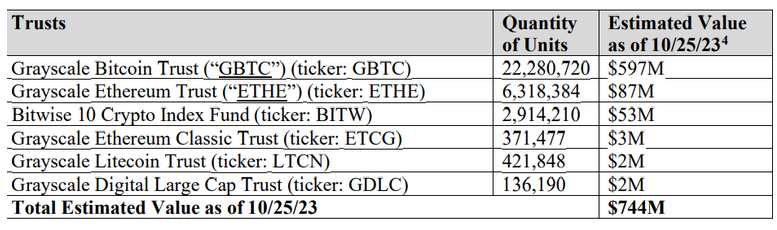

A significant portion of the $873 million in assets approved for sale by FTX is represented by Grayscale's flagship product, the Grayscale Bitcoin Trust (GBTC), with an approximate value of $700 million.

Following the bankruptcy filing on November 29, the insolvent crypto exchange FTX has received permission from the Delaware bankruptcy court to sell approximately $873 million in trust assets to repay creditors affected by the exchange's collapse in 2022.

These assets consist of various trust shares, with approximately $700 million in value representing Grayscale Investments, a crypto asset manager, and an additional $66 million expected from Bitwise, a custody service provider. Although the court document referred to $744 million in assets as of October 25, 2023, the total value of the assets has increased since that date.

Approximately four weeks after FTX debtors submitted a petition to Judge John Dorsey on November 3, requesting permission to sell six cryptocurrency trust shares, including Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust (ETHE), and Bitwise 10 Crypto Index Fund (BITW), approval has been granted.

As of now, FTX holds 22 million GBTC shares, valued at $691 million, making it the flagship Bitcoin product of Grayscale. Additionally, FTX has about 6.3 million ETHE shares, currently worth around $106 million.

Three other assets, Grayscale Ethereum Classic Trust (ETCG), Litecoin Trust (LTCN), and Digital Large Cap Trust (GDLC), are positioned as other assets that FTX can sell to compensate for the losses of its customers affected by bankruptcy.

FTX executives, led by Chairman John J Ray III, have been making efforts to recover assets since the collapse of Sam Bankman-Fried's former crypto empire in November 2022. So far, approximately $7 billion in assets have been recovered, and almost half of this amount ($3.4 billion) comes from cryptocurrencies. In June, FTX debtors estimated that the total value of misappropriated customer assets was $8.7 billion. Sam Bankman-Fried was convicted of seven fraud-related charges on November 2 and will begin serving his sentence on March 28.