Can Binance Coin (Bnb) Surpass $300 Based On Current Price Movements?

- Posted on December 28, 2023 12:36 AM

- Cryipto News

- 678 Views

BSC Chain has experienced an increase in investments and activities, but there are doubts about the sustainability of this momentum.

On December 26th, the native token of BSC Chain, Binance Coin (BNB), witnessed an 11% increase, reaching its highest level in the last six months. Despite struggling to surpass the $300 resistance, this rally successfully closed the market value gap opened by Solana.

Before December 23rd, BNB was positioned as the third-largest cryptocurrency, excluding stablecoins. However, SOL changed the situation with an impressive 50% surge within seven days, making it the third-largest. Now, the main question arises whether BNB can maintain its market value of over $46 billion to regain its third-place position. Both BSC Chain and Solana offer fast and cost-effective blockchain solutions without the need for layer 2 scaling, despite concerns about decentralization.

The significant portion of BNB's value comes from low transaction fees and Binance's private launchpad services. Initially, investors were fearful that the founder, Changpeng 'CZ' Zhao, accepting Federal charges in the US on November 21st, would rapidly diminish Binance's market share. This fear persisted until the resolution of the case and the decision that Binance needed to report all its transactions to an observer appointed by the Department of Justice. However, Binance's recent meeting with the US Commodity Futures Trading Commission (CFTC) on December 18th further reduced the risk of closure.

Nevertheless, BNB faces selling pressure due to the majority of the token's supply being held by Binance's founders and team. The lack of transparency regarding the initial distribution of BNB tokens, especially after changes to the token burning mechanism over the years, has eroded investor confidence. Binance's initial commitment to use revenues for buybacks was replaced by a simple burning mechanism.

The increase in DApp transactions and volume supports the BNB price. Various valuation models can be created for BNB, but none can accurately explain how most market participants assess benefits and risks. However, comparing how the network performs against rival chains can also be insightful. The active use of decentralized applications (DApps) on BNB Smart Chain indicates demand for the BNB token. The value of BNB is largely dependent on its usage within the BSC Chain, along with Binance's products and offerings.

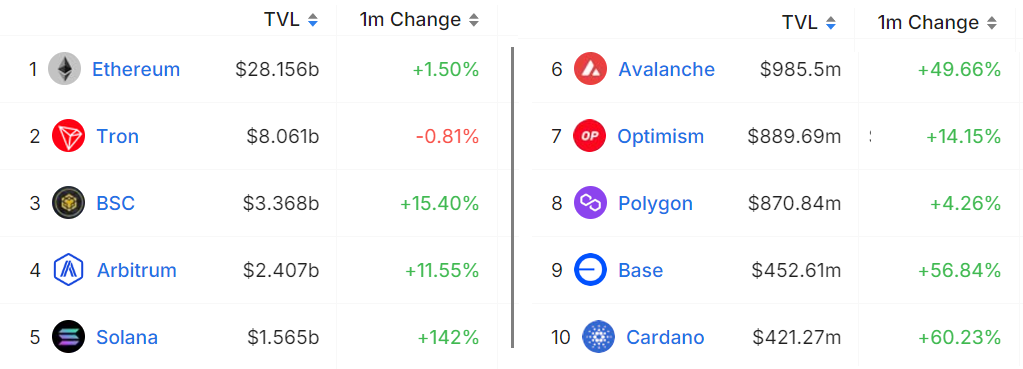

The total value locked (TVL) in smart contracts on the BSC Chain surpasses $3.6 billion, equivalent to only 13% of Ethereum's $28.2 billion value. Importantly, BSC Chain's TVL, which has grown by 25% in the last 30 days, surpasses the combined TVL of Ethereum's leading scaling solutions, including Arbitrum, Optimism, Polygon, and Base, totaling $4.6 billion. Meanwhile, competitors like Solana and Avalanche gained 142% and 50%, respectively, in the same period.

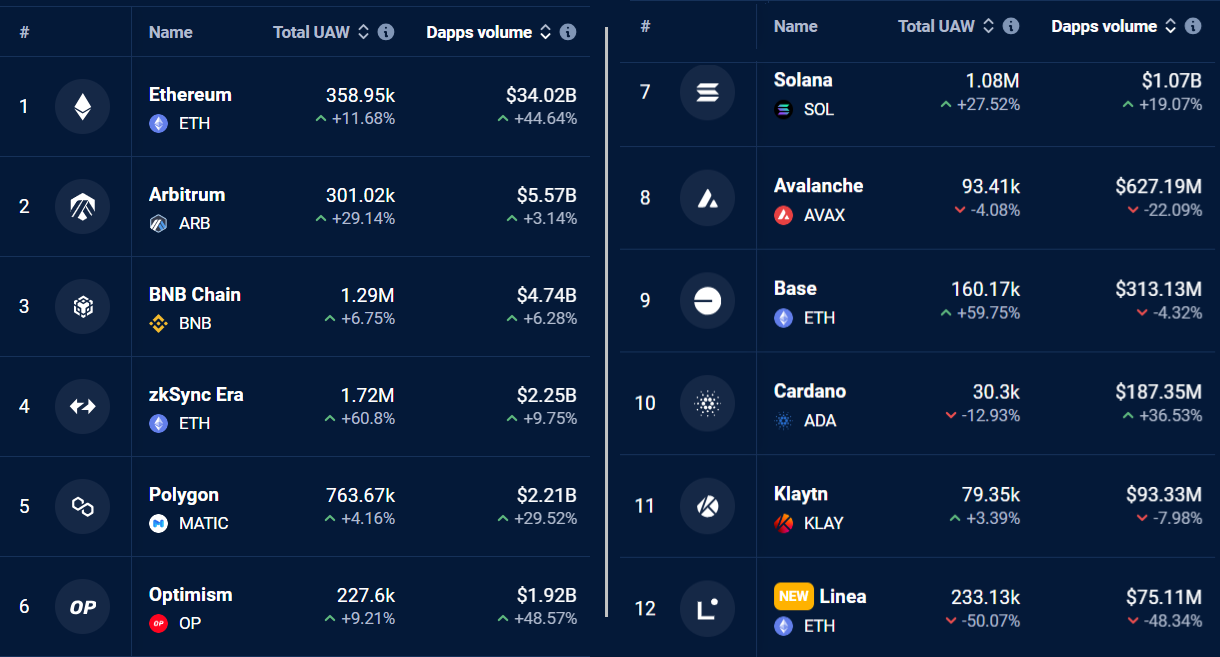

When analyzing networks focused on decentralized applications (DApps), both the number of addresses involved in smart contracts and the volume should be considered.

Ethereum and layer 2 scaling solutions, maintaining a volume of over $46.4 billion in the last 30 days, remain unrivaled in terms of volume, with Ethereum's base layer constituting 73% of this volume. In contrast, during the same period, BSC Chain accumulated a volume of $4.7 billion, showing only a 6% increase from the previous month. However, when considering active unique addresses (UAW), BSC Chain leads alongside Solana and zkSync. This raises questions about whether these figures accurately reflect the reality.

From a relative perspective, the 7% increase in the number of addresses interacting with DApps on BSC Chain in the last 30 days is concerning, especially when compared to Ethereum's 12% increase during the same period.

Similarly, Solana experienced a 28% increase in the UAW metric. Therefore, attributing the price increase of BNB solely to increased activity on BSC or an increase in TVL compared to other blockchains seems unlikely. This situation indicates that reclaiming the third position in terms of market value for BNB may be challenging unless network activity increases.