Bitcoin Network Fees Underwent A Complete Transformation After Halving.

- Posted on April 26, 2024 4:26 PM

- Cryipto News

- 793 Views

The increase in block fees on the day of the halving allowed miners to partially offset the revenue they lost after the reward halving, but now the situation has changed.

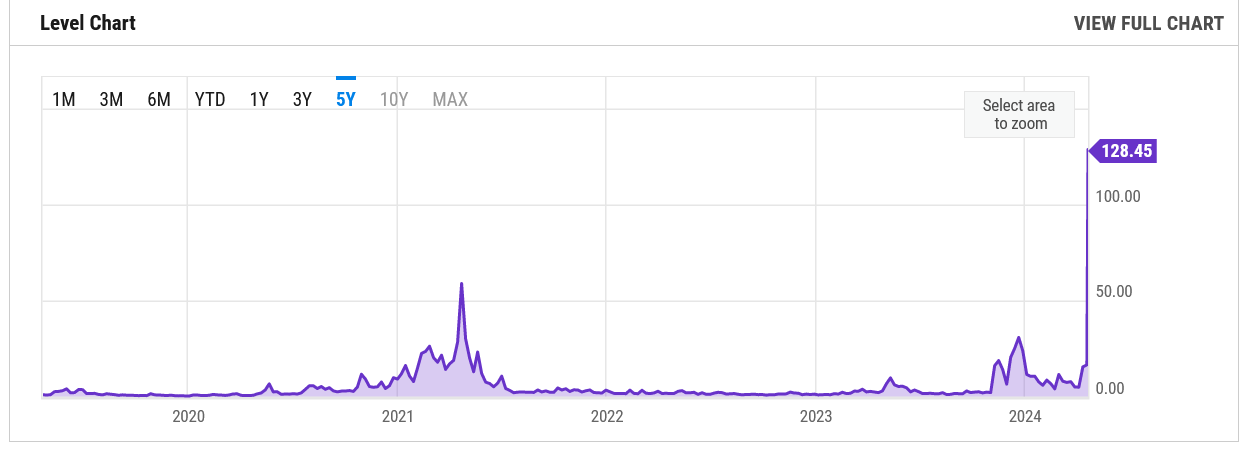

The average fees paid to Bitcoin reached a record high of $128 on April 20th, just one day after Bitcoin's fourth halving. However, they rapidly declined thereafter. According to Mempool.space, as of April 21st, Bitcoin fees dropped to an average of $8 to $10 for medium-priority transactions.

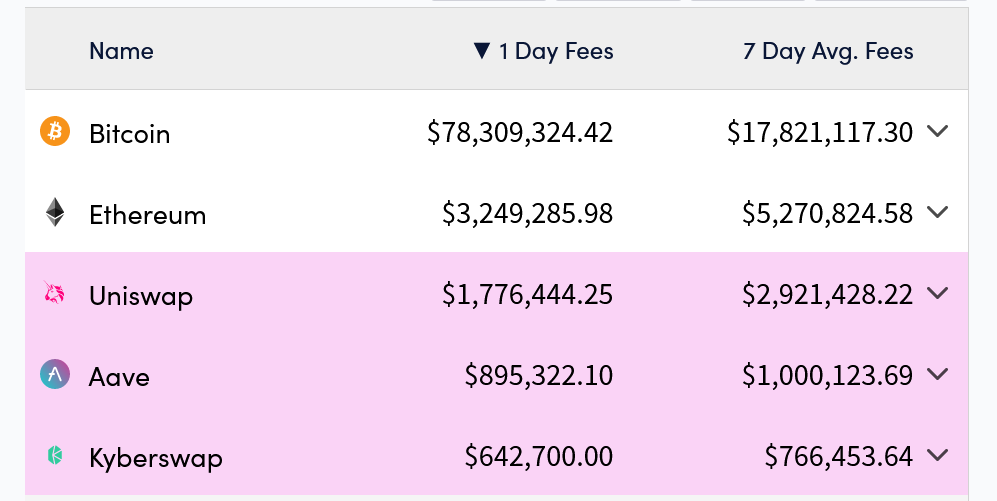

According to Crypto Fees, just one day ago, Bitcoin collected a total of $78.3 million in fees, surpassing Ethereum by more than 24 times.

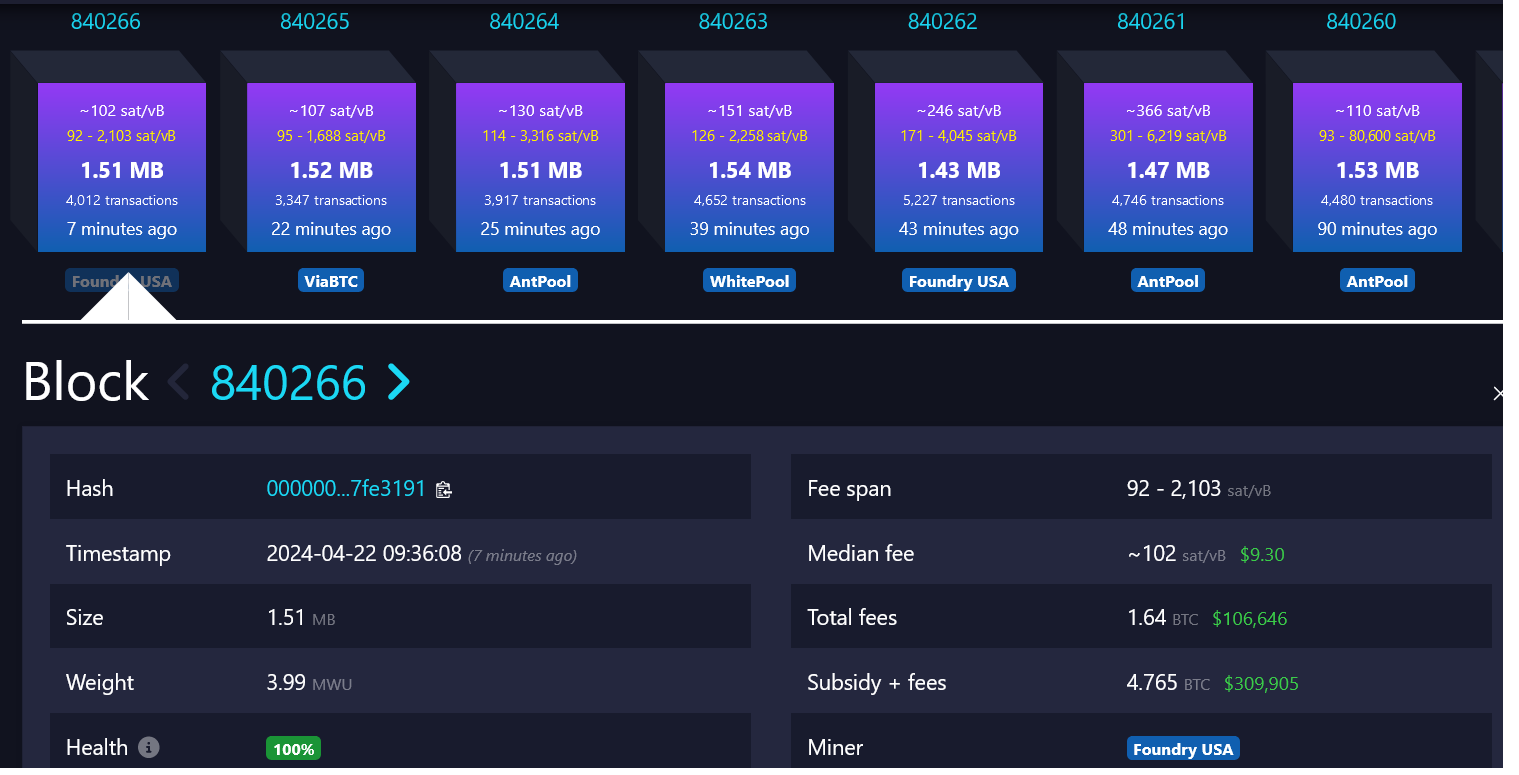

During the day, in the Bitcoin halving block at height 840,000, a payment of 37.7 Bitcoin (equivalent to $2.4 million) was made to the Bitcoin miner ViaBTC, making it the most demanded digital asset piece in the network's 15-year history.

Most of the demand in Block 840,000 came from enthusiasts of meme coins and non-fungible tokens (NFTs) competing to mint and write rare satoshis through the Runes protocol, a new token standard introduced during the halving block.

This block included 3,050 transactions, meaning an average user made approximately an $800 payment.

According to Mempool.space, high block fees persisted for approximately 840,200 blocks, but since then, block fees have dropped to around 1-2 Bitcoin.

The large block fee payments to miners on halving day initially weren't affected by the reduction in block rewards from 6.25 Bitcoin to 3.125 Bitcoin.

However, since the average block fee is now significantly below 3.125, the situation has changed.

Meanwhile, from April 15 to 20, Bitcoin fees outpaced Ethereum for six consecutive days, and the current 7-day average fee stands at around $17.8 million.

According to CoinGecko, the halving event did not significantly impact Bitcoin's price. Since the halving, BTC's price has increased only by 1.5%, reaching $64,840.

You can follow the latest developments and news in the cryptocurrency markets in real-time with Kriptospot.com.