Bitcoin Appears To Be Recovering After Fed's Interest Rate Decision

- Posted on March 22, 2024 12:01 AM

- Cryipto News

- 531 Views

The crypto market enters a recovery phase following the Fed's interest rate decision, leaving investors who had opened short positions facing losses.

Bitcoin shifts its direction upwards with a sharp recovery, providing bull investors with a 12% gain.

BTC Price Rises After FOMC Decision

Following a dramatic reversal the previous day, data shows the price stabilized within a narrow range.

Bitcoin responded positively to statements from the United States Federal Reserve, which decided to keep interest rates steady at current levels.

After the Federal Open Market Committee (FOMC) meeting, Fed Chairman Jerome Powell indicated that it would be reasonable to implement rate cuts within the year.

"The Committee believes it is not appropriate to lower the target range until there is more confidence that inflation is moving sustainably towards the 2% target."

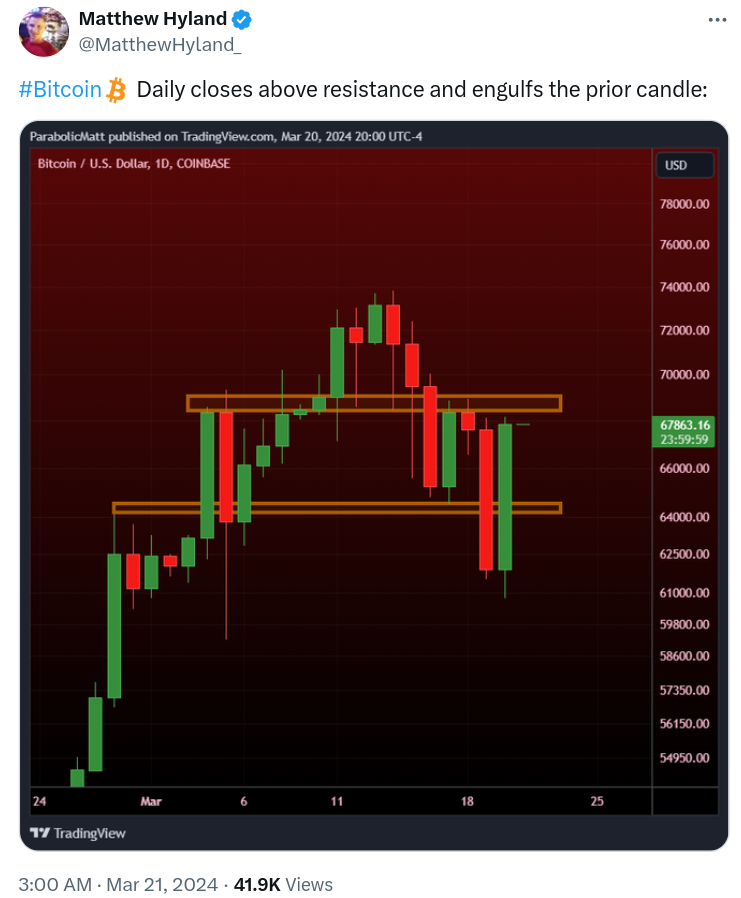

After testing the $60,000 support level once more, BTC experienced a swift rise towards $68,000, recovering its recent losses.

Famous analyst Jelle stated in his latest analysis on the X platform (formerly known as Twitter), "Today's goal: staying above $65,300."

"If successful, a return to the peak levels of the 2021 cycle could be on the agenda."

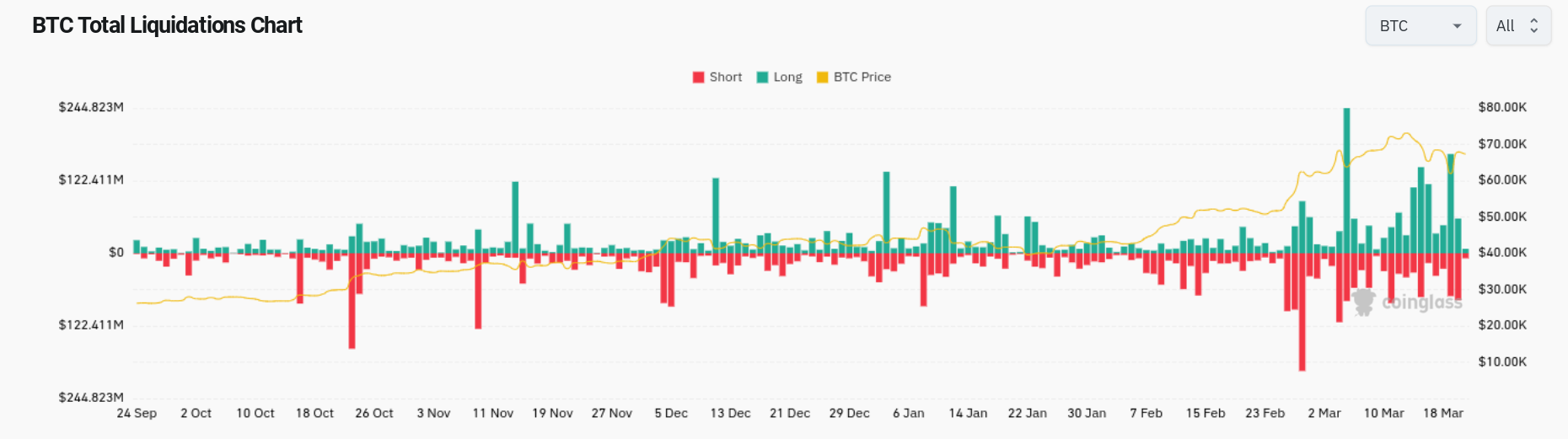

As expected, those who suffered during this fluctuation were generally investors who had taken short positions. According to information provided by the market analysis platform CoinGlass, a total of $70 million worth of short Bitcoin positions were liquidated on March 20th.

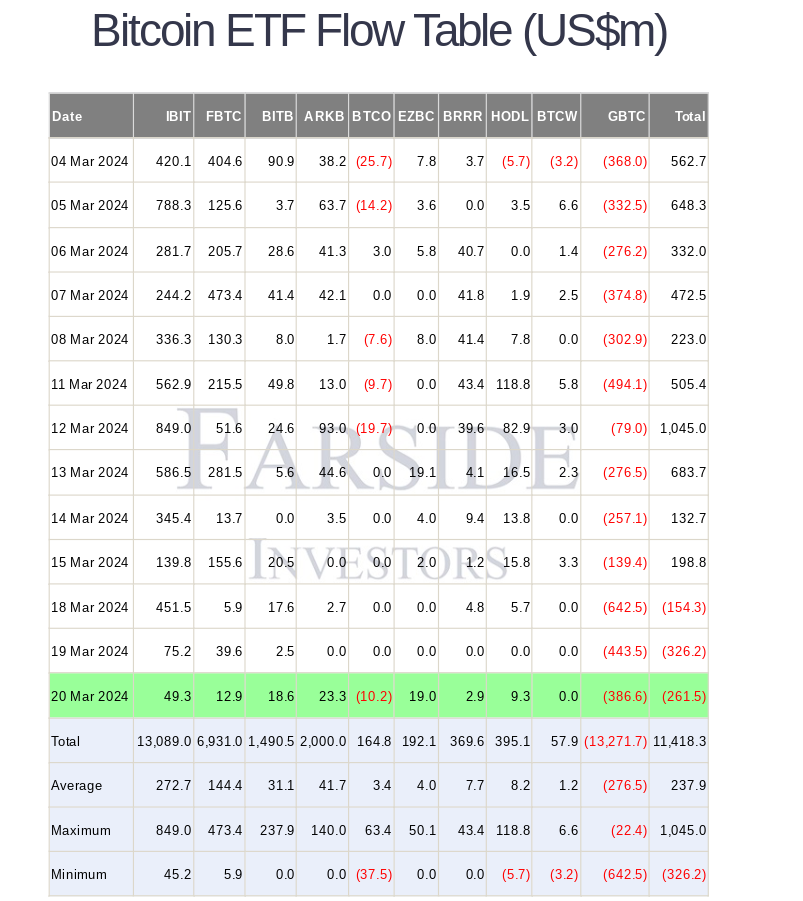

Outflows from Bitcoin ETFs continued for a third day. Despite efforts to dampen sentiment, new exits were witnessed from spot Bitcoin exchange-traded funds (ETFs) listed in the United States.

According to the latest data from Farside, a UK-based investment firm, there was an outflow of $261 million from new ETF products on March 20th, with a significant portion of this amount coming from a $386 million outflow from the Grayscale Bitcoin Trust (GBTC).

Other ETFs saw entries that only constituted a fraction of the daily revenue at the beginning of the month.

Market observers have continued to maintain their optimism despite witnessing outflows from Bitcoin ETFs for three consecutive days. Dyme, a leading commentator, suggested that Bitcoin's indifference to ETF outflows signifies a new resilience against ETF dynamics.

In a post on X (formerly known as Twitter), Dyme stated, "Today's rise, despite negative inflows, indicates that the market does not depend on ETFs to move upwards."

Moreover, Samson Mow, CEO of the cryptocurrency adoption-focused company Jan3, also claimed that even GBTC will experience net inflows as a standard in the future. Mow offered an optimistic outlook to crypto investors, saying, "I believe that all Bitcoin ETF outflows will eventually turn into inflows. Plan accordingly."

For the latest developments and news in the crypto markets, stay updated with Kriptospot.com.