"Diamond Hands In Bitcoin: Patiently Waiting"

- Posted on July 13, 2024 8:32 AM

- Cryipto News

- 514 Views

Unrealized Losses Increase in Bitcoin, But BTC Investors Keep Their Emotions in Check

Long-Term Bitcoin Holders Refuse to Sell During the "Deepest Correction" in the Current BTC Market

The crypto analysis firm Glassnode has shared positive insights about the resilience of Bitcoin investors in its weekly newsletter, The Week Onchain.

Glassnode notes that Bitcoin is experiencing the deepest correction in the current bull market, but emphasizes that long-term Bitcoin holders are not panicking and are refusing to sell.

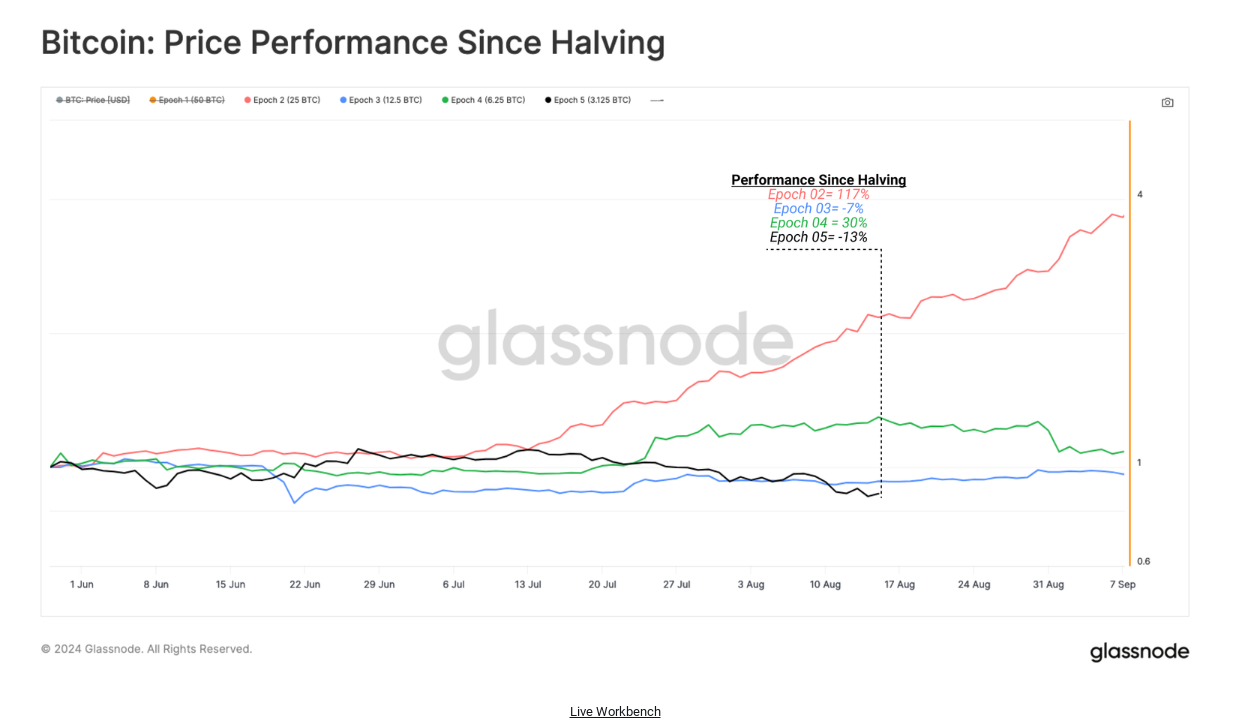

According to Glassnode, when evaluating Bitcoin’s performance relative to its halving dates, the current cycle is considered one of the worst-performing periods in the market. Experts indicate that this situation is occurring for the first time, despite the market reaching a new cyclical peak before the halving in April.

Glassnode: Long-Term Bitcoin Holders Remain Committed Despite Current Market Downturn

Despite some well-known declines in Bitcoin’s recent history, Glassnode reports that long-term investors are maintaining their commitment to holding BTC. The recent drop in the BTC/USD pair to $53,500, the lowest level in the past four months, appears to have had no impact on this determination.

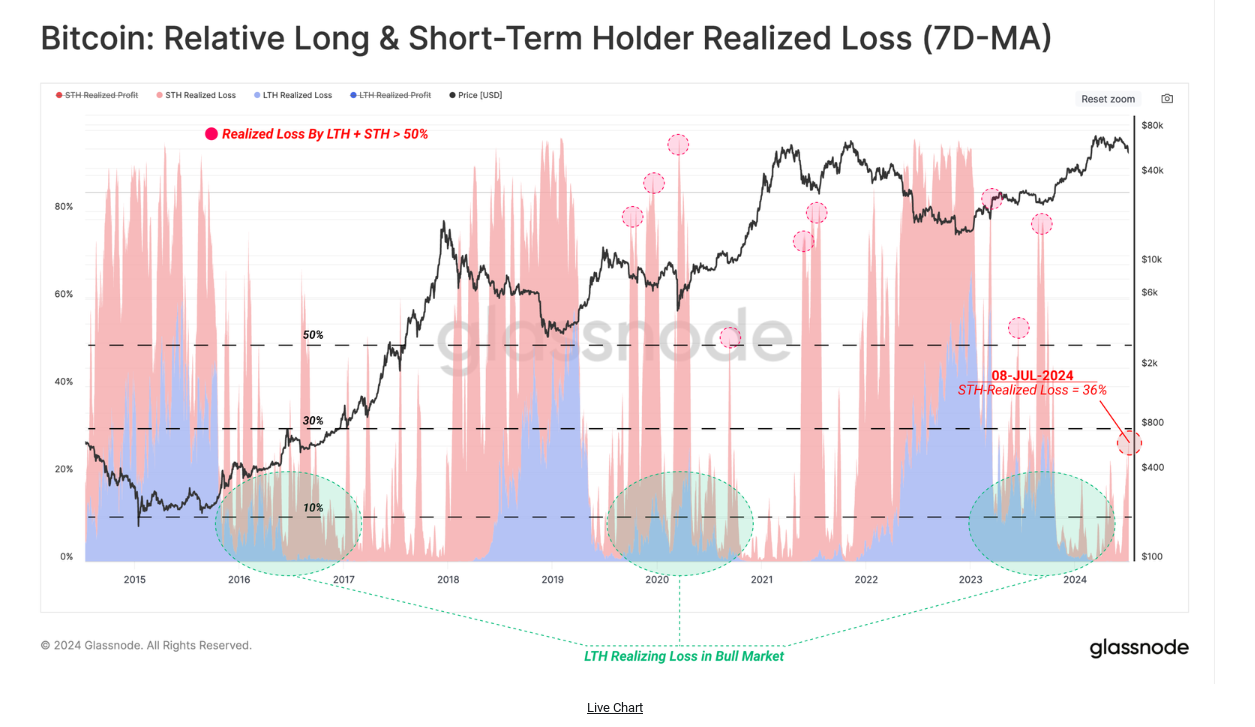

According to Glassnode's weekly newsletter, "When examining losses locked by both Long-Term and Short-Term Holders, we see that this week's decline accounts for less than 36% of the total capital flow on the Bitcoin network."

The newsletter also noted, "In major capitulation events such as those in September 2019, March 2020, and May 2021, losses provided by both groups accounted for more than 60% of capital flows over several weeks."

Long-term holders refer to wallets that have held BTC for more than 155 days, while short-term holders represent those with shorter holding periods. Glassnode presented a chart indicating that the rate of loss-taking among long-term holders during the price decline is significantly low.

Following 18 months of only upward movements and 3 months of a sideways market post-FTX collapse, the market is now experiencing its deepest correction of the cycle. Glassnode commented, "However, the declines in the current cycle present a positive picture when compared to historical cycles, indicating that the market structure remains relatively robust."

Are We Weeks Away from a Bitcoin Price Rebound?

With profit margins moving into negative territory, short-term investors and day traders have become the focal point of the Bitcoin market.

According to Glassnode data, when the BTC price dropped to $53,500, short-term holders faced unrealized losses on approximately 2.8 million BTC, which constitutes 14.2% of the total supply.

Miners are also a source of concern. The decline in hashrate has led some experts to draw parallels with the bear market bottom of late 2022. On July 10, Charles Edwards, founder of Capriole Investments, informed his followers on X, "A Hash Ribbon Capitulation signal was triggered in mid-May, following the FTX collapse and the drop to $15,000."

In subsequent statements, Edwards suggested that a buy signal might be "at least a few weeks away."

For the latest updates and developments in the cryptocurrency market, you can follow Kriptospot.com.