Bitcoin Falls After Etf Approval

- Posted on January 15, 2024 11:14 PM

- Cryipto News

- 733 Views

The price of Bitcoin dropped by approximately 7% just two days after spot ETF approvals.

Between January 11th and January 12th, the price of Bitcoin experienced a decline of 6.8%, confirming analysts' theories of profit-taking after the approval of the spot Bitcoin exchange-traded fund (ETF). This anticipated event was a source of excitement for Bitcoin, which had previously seen a 75% rally in the past 90 days. However, this decline might have created some lack of excitement in the market, and it resulted in a correction with the price dropping to $43,180.

Concerns about the market entering a downward trend arose after last week's unsuccessful attempts by Bitcoin to surpass the $47,000 levels. Behind this concern, there could be some reasons, such as market makers and whales trying to manage the spot ETF issuers by purchasing them before launch. If this hypothesis is correct, these actors might face the risk of making sales at a loss. Additionally, Bitcoin miners might feel pressure to sell some of their assets as there is less than 100 days until the halving.

Regardless of how profitable Bitcoin mining is, a 50% reduction in block subsidies could significantly impact miners' margins. According to Bitcoin News, the outflow of miners reached its highest level in the last six years after sending $1 billion worth of BTC to exchanges.

NEW: #Bitcoin miners' outflow hits a six-year high as more than 💵 $1B worth of #Bitcoin is sent to exchanges 👀 pic.twitter.com/Jr4VFdoCPo

— Bitcoin News (@BitcoinNewsCom) January 12, 2024

However, according to CryptoQuant data, other peaks in BTC transfers from miners coincided with price bottoms in June 2022, November 2022, March 2023, and August 2023. While these data points may increase confidence among bulls, they could also be coincidental. There is no conclusive evidence of a cause-and-effect relationship between net flows from Bitcoin miners and short-term BTC prices, and the same chart shows numerous large transfers with no significant impact on the price.

To gain more insight into whether BTC is effectively entering a downtrend, it is crucial to analyze the Bitcoin derivative markets. For beginners, the total open interest in futures positions increased by 14% to 446,500 BTC since January 5th, indicating that investors' interest in leveraged positions has not diminished, and they have not been negatively affected by liquidations. It is essential to note that CME, with its 135,480 BTC contracts and a 30% market share, is a leading player.

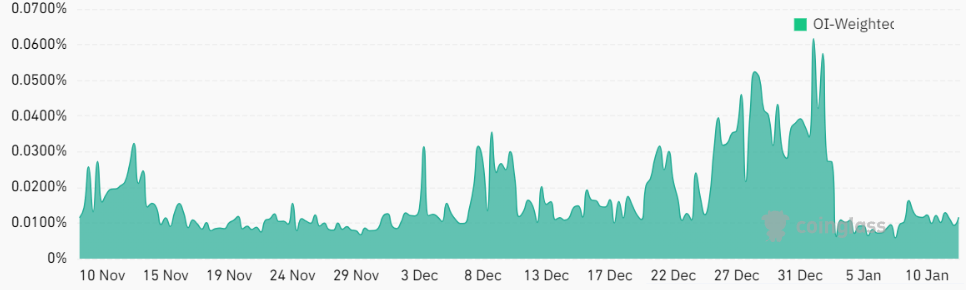

Next, it is necessary to evaluate whether leveraged retail investors using leverage affect the price movement. Continuous contracts, also known as inverse swaps, typically have a funding rate that updates approximately every eight hours. A positive funding rate indicates an increased demand for leverage among long (buy) positions.

The data indicates that the BTC futures funding rate has remained stable at only 0.2% weekly since January 4th, signaling a balanced leverage demand between longs and shorts (sells). Essentially, it has not been triggered by retail traders using excessive leverage or investors betting on a price decline during the recent sell-off.

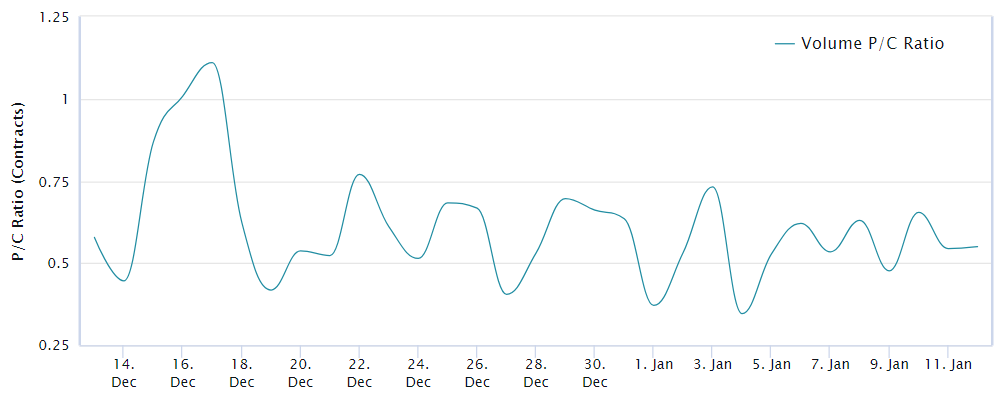

Additionally, investors can assess the market's sensitivity by measuring whether there is more activity in call (buy) options or put (sell) options. A put-to-call ratio of 0.70 suggests that the open interest in put options lags behind bullish calls, indicating a bullish sentiment. On the other hand, a 1.40 indicator would prefer selling options, which could be interpreted as bearish.

The put-to-call ratio for Bitcoin option volume fluctuated between 0.35 and 0.65 in the last seven days, reflecting low demand for put (sell) options. If investors were concerned about a potential BTC price collapse, this ratio would show a shift towards a more balanced level.

Part of the Bitcoin decline on January 12th can be explained by the lack of information on how the spot ETF operates in terms of creation, redemption, and price formation. For example, there may be slight discrepancies among issuers, so entry data could be delayed by a few days. Additionally, investors have adopted a skeptical attitude following numerous false ETF approval warnings and the FUD (fear, uncertainty, and doubt) caused by some brokers not allowing their clients to invest in the sector.

Furthermore, after weekend pauses in spot Bitcoin ETFs, no one knows how they will open and handle the final fluctuation outside normal market hours. If there is a lack of information and the full impact of the ETF is not fully understood, investors are likely to panic-sell to avoid negative surprises, potentially amplifying the FUD behind the recent price correction.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.