Arthur Hayes Makes Surprising Prediction For Post-Bitcoin Halving.

- Posted on April 12, 2024 11:11 PM

- Cryipto News

- 554 Views

The co-founder of BitMEX expressed expectations of significant turbulence in the crypto markets in the latter half of April due to the Bitcoin halving and the policy moves of the Fed.

Arthur Hayes, the co-founder of BitMEX, recently stated that the upcoming Bitcoin halving, combined with the policies of the U.S. Federal Reserve (Fed) and the Treasury Department, is poised to exert substantial pressure on the crypto markets. In a blog post dated April 8, Hayes suggested that while the halving might boost prices in the medium term, it could negatively impact the market both immediately before and after the event.

According to Hayes, when the majority of market participants agree on a particular outcome, it often leads to the opposite happening. He also noted that the halving coincides with a period of already tight dollar liquidity, which could pressure Bitcoin and crypto prices in general.

Hayes finds the latter half of April particularly risky. He highlighted the potential dangers for risky assets due to U.S. tax payments reducing liquidity, the Fed entering a phase of reducing the money supply, and the Treasury's unutilized funds. Hayes predicts that post-May 1, the Fed will tighten the money supply further, but the Treasury will likely inject liquidity that could bolster the markets.

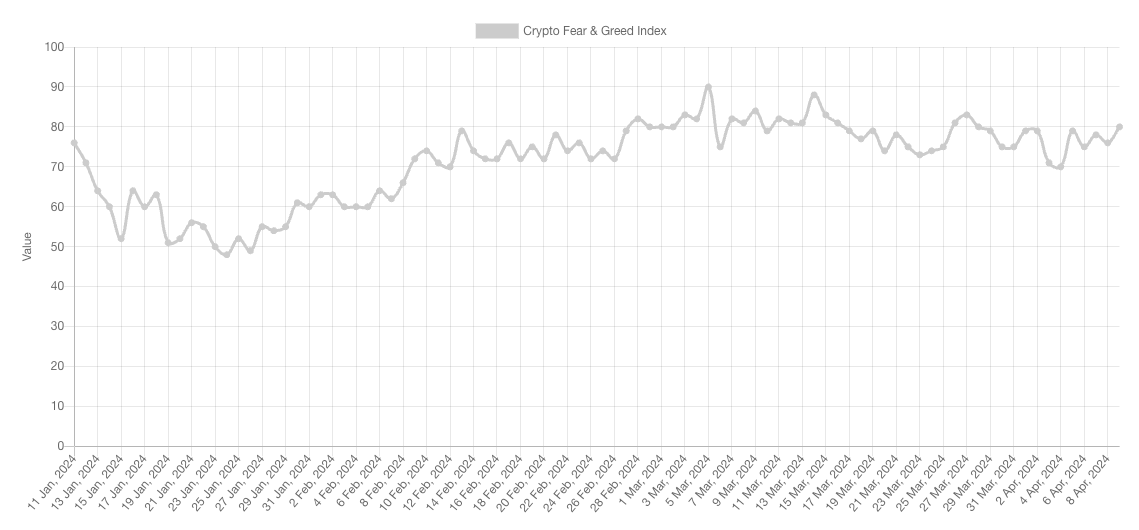

During this period, Bitcoin has seen a 61% increase from the start of the year, rising from $42,200 to $71,170, while market sentiment has also improved, staying at a "Greed" level and creating a positive atmosphere among investors. However, Hayes prefers to stay away from trading until May, indicating ongoing uncertainties about the market's future.

The index started the year at a "Greed" level with a score of 65 but reached its highest level in two years at 90 on March 5.

In his blog post, Arthur Hayes mentioned that if the liquidity scenarios he theorized were to materialize, it would give him "much more confidence to get into all sorts of trouble."

"I definitely prefer to avoid losses for my portfolio and lifestyle. Even if I miss out on a few points of gain, that's an acceptable outcome," he added.

You can stay up to date with the latest developments and news in the cryptocurrency markets by following Kriptospot.com.