Bitcoin Attracts Attention Again After A Major Data Release.

- Posted on April 13, 2024 12:03 AM

- Cryipto News

- 630 Views

After losing value following the release of US inflation data, Bitcoin is rapidly recovering on Thursday morning.

With the US inflation data triggering a recovery in Bitcoin, the Grayscale Bitcoin Trust (GBTC) also witnessed a significant drop in outflows, achieving a new record low with a nearly 90% decrease compared to the previous day.

According to Farside data, there was an outflow of $17.5 million from GBTC on April 10th, a sharp decrease from the $154.9 million in daily sales recorded the previous day.

Simultaneously, according to CoinMarketCap data, the price of Bitcoin has increased by 2.08% in the last 24 hours, currently standing at $70,474.

Following the announcement of a 3.5% annual increase in the US Consumer Price Index (CPI) for March, Bitcoin briefly dropped to the day's low of $67,482 during the same period. This has led to concerns that the Federal Reserve may further delay interest rate cuts.

According to some crypto analysts, there is renewed hope that the slowdown in GBTC outflows since its conversion to a spot Bitcoin ETF in January could be the beginning of a trend reversal.

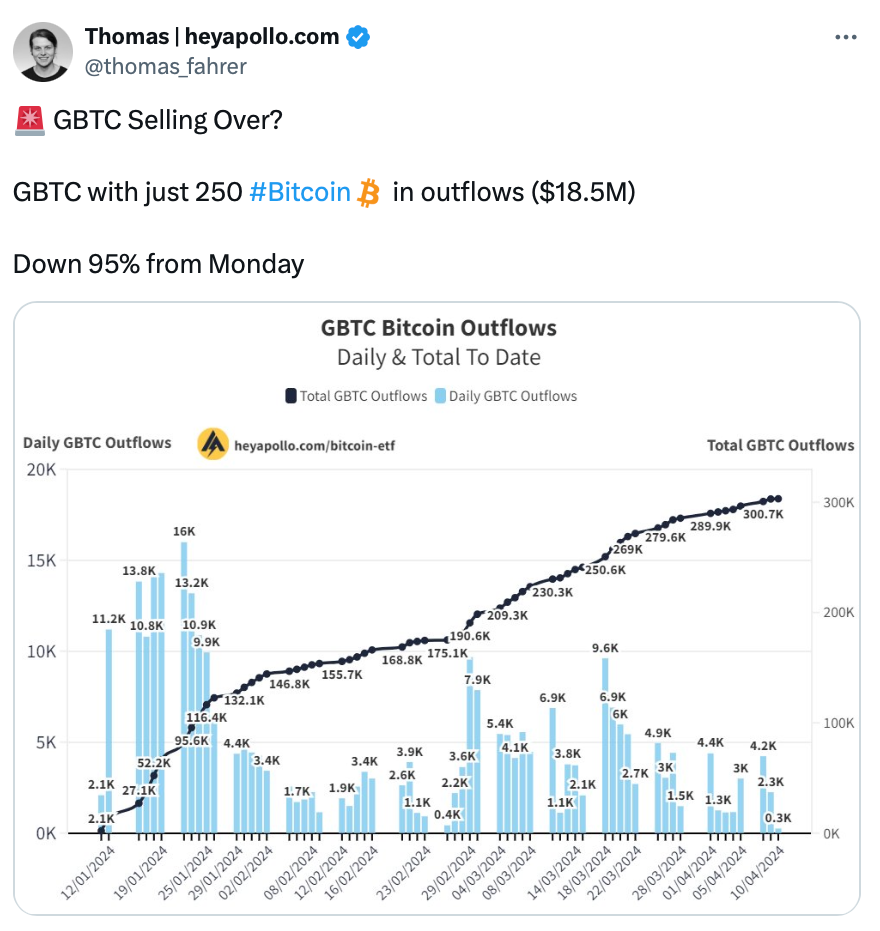

"Has GBTC selling stopped?" Thomas Fahrer, CEO of the crypto-focused review portal Apollo, posed this question to his 41,500 X followers in a post dated April 11th.

Fahrer also noted that the outflows on April 10th amounted to approximately 250 Bitcoin and that there has been nearly a 95% decrease in outflows since the beginning of the week.

Just a few days ago, on April 8th, there were outflows from Grayscale totaling $303 million, equivalent to 4,288 Bitcoin.

The lowest outflow from GBTC occurred on February 26th, amounting to $22.4 million. Over a four-month period, the average daily outflows from GBTC were recorded at $257.8 million.

In contrast, other funds recorded significant inflows: the Fidelity Wise Origin Bitcoin Fund (FBTC) saw $76.3 million, the iShares Bitcoin Trust (IBIT) $33.3 million, the Bitwise Bitcoin ETF (BITB) $24.3 million, and the ARK 21Shares Bitcoin ETF (ARKB) $7.3 million in inflows.

Moreover, the recently bankrupt cryptocurrency lending company Genesis had put up for sale approximately 36 million GBTC shares to acquire 32,041 Bitcoin.

For real-time updates and the latest developments in the cryptocurrency markets, you can follow Kriptospot.com.