Blackrock's Move Into Risk-Weighted Assets (Rwa) Has Impacted Us Treasuries.

- Posted on March 29, 2024 10:49 PM

- 575 Views

This significant development followed the launch of BlackRock's first tokenized asset fund, BUIDL, which recently joined 16 other tokenized government securities funds introduced last week.

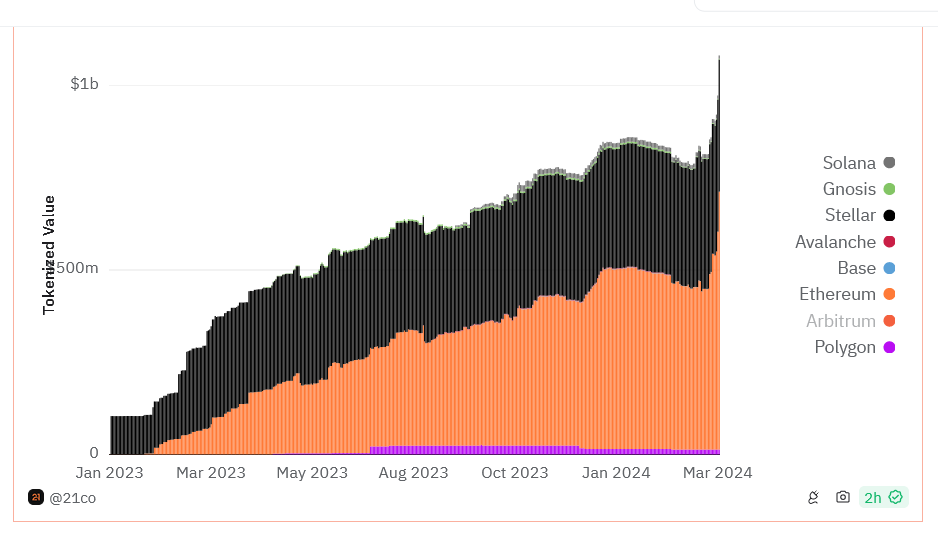

Thanks to the recently launched USD Corporate Digital Liquidity Fund by BlackRock, there are over $1 billion worth of US Treasury bonds across blockchain networks such as Ethereum, Polygon, and Solana.

Introduced on Ethereum on March 20th, the BlackRock product named "BUIDL" has already reached a market value of $244.8 million. According to Etherscan data, with a total of $95 million worth of four transactions made during the week, the fund quickly grew to become the second-largest tokenized government securities fund.

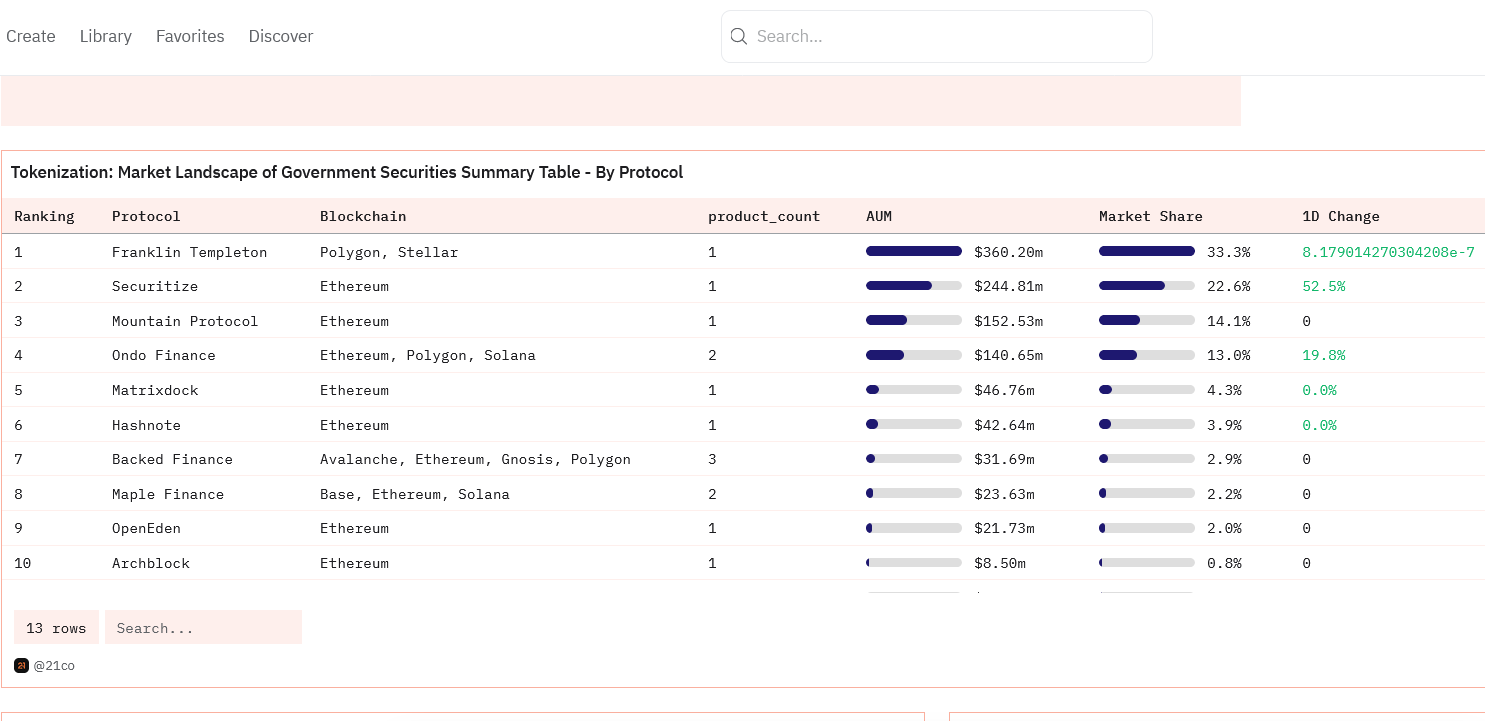

According to the indicator table published on Dune Analytics by the parent company of 21Shares, BUIDL currently trails behind the 11-month Franklin OnChain U.S. Government Money Fund (FOBXX), managed by Franklin Templeton, which holds $360.2 million worth of US Treasury bonds.

The indicator table indicates that there is currently $1.08 billion worth of US Treasury bonds across a total of 17 tokenized products.

Real-world asset tokenization firm Ondo Finance recently invested $79.3 million into BlackRock's fund, enabling instant payments for its own US Treasury-backed token, OUSG. According to Etherscan data, the company executed a total investment of $95 million across four transactions.

Tom Wan, a research strategist at 21.co, mentioned in a post published on X on March 27, that Ondo Finance holds a 38% stake in BUIDL. The price of BUIDL is pegged 1:1 to the US dollar, and it pays out dividends accrued daily to investors each month. It was launched on Ethereum through the Securitize protocol.

In the Dune dashboard, 21.co described tokenized government treasuries as more attractive than stablecoin yields in terms of both risk and return, considering the high-interest-rate environment.

Recently, BlackRock CEO Larry Fink discussed how blockchain tokenization could make capital markets more efficient, highlighting a Boston Consulting Group forecast that sees it becoming a $16 trillion market by 2030.

US Treasury bonds are just a slice of the pie. RWA technology can also tokenize stocks, real estate, and many other assets. Ethereum also represents $700 million of all tokenized real-world assets (RWA) on-chain.

Franklin Templeton's FOBXX is tokenized on Stellar and Polygon, holding market shares of $358 million and $13 million, respectively.

WisdomTree stands out as one of the major asset management firms tokenizing real-world assets (RWAs), alongside companies such as Ondo Finance, Backed Finance, Matrixdock, Maple Finance, and Swarm, which are specifically engaging in this field through blockchain technology. These firms are utilizing blockchain to transform various assets into digital tokens, thereby offering investors new opportunities not found in traditional financial markets. Tokenization enhances the liquidity and accessibility of assets while promoting a more transparent and efficient market structure. The efforts of these companies are accelerating digital transformation in the finance sector and showcasing the potential of blockchain technology.

For the latest developments and news in the crypto markets, you can follow updates instantly on Kriptospot.com.