Brazilians Trust Usdt

- Posted on October 31, 2023 5:00 AM

- Economic News

- 742 Views

USDT Represents a Significant Portion of Crypto Transactions in Brazil

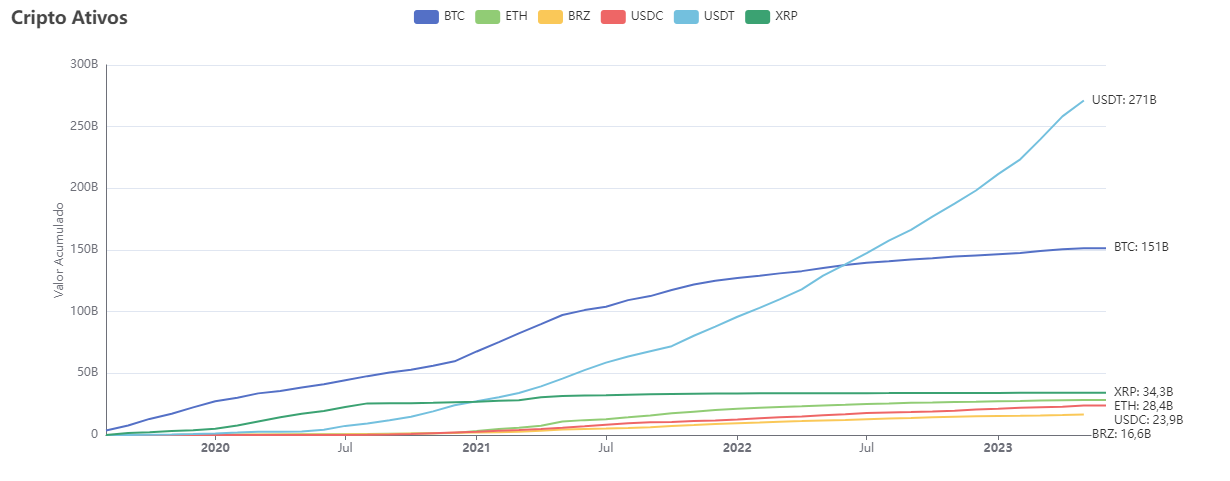

According to data from the Brazilian Federal Revenue Service, the adoption rate of the popular stablecoin USDT has significantly increased. By mid-October, USDT transactions conducted in Brazil reached approximately 271 Brazilian reais (55 billion dollars). This means USDT has doubled its transaction volume when compared to Bitcoin transactions, which remained around 30 billion dollars. Stablecoins are crypto currencies that are typically pegged to traditional fiat currencies like the US dollar and the Brazilian real.

The growth in USDT transactions in Brazil has been continuous since 2021. In July 2022, USDT surpassed Bitcoin for the first time. One of the main reasons for this growth has been attributed to the challenges faced by platforms like Three Arrows Capital and Voyager Digital during the same period.

According to a government report, due to crises in the crypto markets in 2022, the crypto volume decreased by 22%, amounting to 31 billion dollars.

The Brazilian Tax Authority employs a system based on artificial intelligence and network analysis to monitor its citizens' crypto activities, effectively detecting suspicious crypto transactions.

The country's revenue service has adopted a policy aimed at generating income from the crypto assets of Brazilian citizens living abroad. In line with this policy, the Congress passed a new law on October 25th, aiming to impose taxes on overseas earnings of Brazilian citizens.

As per the new law, earnings ranging from 6,000 Brazilian reais to 50,000 Brazilian reais will be taxed at a rate of 15% starting from January 2024. Earnings exceeding the specified threshold will be subjected to a 22.5% tax rate.

Crypto exchanges operating in Brazil have been required to report all user transactions to the government since 2019. Among the crypto exchanges operating in the country are international platforms like Coinbase, Binance, Bitso, Crypto.com, as well as local exchanges such as Mercado Bitcoin and Foxbit.