Chicago Mercantile Exchange (Cme) Has Claimed The Title Of The Second-Largest Bitcoin Futures Exchange As Interest In Bitcoin Futures Has Grown, Coming In Just Behind Binance.

- Posted on October 31, 2023 4:28 AM

- Cryptocurrency Exchanges News

- 574 Views

As interest in Bitcoin futures has surged, the exchange now holds the second position with a 25% market share, just behind Binance.

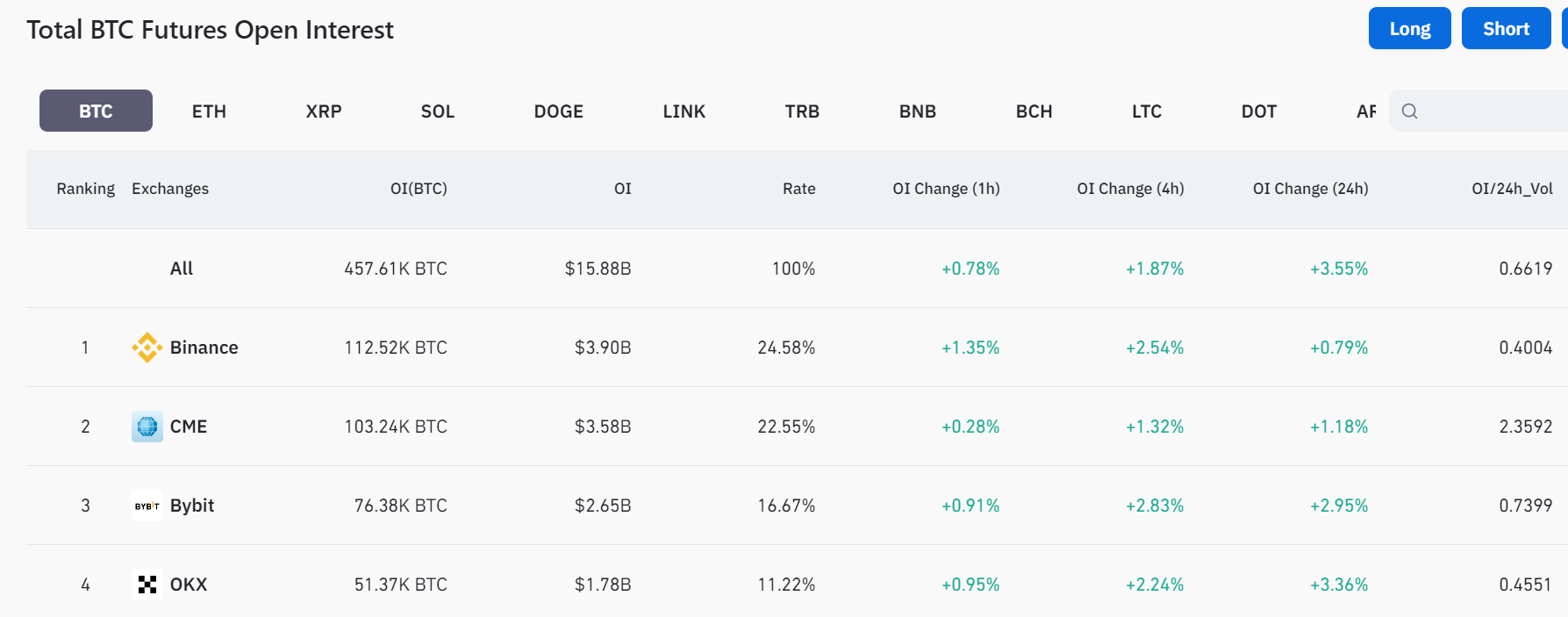

As the interest in cryptocurrency futures has grown worldwide, the regulated derivative exchange Chicago Mercantile Exchange (CME) is rapidly climbing in Bitcoin futures. CME achieved a total trading volume of $3.58 billion on October 30, placing it in second place just behind Binance. This accomplishment is particularly noteworthy as it surpassed both Bybit, which had a trading volume of $2.6 billion, and OKX, with a trading volume of $1.78 billion. Currently, CME is in second place, trailing Binance's $3.9 billion in trading volume by just a few million dollars. Bitcoin futures hold a significant position in the cryptocurrency market, and CME's success reflects its growth in this area.

Standard Bitcoin futures contracts offered by the Chicago Mercantile Exchange (CME) are valued at five BTC, while micro contracts are worth one-tenth of a Bitcoin. In contrast to traditional futures contracts, CME's perpetual futures contracts do not have a specific expiration date and instead use the funding rate method to maintain a price parity with the market. These types of contracts constitute a significant portion of short positions on offshore exchanges.

Short positions refer to the total number of open Bitcoin futures and options contracts in the market. It serves as an indicator of the total capital invested in Bitcoin derivatives and includes both capital inflows and outflows. If more capital is invested in Bitcoin futures, the demand for short positions will increase, but it will decrease if there is capital outflow.

CME's growing demand for short positions has contributed to the regulated derivatives exchange's rise to second place among cryptocurrency futures exchanges. Additionally, the volume of cash-settled futures contracts has exceeded 100,000 BTC. The increasing interest of investors in the Bitcoin futures market has led to CME's 25% market share in the Bitcoin futures market.

The majority of investments in CME futures contracts are made through standard futures contracts. This indicates an increase in institutional interest, especially with Bitcoin's price surpassing $35,000 in October.