Ethereum Could Surpass $2,500, But How Is It Possible?

- Posted on December 24, 2023 11:50 AM

- Cryipto News

- 718 Views

The value of Ethereum is on the rise, driven by DApp activities.

Ether approached the $2,400 resistance level on December 9 but failed to surpass it, resulting in a retest of the $2,120 support level. Investors are gaining confidence in Ethereum reaching an unprecedented level since May 2022, especially with the collapse of the Terra ecosystem.

On December 22, Ether stood out with a 4% increase, while no significant price movement was observed in other major cryptocurrencies like Bitcoin and BNB.

Despite ETF news being the main driving force behind recent gains in cryptocurrencies, there are reasons why the asset's value could surpass $2,500 before the potential approval of an ETF.

At this point, the volume of DApps (decentralized applications) and protocol fees on the Ethereum network plays a crucial role. Rather than predicting the future, analyzing recent trends that could trigger Ether demand, especially in sectors such as NFT marketplaces, games, layer-2 bridges, and social networks, would be more sensible.

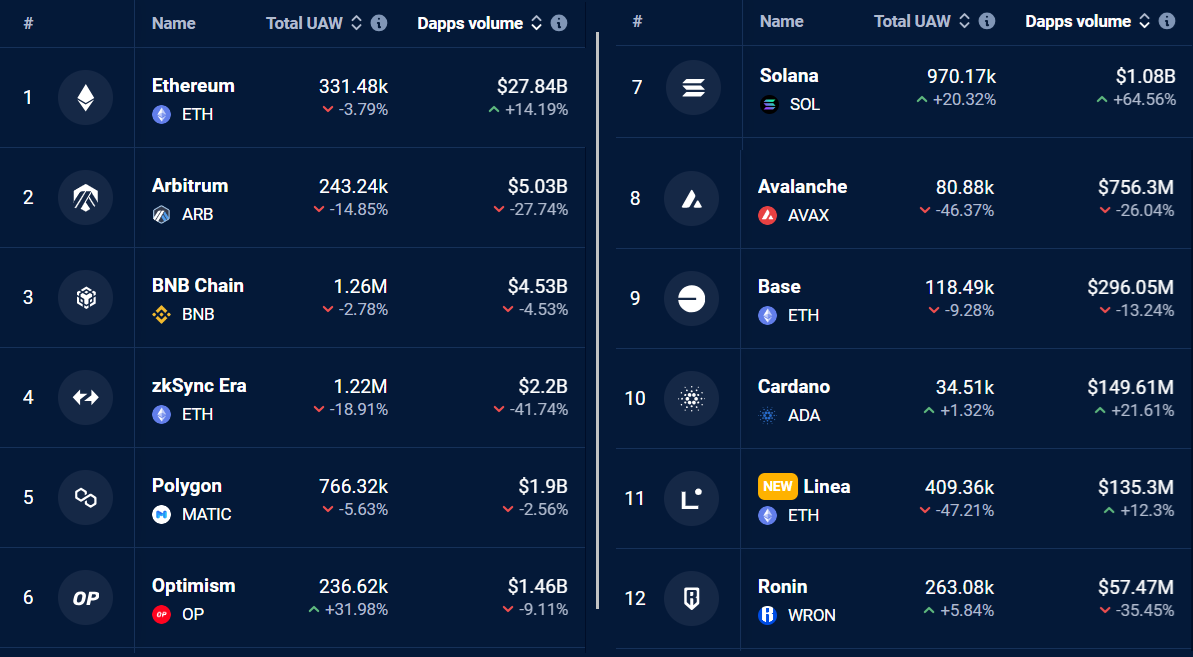

In the last seven days, Ethereum DApp volumes reached $27.8 billion, marking a 14.2% increase compared to the previous week. This growth was driven by a 21% increase in Uniswap volumes and a 52% increase in Balancer volumes. During this period, the volume of BNB Chain stood at $4.5 billion, while Arbitrum's revenue reached $5 billion. Ethereum was the only one among the top six blockchains that experienced an increase in volume in the last seven days.

For better understanding, it's essential to note that Solana would need to increase its current transaction volume by 12 times to reach half of Ethereum DApps' current transaction volume.

However, except for Bitcoin, which does not have a direct competitor within the DApp ecosystem, no other blockchain can compete with the Ethereum protocol, which earned $95.4 million in transaction fees in the last seven days. This data indicates a significant potential for increased activity after future updates, such as 'DenCun,' planned for January, aiming to increase transaction capacity and reduce costs.

The likelihood of approval for an Ethereum spot ETF could also be a factor that sets Ethereum apart from other cryptocurrencies in terms of regulation. In cases of unregistered securities brought to exchanges, regulators only nominally mention competing networks.

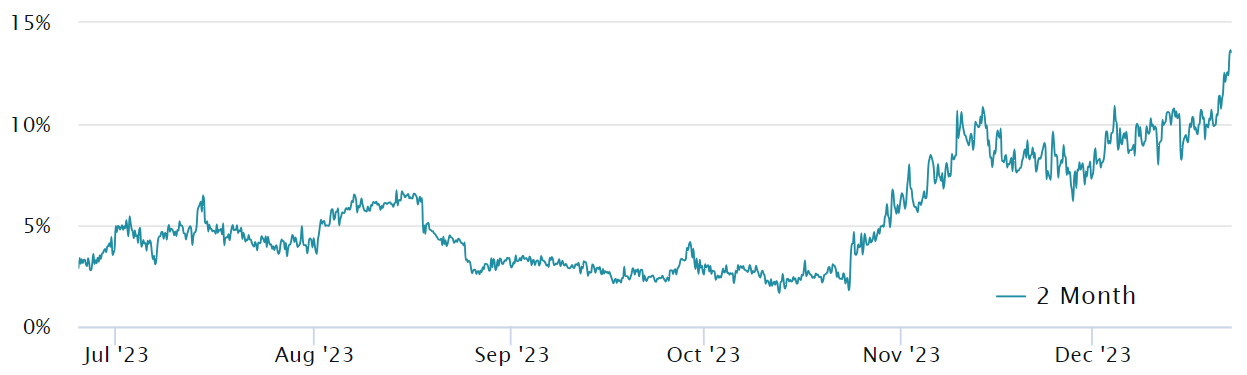

Lastly, investors, especially large investors and market makers, should assess their positions, particularly Ether derivative traders. The Ether futures premium, measuring the difference between two-month contracts and the spot price, reached its highest level in over a year. In a healthy market, the annual premium or basis rate generally falls within the range of 5% to 10%.

The current 13.5% annual premium in Ether futures indicates that investors are taking the approval of an Ether ETF seriously. With an increasing demand for leveraged long positions during widespread excitement, this indicator has a tendency to surpass 20%, potentially causing price distortions compared to the spot market. These data suggest a positive impact potential on the price if the ETF is approved in January or March.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.