Ethereum Etf Approval Didn't Meet Expectations For Eth Price.

- Posted on May 27, 2024 4:19 AM

- Cryipto News

- 594 Views

ETH price performance remains weak due to stagnant network usage, high transaction fees, and regulatory uncertainties.

On May 23, the U.S. Securities and Exchange Commission (SEC) approved Ethereum spot exchange-traded funds (ETFs). Despite this long-awaited approval, Ether (ETH) failed to hold the $3,800 level on May 24. Just two days before the approval, ETH had approached the $4,000 mark, and its inability to sustain this rise surprised investors.

ETH is currently trading 24% below its all-time high. Some market participants point out that the SEC has yet to approve individual S-1 filings for each issuer, a process that could take weeks or months. This delay, along with other factors such as stagnant network growth, high transaction fees, and regulatory uncertainties in the U.S., negatively impacts ETH's performance.

Recent profit-taking partially stemmed from the anticipation of the spot ETF approval, which triggered a 23% rally on May 20, often referred to as "selling the news." Investors bought ETH in anticipation of the official announcement, especially after the SEC urged exchanges like NYSE and Nasdaq to expedite their 19b-4 filings on May 20.

Despite the excitement surrounding the spot ETF approval, Ether remains 24% below its all-time high of $4,868 set in November 2021. This indicates that the current enthusiasm is insufficient to push Ether's market value beyond the existing $445 billion. In contrast, Bitcoin (BTC) is trading just 7% below its all-time high as of March 2024, highlighting that other factors are constraining ETH's performance.

Over the past 30 days, Ethereum's network usage metrics have shown no growth in decentralized application (DApp) volumes or deposit activities. This stagnation explains the network's sluggishness and the weakness in price performance.

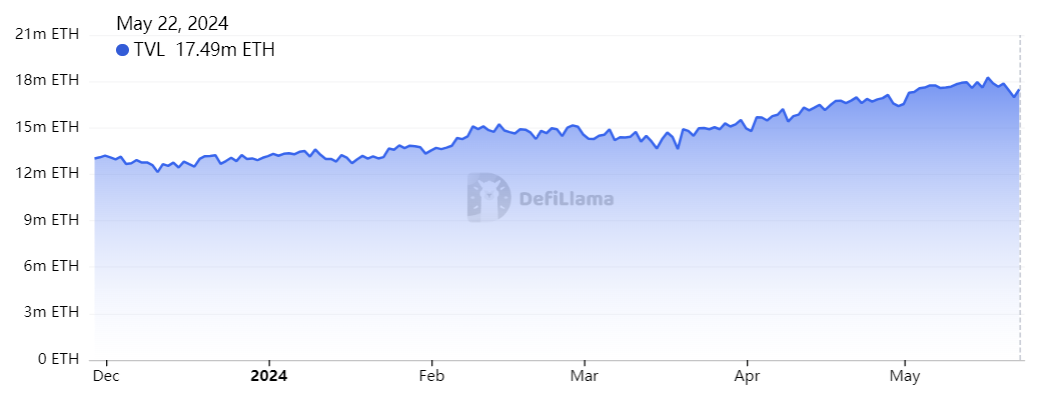

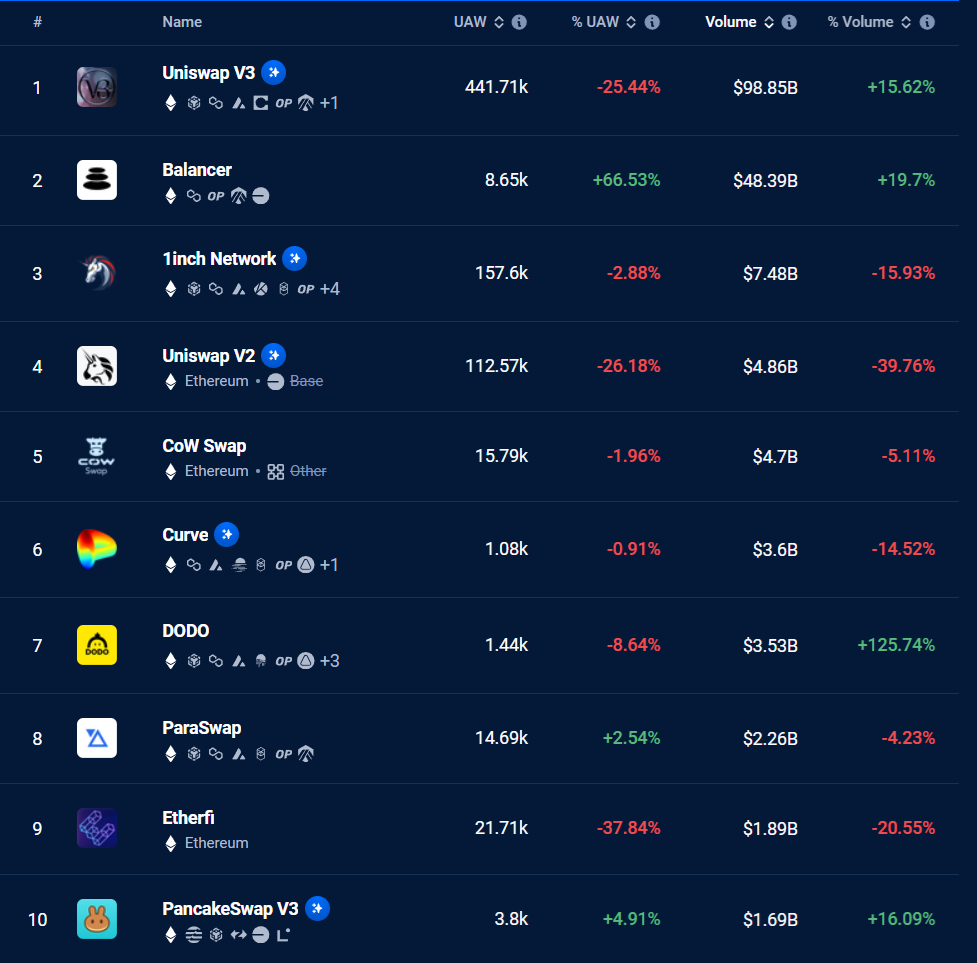

The total value locked (TVL) in the Ethereum network reached a peak of 18.3 million ETH on May 16 but has since decreased by 6%. This metric does not account for DApps that do not require a large deposit base, such as NFT marketplaces, games, social networks, and collectibles. A detailed analysis of the network's leading applications reveals a significant volume concentration in Uniswap, the top decentralized exchange (DEX).

Over the past 30 days, seven of the top ten Ethereum DApps ranked by volume have seen a decline in active addresses. The leading DApp, Uniswap, experienced a 25% reduction in activity. Additionally, several DApps failed to attract more than 4,000 active addresses, heightening concerns about Ethereum's total addressable market, especially as competitors offer significantly lower fees.

Arbitrage and Regulatory Uncertainties

Arbitrage issues stemming from validators and regulatory uncertainties also pose significant challenges for Ethereum. Miner Extracted Value (MEV) is a practice where validators organize transactions within a block to create slippage on DEX exchanges or to front-run NFT mints for profit. This practice leads to network congestion and higher gas fees.

Ethereum's co-founder, Vitalik Buterin, addressed this issue on May 17th. He proposed protocol-level controls that either completely separate the verification process from the content of the block or limit the block producer's ability to prioritize certain transactions, thereby reducing the information available to MEV developers. Despite these efforts, a practical solution seems unlikely to emerge in the coming months.

Impact of Regulatory Uncertainties

According to Paul Grewal, Chief Legal Officer of Coinbase, the approval of a spot ETF, which classifies Ether as a digital commodity, is a positive regulatory development. However, ongoing regulatory actions against Consensys and the Ethereum Foundation continue to cast a shadow. Some analysts claim that until the SEC signs off on individual S-1 registration statements, the classification of Ether as a non-security remains an open question.

In April, Consensys received a Wells notice from the SEC regarding the trading and staking services of MetaMask. Additionally, reports published by Fortune magazine in March stated that the regulator was investigating firms allegedly connected to the Ethereum Foundation for their staking services, perpetuating regulatory uncertainty. These uncertainties further negatively impact Ether's performance.