Grayscale's Share In The Bitcoin Etf Market Falls Below 50 Percent.

- Posted on March 14, 2024 10:57 AM

- Cryipto News

- 610 Views

For the first time since January, Grayscale's share in the Bitcoin ETF market has dropped below 50 percent.

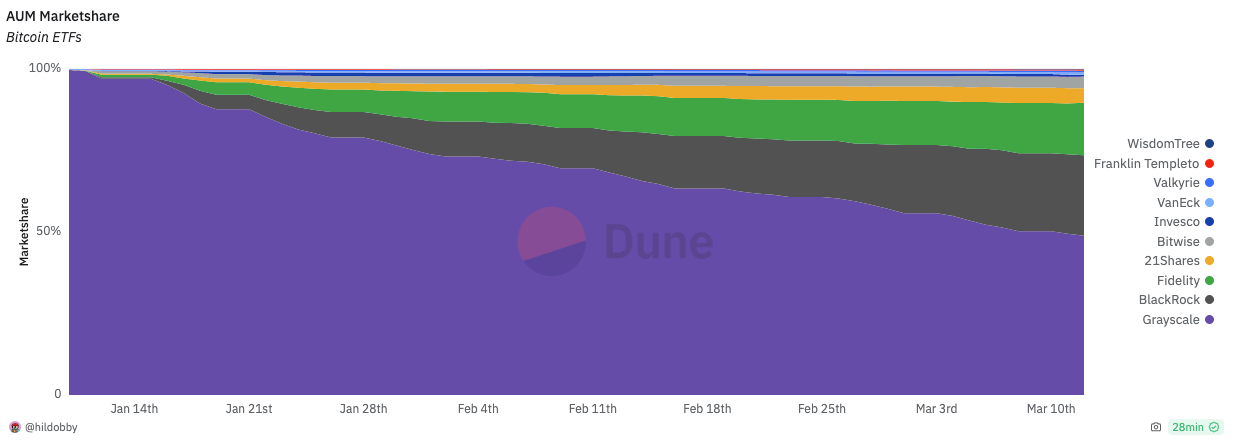

Since the inception of spot Bitcoin ETFs in the United States on January 11th, the market share of Grayscale's spot Bitcoin exchange-traded fund (ETF) has dropped below 50% for the first time.

According to data from Dune Analytics, as of March 12th, the total assets under management (AUM) in the Grayscale Bitcoin Trust (GBTC) have declined to $28.5 billion, and Grayscale currently holds 48.9% of the total $56.7 billion among the 10 Bitcoin ETFs trading in the United States.

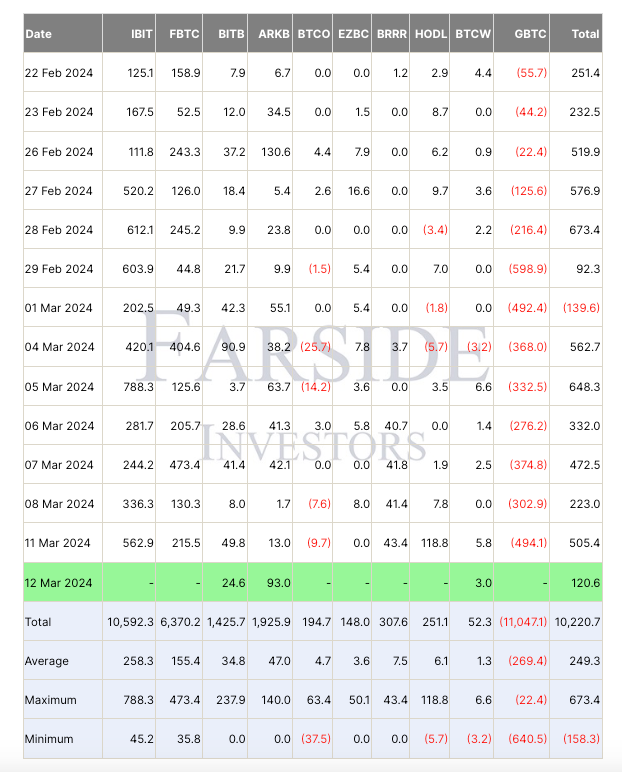

The launch of spot Bitcoin ETFs in the United States has led to a significant decrease in Grayscale's market share, marking a notable trend. On the first trading day, Grayscale's market share was approximately 99.5% of the total funds, but this ratio has substantially decreased over time. Continuous daily outflows from GBTC, especially with an average daily amount of $329 million, have contributed to the erosion of the ETF's market share. The outflows from GBTC reached their peak in the first month following the launch of the ETFs, resulting in $7 billion leaving the fund in just over a month. Although these outflows slowed by the end of January, they picked up speed again in February when bankruptcy courts allowed the crypto lending company Genesis to liquidate approximately $1.3 billion worth of GBTC shares as part of its efforts to repay investors.

The transformation of Grayscale into an ETF allowed investors, particularly institutional investors, to exit their funds or shift their assets to other Bitcoin ETFs with lower fees. This transformation occurred following a court victory against the Securities and Exchange Commission and the regulator's approval of other spot Bitcoin ETF applications.

Initially, the increasing outflows concerned the market, but the rising net inflows into new funds like BlackRock's iShares Bitcoin ETF (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have created an optimistic atmosphere in the market. Both funds have attracted a total of $16.9 billion in inflows since their inception, indicating that investor interest in Bitcoin remains strong and that the new ETF structures are gaining acceptance.

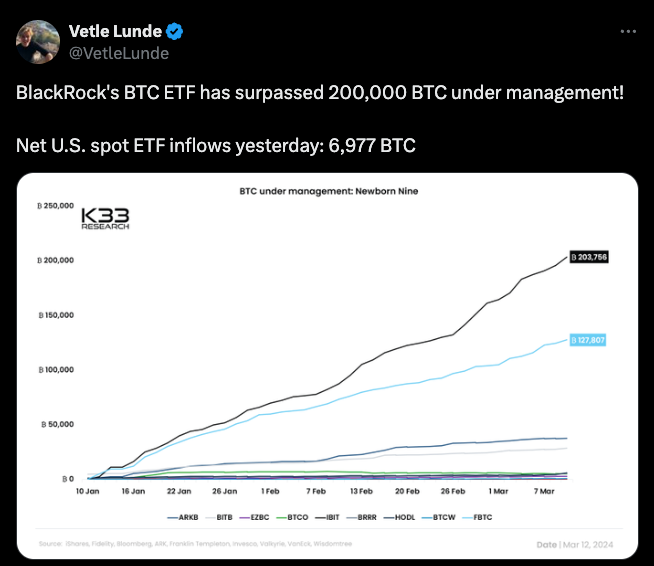

Bitcoin reaching its all-time high on March 11 underscores the significant impact of the nine newly launched Bitcoin ETFs on the market. The increasing inflows into these ETFs are viewed as one of the primary drivers propelling Bitcoin's price swiftly upwards. Notably, BlackRock's fund, holding slightly over 200,000 BTC, represents a volume of approximately $14.3 billion based on current market values. This highlights not only the market influence of these funds but also the continuing rise in interest towards Bitcoin. Data from K33 Research illustrates the critical role that leading financial institutions like BlackRock play in the cryptocurrency markets and emphasizes the influence these major players have on market dynamics.

BlackRock currently holds over 200,000 bitcoins.

You can follow the latest developments and news in the cryptocurrency markets on Kriptospot.com in real-time.