Grayscale's Bitcoin Fund Sees A Development For The First Time In A Long While.

- Posted on May 5, 2024 11:42 PM

- Cryipto News

- 627 Views

Grayscale Investments' GBTC fund recorded its first daily inflow since January, following over $17.5 billion in outflows since the launch of Bitcoin ETFs.

Grayscale Investments' Grayscale Bitcoin Trust (GBTC) experienced its first net positive inflow day after four months of continuous outflows since its transformation into a Bitcoin exchange-traded fund (ETF) in January.

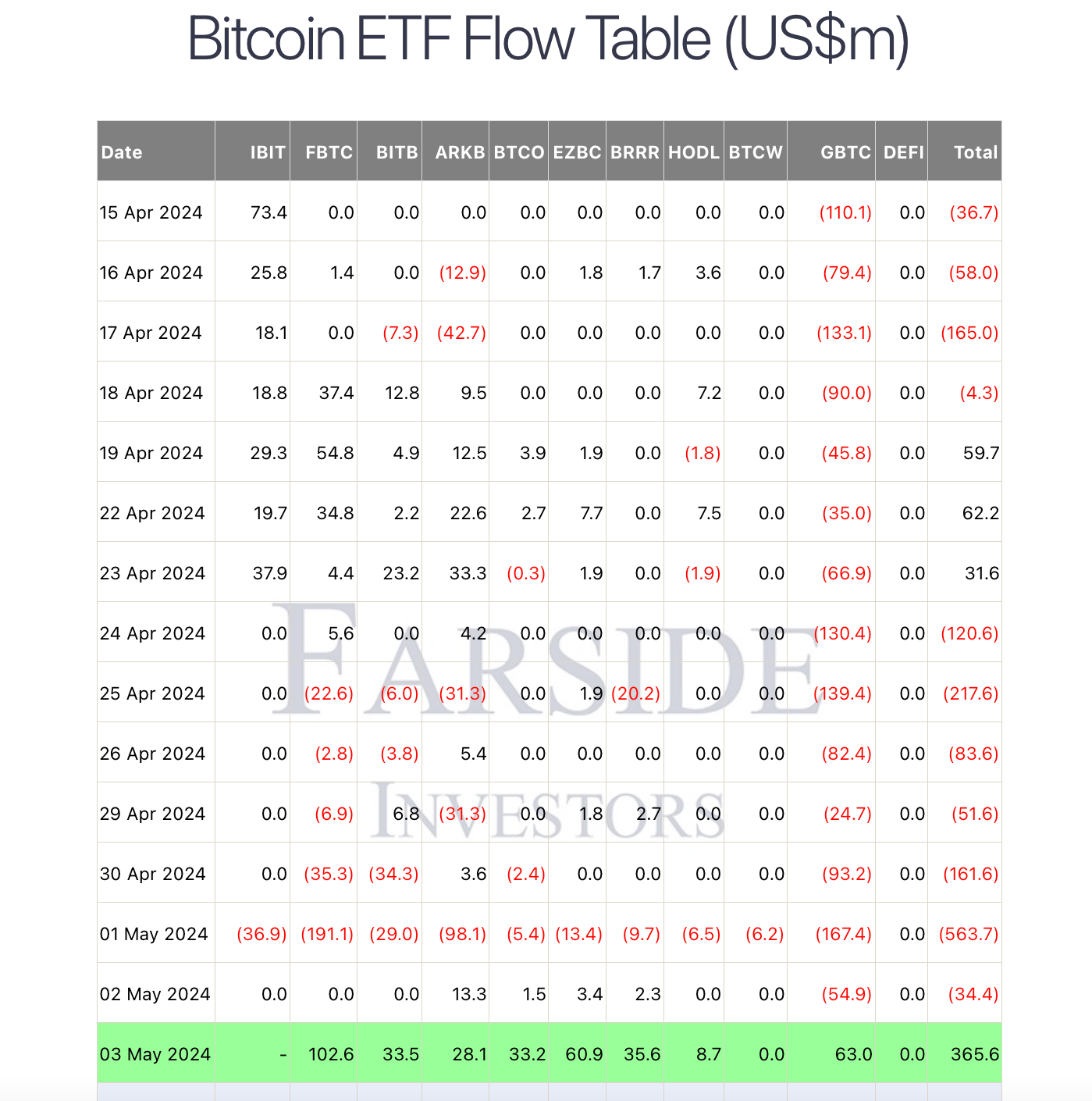

According to Farside data, after an outflow of approximately $17.5 billion starting with the launch of 11 spot Bitcoin ETFs on January 11, GBTC recorded an inflow of $63 million on May 3.

Meanwhile, Franklin Templeton's Bitcoin ETF (EZBC) saw the highest single-day inflow to date at $60.9 million. The day's largest inflow was led by the Fidelity Wise Origin Bitcoin Fund (FBTC) with $102.6 million, followed by the Bitwise Bitcoin Fund (BITB) with $33.5 million and the Invesco Galaxy Bitcoin ETF (BTCO) with $33.2 million.

The cryptocurrency community is discussing how movements in funds could impact the price of Bitcoin. Crypto investor DivXman told his followers that the Grayscale Bitcoin Trust (GBTC) has been a primary source of selling pressure in spot Bitcoin ETFs, but noted that this situation is changing.

In a post on May 3, DivXman told his 20,800 followers, "If ETFs are collectively buying more Bitcoin than miners, this could mean a decrease in selling pressure and an increase in demand."

Meanwhile, crypto trader Jelle expressed the potential for Bitcoin to reach its all-time high. Speaking to his 80,300 followers on the same day, Jelle said, "There was a $60 million inflow into Grayscale's ETF. With the end of the halving dip, Bitcoin is expected to reach six-figure numbers shortly."

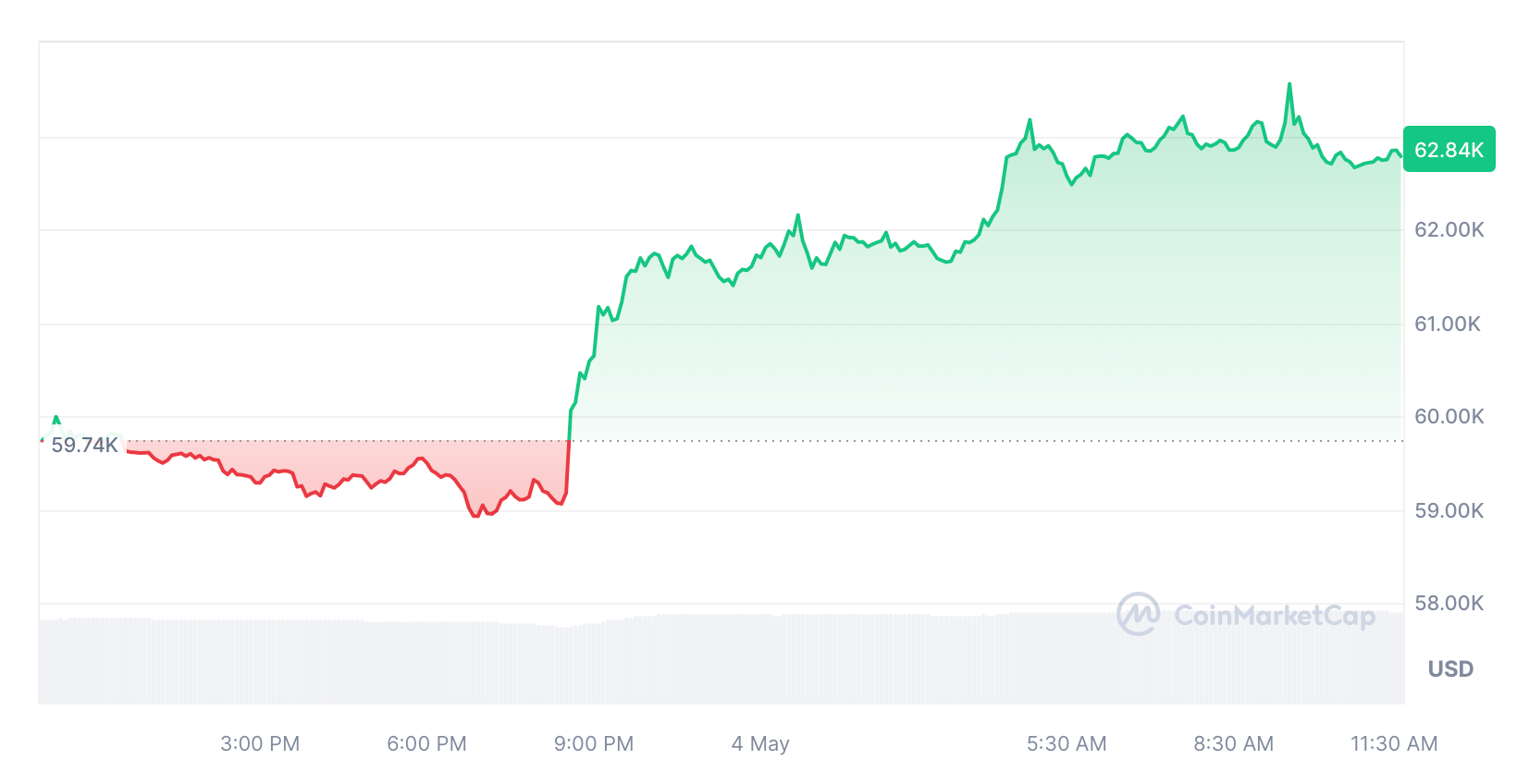

Another crypto trader, Jordan Lindsey, noted that the price of Bitcoin has responded decisively to both outflows and inflows from the funds. According to CoinMarketCap data, the price of Bitcoin rose by 4.91% in the last 24 hours, reaching $62,840.

Several factors contribute to the prolonged fund outflows of the Grayscale Bitcoin Trust (GBTC). One of these factors is the relatively high management fees of GBTC compared to competitive ETFs. The management fee of 1.5% for GBTC stands out significantly when compared to the majority of other ETFs, which typically have fees below 1%. For instance, the ETF offered by Franklin Templeton charges only a 0.19% fee, making it one of the lowest-cost options in the market.

Another significant factor is the release of large amounts of GBTC shares into the market by bankrupt crypto firms such as FTX and Genesis to repay their creditors. This additional selling pressure has negatively impacted the market performance of GBTC.

You can stay up to date with developments and the latest news in the cryptocurrency markets by following Kriptospot.com.