Grayscale And Coinbase Are In Talks With The Sec Regarding An Ethereum Etf.

- Posted on March 10, 2024 8:55 PM

- Cryipto News

- 553 Views

Grayscale and Coinbase met with the SEC on March 6th to discuss concerns regarding converting Grayscale's Ethereum Trust into a spot ETF.

Leading companies in the cryptocurrency sector, Grayscale and Coinbase, recently held discussions with the United States Securities and Exchange Commission (SEC) about a regulatory change to create Ether-based spot exchange-traded funds (ETFs).

Grayscale aims to convert its Ethereum Trust into an ETF that reflects the market value of Ether, similar to the process it underwent with its Bitcoin Trust. Following the completion of the public comment period for the proposed change in January, concerns regarding potential market manipulation risks if the fund were approved were addressed in a meeting on March 6th.

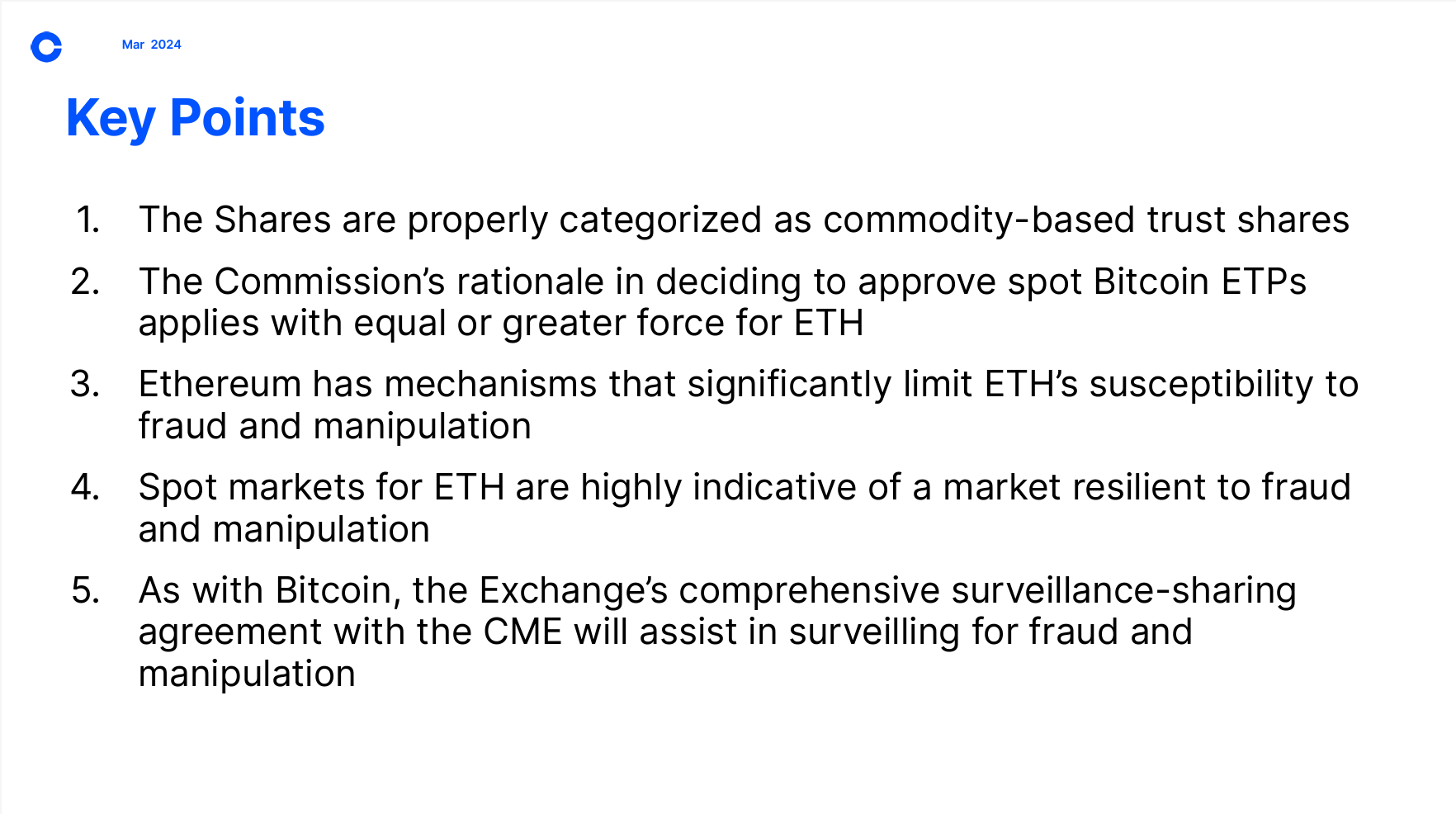

In a presentation to the SEC, Coinbase argued that the logic that led to the approval of Bitcoin ETFs should also apply to Ether. This argument was supported by the assertion that Ether possesses significant protective features against fraud and manipulation.

Another key point in Coinbase's presentation to the SEC was their surveillance-sharing agreement established with the Chicago Mercantile Exchange (CME). This arrangement was developed at the request of the SEC to enhance the trade monitoring systems for Bitcoin ETFs.

Nate Geraci from ETF Store noted that Coinbase highlighted the relationship between Ether futures and spot markets. Geraci stated, "The SEC has already approved ETFs based on Ether futures traded on the CME. Thus, I find it hard to see a reason not to approve spot Ether ETFs."

Grayscale is also proposing a second ETF based on Ether futures. The fundamental distinction between spot and futures markets is that in the spot market, assets can be bought and sold immediately, whereas in the futures market, contracts can be made to buy or sell an asset at a specific price on a future date.

Some analysts suggest that Grayscale's application for a futures ETF might be a strategic move to pressure the SEC into approving a spot Ether ETF.

Many major asset managers, including Invesco, Galaxy Digital, Fidelity, Franklin Templeton, and BlackRock, are in pursuit of approval for a spot Ether ETF. The SEC's decision is expected to be announced in May.

Bloomberg analyst Eric Balchunas commented that asset managers are not fully aware of the SEC's stance on cryptocurrency investment tools. Balchunas said, "Normally, this would be considered a positive sign, but as far as I know, the SEC officials have not yet provided any feedback to the issuers. This is not necessarily a good sign, unlike when they made statements about BTC ETFs in the past."

Stay updated with the latest developments and news in the cryptocurrency markets with Kriptospot.com.