Important Developments Expected In Bitcoin: Here Are Five Points To Watch Out For

- Posted on June 5, 2024 9:17 AM

- Cryipto News

- 632 Views

Bitcoin market analysts predict that the price of BTC is approaching a milestone that will make history.

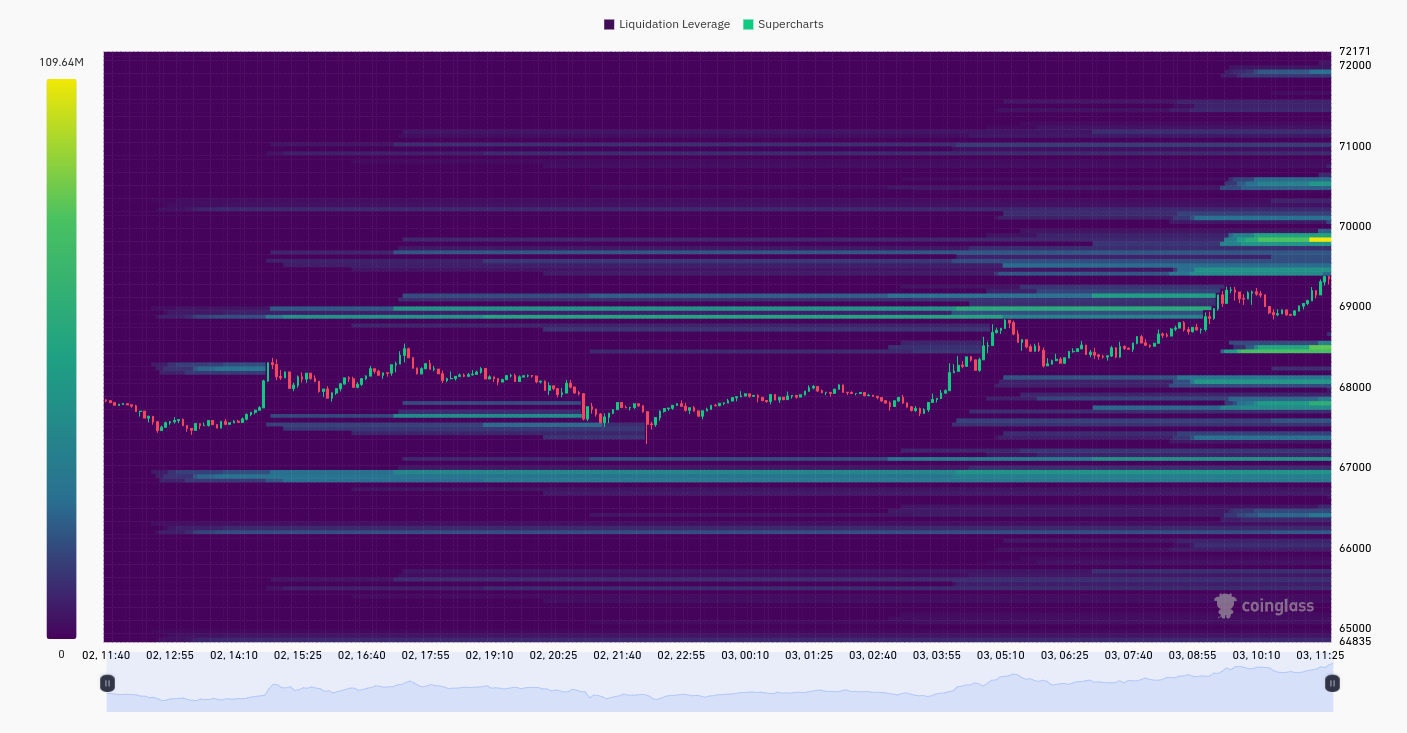

Bitcoin (BTC) kicked off June by approaching a critical resistance level, coinciding with a recovery in traditional markets, balancing the price of BTC around $69,000. The main question for participants in the Bitcoin market is whether this level can be breached, and various opinions have been expressed on this topic in recent weeks. Experts have been eagerly awaiting a rise in the fluctuating BTC/USD pair over the last three months.

In the coming days, some critical data that could help bulls overcome this resistance are expected to emerge. Notably, the US unemployment rates, a significant factor in the volatility of risk assets, are due to be announced towards the weekend.

The current focal point for Bitcoin is at the $69,000 level. Following the movements over the weekend, BTC/USD showed a recovery at the weekly close.

Bitcoin bulls reactivated on the morning of June 3rd.

The BTC price is trading above $69,000 as of the time of writing, and the ongoing struggle around this level indicates that the market is still alive.

Renowned analyst Skew emphasized the vital importance of overcoming the $69,000 level for the market to reach new highs in their latest analysis on the X platform.

Skew stated that following the declines earlier in the week, they would focus on opportunities that could arise by monitoring risk factors. Additionally, they described $69,000 as a "critical price point for this week," pointing to increased demand liquidity above $70,000 and mentioned that most orders are still clustered around $66,000.

"Current spot demand is still around $66,000 - $65,000; given the current market conditions, we hope to see some spot orders rise towards $67,000," Skew said.

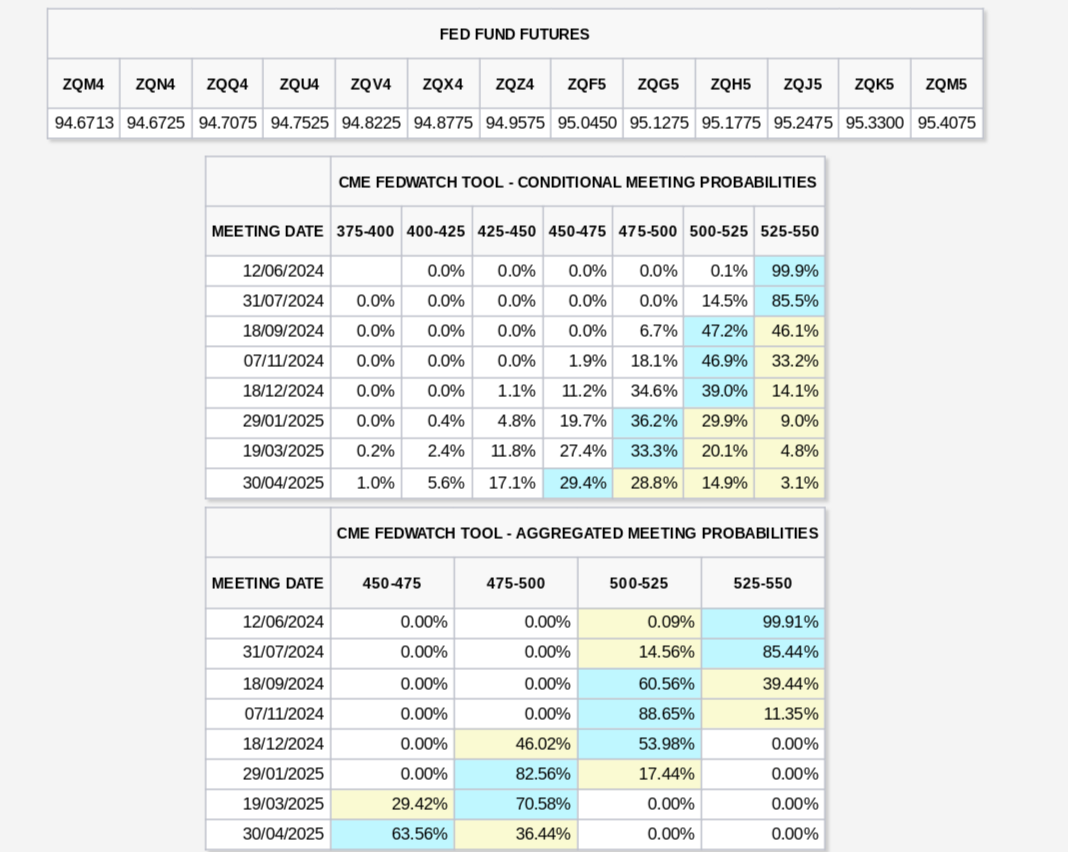

Unemployment data takes center stage before entering FOMC week. While the start of the week is relatively calm from a macroeconomic perspective, it doesn't necessarily mean that potential volatility for risk assets has completely disappeared.

Initial jobless claims in the US will be announced on June 6th, with additional unemployment figures expected the following day. Bitcoin and crypto markets are particularly sensitive to employment data this year, which has been lower than expected.

High unemployment rates indicate that the Fed is implementing tight monetary conditions in the economy. Therefore, the possibility of these conditions being relaxed sooner or later is increasing.

Later in the month, the FOMC meeting will convene to discuss changes in interest rates. The Kobeissi Letter noted in a section of their commentary, "This is the last employment data week before the June Fed meeting begins."

CME Group's FedWatch tool's latest data indicates that market expectations remain unchanged. The likelihood of a significant interest rate cut in September or later appears to be low.

In its latest issue on June 2nd, Mosaic Asset's regular bulletin "The Market Mosaic" stated, "Even if the Fed manages to implement an interest rate cut this year, the central bank seems compelled to keep interest rates high for a longer period." The bulletin also emphasized that the decreasing probability of an interest rate cut is not necessarily "bad for the stock market."

When will the prolonged consolidation in BTC come to an end?

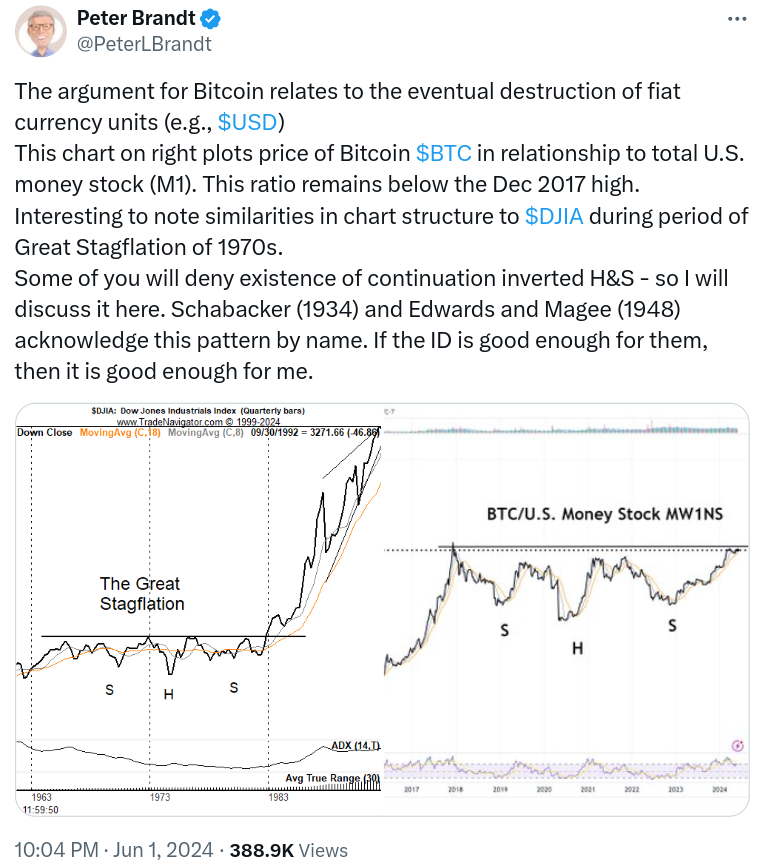

On social media, comparisons between the US M1 money supply and Bitcoin's performance are often made. The M1 money supply represents the total amount of cash, demand deposits, and traveler's checks in the US economy. Bitcoin has exhibited significant dynamics against M1 over the years, and as of June 2024, it appears to be repeating its largest surge to date.

Popular trader and analyst TechDev stated on June 1st: "Bitcoin has only seen peaks from breakthroughs against the M1 money supply. And the longer the consolidation lasts, the longer the upward trend continues. This breakthrough occurred after the longest consolidation seen so far."

The chart actually depicts a breakout phase that began last year, but it's noted that it hasn't been fully felt yet according to historical standards.

TechDev continued his remarks: "This actually represents the breakout of a 5-year expanding wedge."

"Over the past 5 years, we've seen a corrective move against M1. BTC is now showing an impulsive move against M1 for the first time since 2017. We haven't seen such a Bitcoin breakout before."

This phenomenon has also caught the attention of the financial community and has been noticed by experienced traders like Peter Brandt.

Popular commentator WhalePanda shared in part of his response, "We never had a blow-off top in 2021 and it was all consolidation against M1 money supply, so we're in a mega bull run now."

During the breakout in 2017, BTC/USD experienced a parabolic rise over the following nine months.

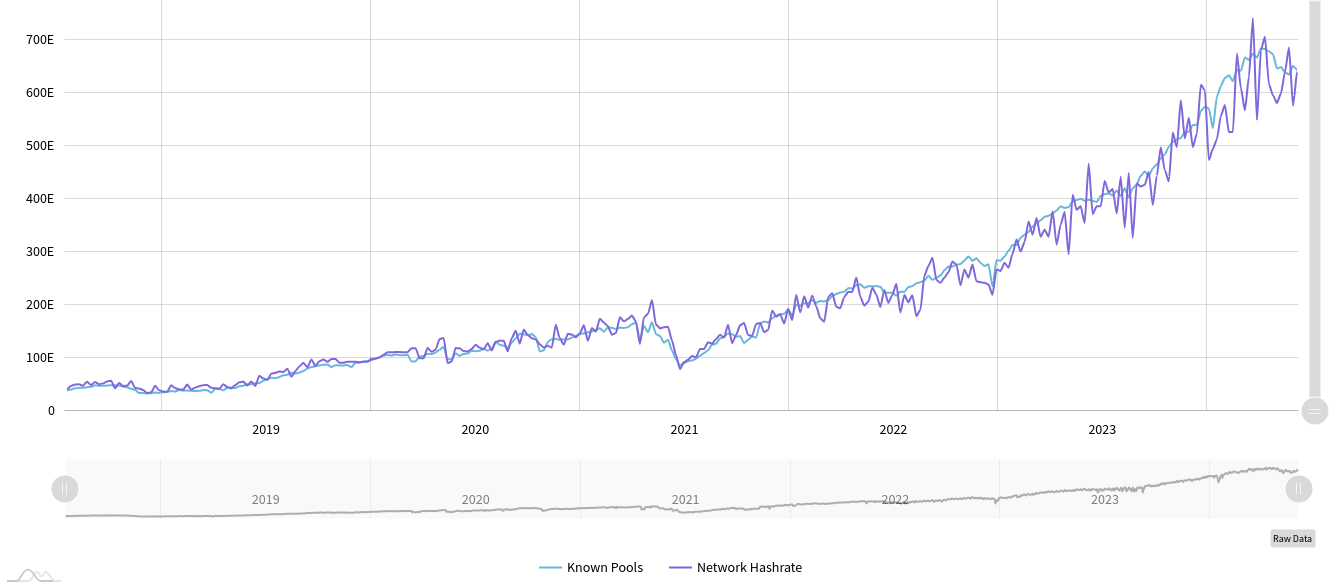

Mining difficulty is recovering The fundamentals of the Bitcoin network are gradually recovering after the rapid cooldown during the downward price movements at the beginning of May.

Latest data from BTC.com predicts a mining difficulty increase of about 1.7% on June 6.

This will be added to the 1.5% increase from two weeks ago, helping to compensate for the prior 5.6% decrease.

According to raw data from MiningPoolStats, the hash rate, which reached record levels in April, represents the total processing power allocated to the network by miners and continues to consolidate during this process.

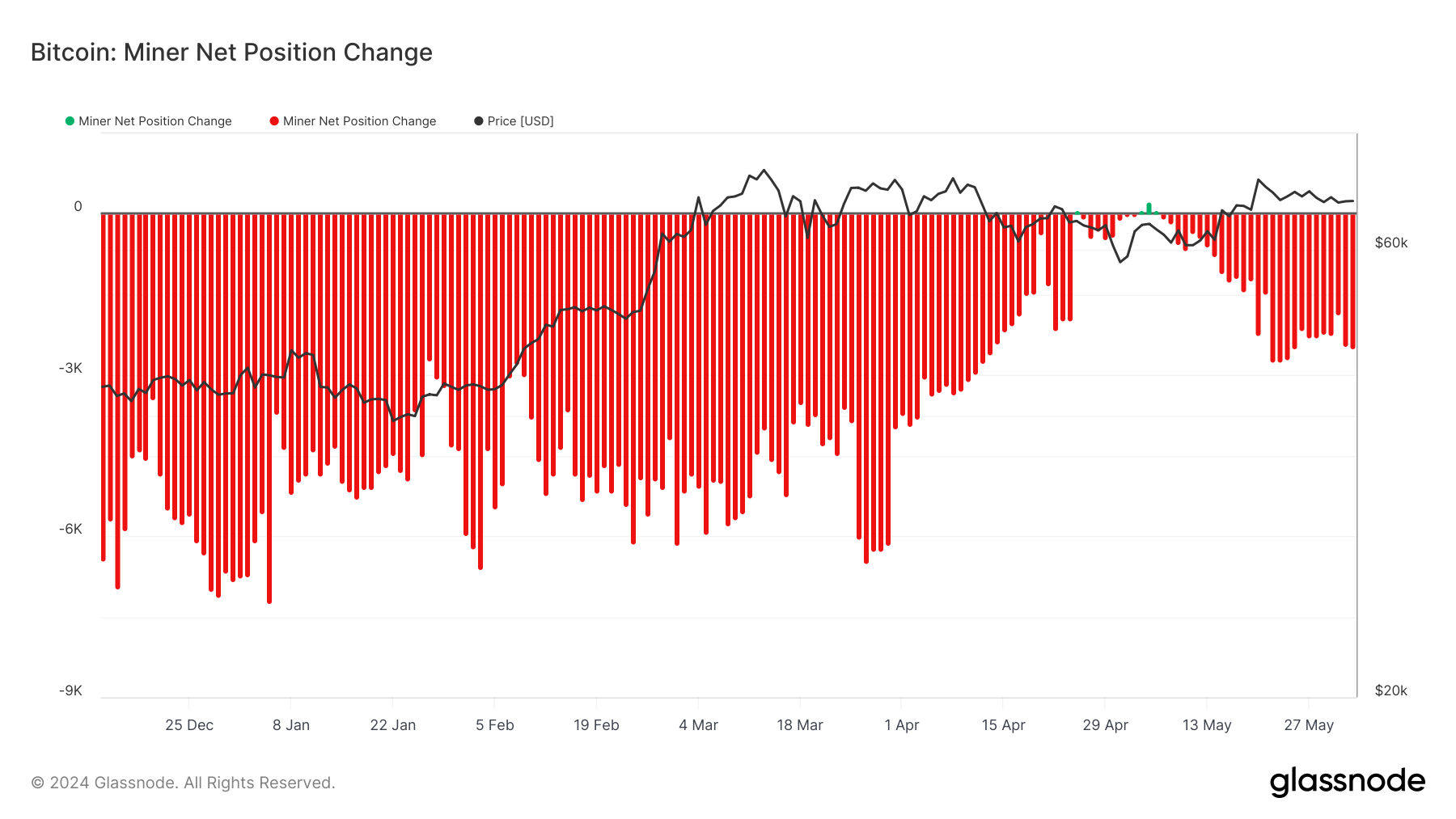

According to reports from Glassnode, Bitcoin miners are going through a challenging period a few weeks after the halving event. As of June 2nd, the total amount of Bitcoin held by miners has decreased by 2,500 BTC compared to a month ago. This decline indicates a less sharp decrease compared to previous halving periods. Glassnode notes that since November 2023, miners have shown an increasing tendency to sell during the first quarter.

A significant amount of Bitcoin (BTC) was withdrawn from the Kraken exchange.

As the trend of declining Bitcoin (BTC) reserves on crypto exchanges continues in recent times, one notable example occurred over the weekend. According to Glassnode's report, the total amount withdrawn from the Kraken exchange on May 30th and 31st reached approximately 50,000 BTC (around $3.44 billion). This withdrawal, recorded as the largest single-day withdrawal in Kraken's history on May 30th, marks the second-highest withdrawal seen since the bear market of 2022.

You can stay updated with the latest developments and news in the cryptocurrency markets by following Kriptospot.com for real-time updates.