Kaiko: This Fund Stands Out Among Ethereum Etfs.

- Posted on May 29, 2024 6:46 AM

- Cryptocurrency Exchanges News

- 684 Views

If Grayscale's spot Ether ETF follows the path of the Bitcoin ETF, it could exert short-term pressure on the price of ETH.

If Grayscale's yet-to-launch spot Ether (ETH) Exchange-Traded Fund (ETF) performs similarly to the Grayscale Bitcoin Trust, it could see an average outflow of $110 million per day in its first month.

In a report dated May 27, Kaiko analysts reminded that the Grayscale Bitcoin Trust (GBTC) converted from a futures-based to a spot ETF on January 11, and saw 23% of its managed assets ($6.5 billion) leave the fund in the first month.

Currently, the Grayscale Ether Trust (ETHE) has about $11 billion in managed assets. According to Kaiko, if ETHE experiences a similar outflow to GBTC, it could amount to $110 million. This outflow would represent about 30% of the ETH volume on the Coinbase exchange.

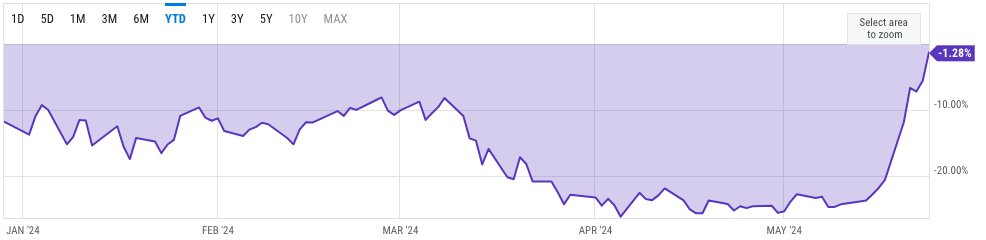

Over the last three months, Grayscale's ETHE has traded at a discount of up to 26% to its net asset value. Kaiko researchers noted that a conversion to a spot ETF could reasonably lead to a decrease in the discount and subsequent profit-taking.

Before its conversion from futures to spot ETF, the GBTC fund had a discount rate exceeding 17%. The decrease in the discount rate proved profitable for many investors.

According to YCharts, GBTC currently has a discount rate of 0.03%.

ETHE's discount has narrowed somewhat since the Securities and Exchange Commission gave its initial approval for spot Ether ETFs on May 23, but the fund has yet to start trading as a spot ETF.

According to YCharts data, ETHE's discount was around 25% on May 1, but quickly dropped to 1.28% in anticipation of the SEC approving spot Ether ETFs.

Kaiko analysts also noted that the outflows from GBTC were balanced by inflows into other Bitcoin ETFs until the end of January.

Furthermore, Kaiko stated that while Ether ETF inflows might disappoint in the short term, this approval had significant implications for ETH and addressed some of the legal uncertainties that negatively impacted Ether's performance last year.

You can follow the latest developments and news in the cryptocurrency markets in real-time with Kriptospot.com.