Could Crypto Investors Be Moving Away From Ethereum?

- Posted on April 9, 2024 12:33 PM

- Cryipto News

- 590 Views

Flows into Ethereum-based crypto investment products saw consecutive declines in the fourth week, however, positive flows into the Solana ecosystem are also notable.

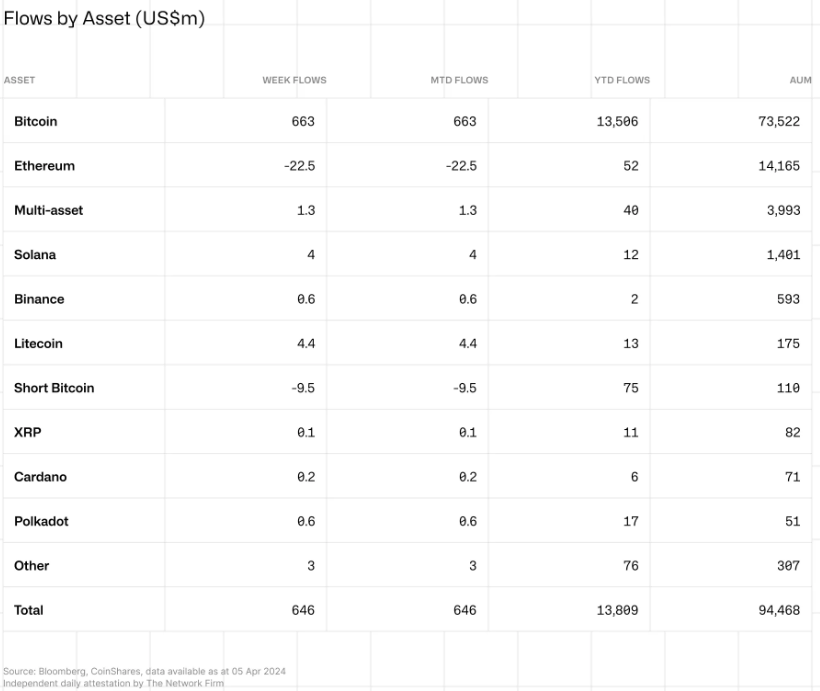

According to a report dated April 8 by CoinShares, Ethereum-based crypto investment products experienced negative cash flows for the fourth consecutive week, despite positive trends in rival cryptocurrencies. Ether products, unlike most other altcoins, saw an outflow of $22.5 million last week.

The report indicated that interest in digital asset investment products continued last week, with total inflows amounting to $646 million. Inflows since the beginning of the year reached $13.8 billion, surpassing the $10.6 billion recorded in 2021 and reaching an all-time high.

While inflows were observed in investment products representing other major altcoins, the continued outflow from Ethereum has surprised many. According to CoinShares' report, Litecoin saw inflows of $4.4 million last week, followed by Solana with $4 million and Filecoin with $1.4 million.

The price of Ethereum surged by 6.8% in the last 24 hours, reaching $3,625 (as of 11:45 Turkey time). According to CoinMarketCap data, the world's second-largest cryptocurrency recorded a weekly increase of 2.3% while experiencing a 8.2% loss last month.

Solana is often regarded as one of Ethereum's biggest competitors, thanks to its scalability and high transaction throughput. Recently, Solana's native token, SOL, has attracted attention by outperforming Ethereum. Solana is described as one of the most promising among the so-called "Ethereum killers." According to TradingView data, Solana increased by 24% last month, while Ethereum experienced a 6.2% decline.

Investors' interest in exchange-traded funds (ETFs) seems to be declining. Despite a weekly inflow of $646 million into digital asset investment products, there is a decreasing trend in interest towards ETFs, according to the CoinShares report. The fact that the weekly flow levels seen at the beginning of March could not be reached and the volumes last week decreased from $43 billion in the first week of March to $17.4 billion, indicate signs of reduced appetite among ETF investors.

Spot Bitcoin ETFs approved in January have accumulated over 834,000 Bitcoins, totaling $60.4 billion in on-chain assets, representing 4.24% of the current BTC supply. This illustrates the significant role ETFs play in the crypto asset market.

Additionally, according to CoinShares, there has been a consecutive third-week outflow of $9.5 million from investment products taking short positions against Bitcoin. This suggests a small capitulation among bearish investors and provides interesting observations on changes in market dynamics.

You can stay updated on developments and the latest news in the cryptocurrency markets by following Kriptospot.com.