Microstrategy Could Bring Millions Together With Bitcoin.

- Posted on February 16, 2024 9:52 PM

- Cryptocurrency Exchanges News

- 586 Views

For MicroStrategy to be listed on the stock market, its market value needs to increase by another $3.7 billion and meet other eligibility criteria.

MicroStrategy, a major corporate investor in Bitcoin (BTC), is making progress towards inclusion in the S&P 500 index, but has not yet taken sufficient steps in this regard.

For MicroStrategy to qualify for inclusion in the S&P 500 index, it needs to meet strict eligibility criteria and experience a significant increase in market value.

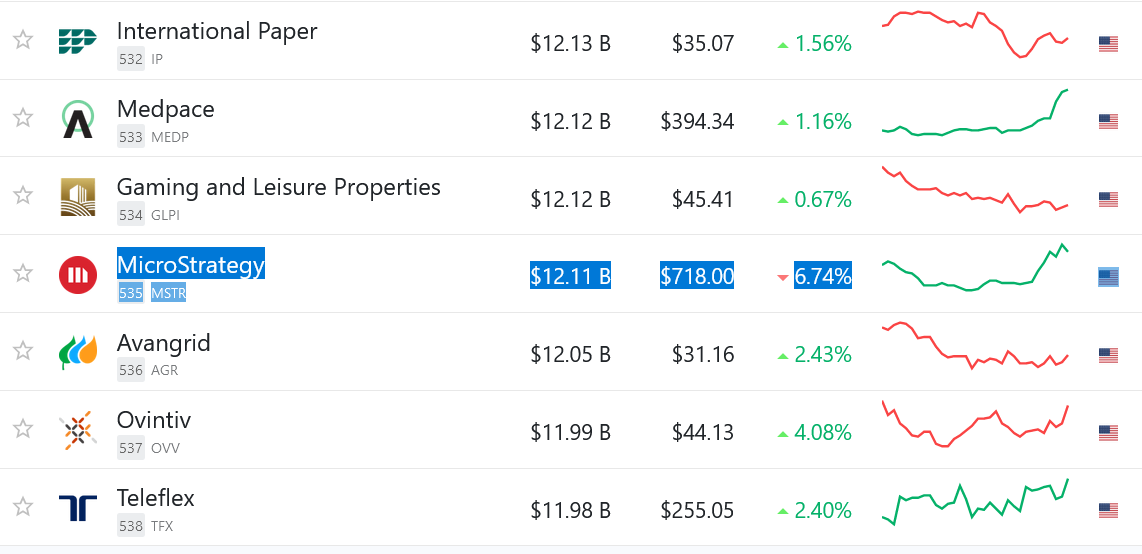

According to data, MSTR shares surged by 46% over an eight-day trading period, reaching 535th place among the largest companies in the United States on February 15th.

For a company to be included in the Standard and Poor's 500 (S&P 500) index, which covers the largest 500 companies listed on U.S. exchanges, it must meet various eligibility criteria. Among these criteria are minimum market capitalization, positive earnings in the previous four quarters, at least 250,000 shares traded, and majority ownership by the public.

MicroStrategy's current market capitalization stands at $12.1 billion, and to qualify for entry into the S&P 500, it needs to reach a market capitalization of $15.8 billion. Additionally, the company has reported positive earnings in the previous four quarters.

However, even if it meets the criteria, MicroStrategy's inclusion in the index requires approval from the 11-member executive committee of the S&P. This committee has made similar decisions in the past, such as temporarily removing Tesla.

If MicroStrategy were to join the S&P 500 and succeed, Joe Burnett, Senior Product Marketing Manager at Bitcoin financial services firm Unchained, believes it could create a "tremendous positive cycle" for Bitcoin in almost every ETF portfolio.

Rising market cap and TTM profitability could position $MSTR for S&P 500 eligibility, pending U.S. Index Committee approval.

— Joe Burnett (🔑)³ (@IIICapital) February 15, 2024

If MSTR is included, it could spark a massive positive feedback loop enabling #bitcoin to begin automatically infiltrating nearly every portfolio. pic.twitter.com/2e4m6oXGJu

Burnett stated that if MicroStrategy were to be included in the S&P 500, Bitcoin would "automatically start to enter almost every portfolio." He noted that this would apply to various portfolios, including traditional 401(k) plans, retirement funds, and 60:40 portfolios.

According to the VettaFi ETF database, the three largest ETFs by assets under management follow the S&P 500. State Street SPY, BlackRock IVV, and Vanguard VOO have assets of over $400 billion.

In the event of MicroStrategy's inclusion in the S&P 500, its portfolio weight in the index fund would be approximately 0.01%.

Data indicates that the S&P 500 currently has a market capitalization of $41.9 trillion. This means that MSTR's 0.01% weight would consume $12 billion in passive capital allocation.

In his post on X, Burnett commented, "Passive index flows drive markets. Inclusion will be equivalent to automatic buying, will boost stock prices, provide more stock issuance for BTC purchases, further boost stock prices, and attract more passive flows."

Saylor found the infinite money glitch:

— The ₿itcoin Therapist (@TheBTCTherapist) February 15, 2024

• Buy #Bitcoin

• MSTR goes up

• Take out more debt

• MSTR goes up

• Sell personal holdings

• MSTR goes up

• Issue more stock

• MSTR goes up

• Join the S&P 500

• MSTR goes up

This is the playbook of the century. 🤯

MicroStrategy currently holds 190,000 BTC with an average purchase price of $31,224, resulting in a $3.9 billion increase in the company's investment.

The company's founder and CEO, Michael Saylor, announced on February 9th that MicroStrategy had transformed from a business intelligence firm into a "Bitcoin development company."

MicroStrategy is a #Bitcoin Development Company.

— Michael Saylor⚡️ (@saylor) February 9, 2024

You can stay updated on developments and the latest news in the cryptocurrency markets by visiting Kriptospot.com for real-time updates.