Markets In Turmoil: Will The Fed Intervene Early?

- Posted on August 7, 2024 2:44 AM

- Cryptocurrency Exchanges News

- 882 Views

At the end of July, the lower-than-expected non-farm payrolls, along with higher-than-expected unemployment claims and unemployment rates in the U.S., placed significant pressure on the Fed.

Global markets had a turbulent start to the new week. Following the Fed's decision to keep interest rates unchanged last week, negative macroeconomic data has heightened fears of an economic downturn in the U.S. Despite Fed Chair Jerome Powell's hints at rate cuts in September after the FOMC meeting, selling pressure has not abated.

At the end of July, lower-than-expected non-farm payrolls and higher-than-expected unemployment claims and unemployment rates in the U.S. placed significant pressure on the Fed.

However, the selling pressure in global markets isn't solely due to the U.S. The Bank of Japan unexpectedly raised interest rates to 0.25% in response to the yen's depreciation against the dollar since the beginning of the year. This move has led to a shift in preferences among carry trade investors, who profit from the interest rate differentials between currencies. The Japanese Nikkei 225 index fell by 13.47% in the first session of the week.

Stocks and Bitcoin Tumble

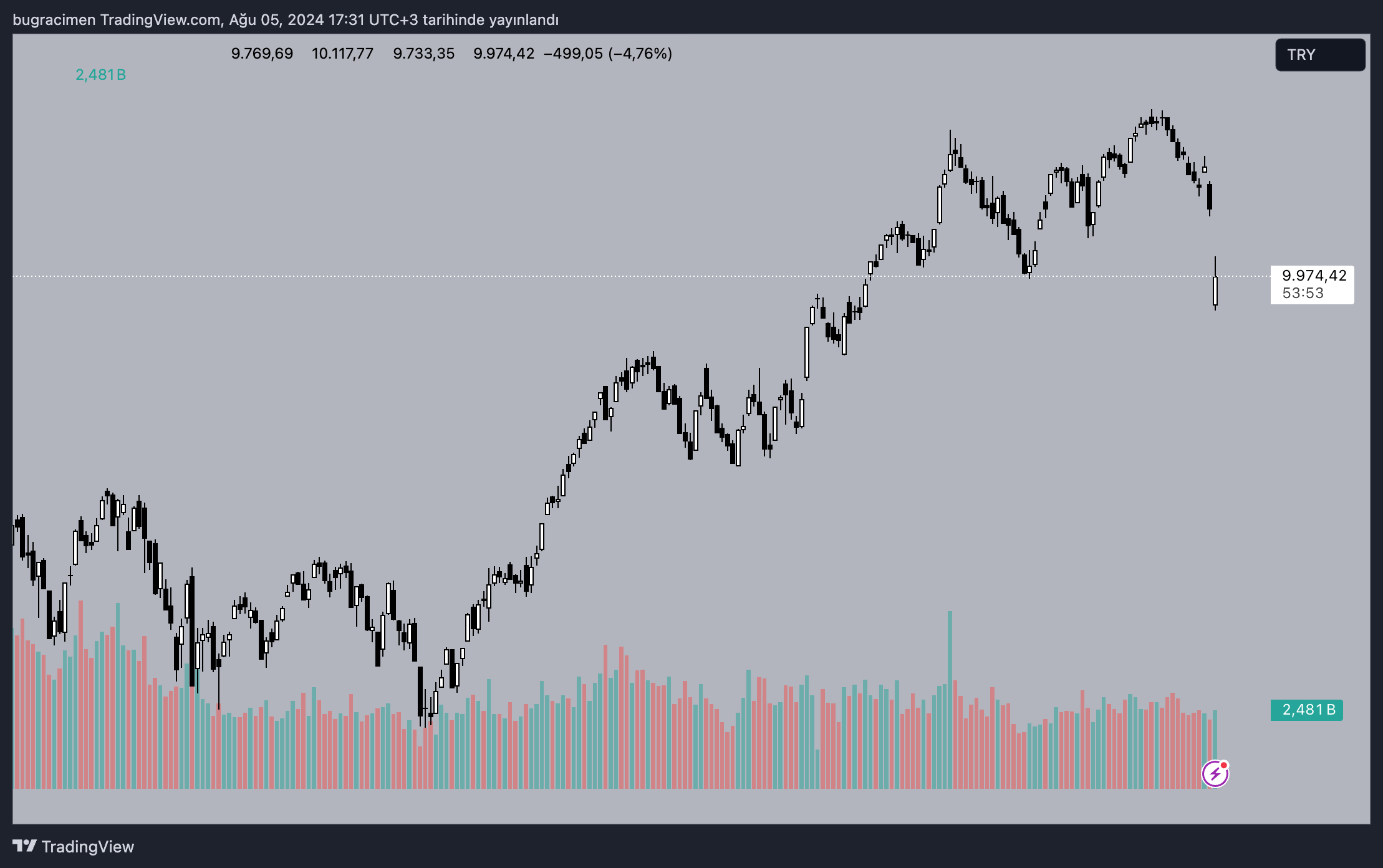

The sell-off in the Japanese market early in the day has adversely affected nearly all stock markets. As of 17:20 Istanbul time, the daily loss in Borsa Istanbul stands at 4.30%. The BIST 100 index is struggling to maintain the 10,000-point level. Similar selling pressure is also dominating European markets.

Compared to stocks, cryptocurrencies—considered higher-risk assets—are experiencing even greater losses. The largest cryptocurrency by market value, Bitcoin, has seen a daily loss of around 11%. Currently, BTC is trading at $53,500. Most altcoins have incurred even larger losses.

Will the Fed Hold an “Emergency” Meeting?

Following the major sell-offs in the stock market on Monday, August 5, a new claim has emerged. Many sources suggest that the extreme sell-offs in stocks and increasing recession fears might force the Fed to hold an extraordinary meeting and make significant interest rate cuts.

According to CME FedWatch data, the U.S. Federal Reserve is expected to cut rates by 50 basis points at its official meeting on September 18.

Cole Smead, CEO of Smead Capital Management, stated on Monday that the possibility of the U.S. entering a recession has intensified the selling wave in global markets and could constrain the Federal Reserve's options.

Smead mentioned in an interview with CNBC that the Fed is still struggling to gauge the true state of the economy due to the ongoing effects of extensive fiscal stimulus from the pandemic. “The Fed is essentially fighting a ghost. This ghost is the massive federal spending deficit that constitutes seven percent of U.S. GDP, and dealing with such an issue is very difficult,” he said.

Smead emphasized that Jay Powell is doing everything he can to understand this problem and address it through monetary policy, noting that it is essentially a fiscal issue that cannot be easily resolved.

Stay updated with the latest developments and news in the cryptocurrency markets on Kriptospot.com.