Research: The Impact Of Etfs On Bitcoin Prices Is Greater Than That Of Miners

- Posted on July 19, 2024 11:11 AM

- Cryipto News

- 743 Views

According to Glassnode's report, the "market impact" of Bitcoin miners on BTC prices remains less significant compared to ETFs and exchanges.

New research confirms that Bitcoin miners' sales are becoming less influential on BTC prices.

In the latest issue of Glassnode's weekly newsletter "The Week Onchain," the report debunks the common belief that Bitcoin miners negatively impact the markets.

Bitcoin Miners vs. Exchange and ETF Influence

Bitcoin miners may have been struggling since the recent halving reduced rewards by 50%. However, the report suggests that the primary influencers of BTC prices are not the miners. According to Glassnode's analysis, central exchanges and spot Bitcoin ETFs in the U.S. are more significant factors affecting BTC prices.

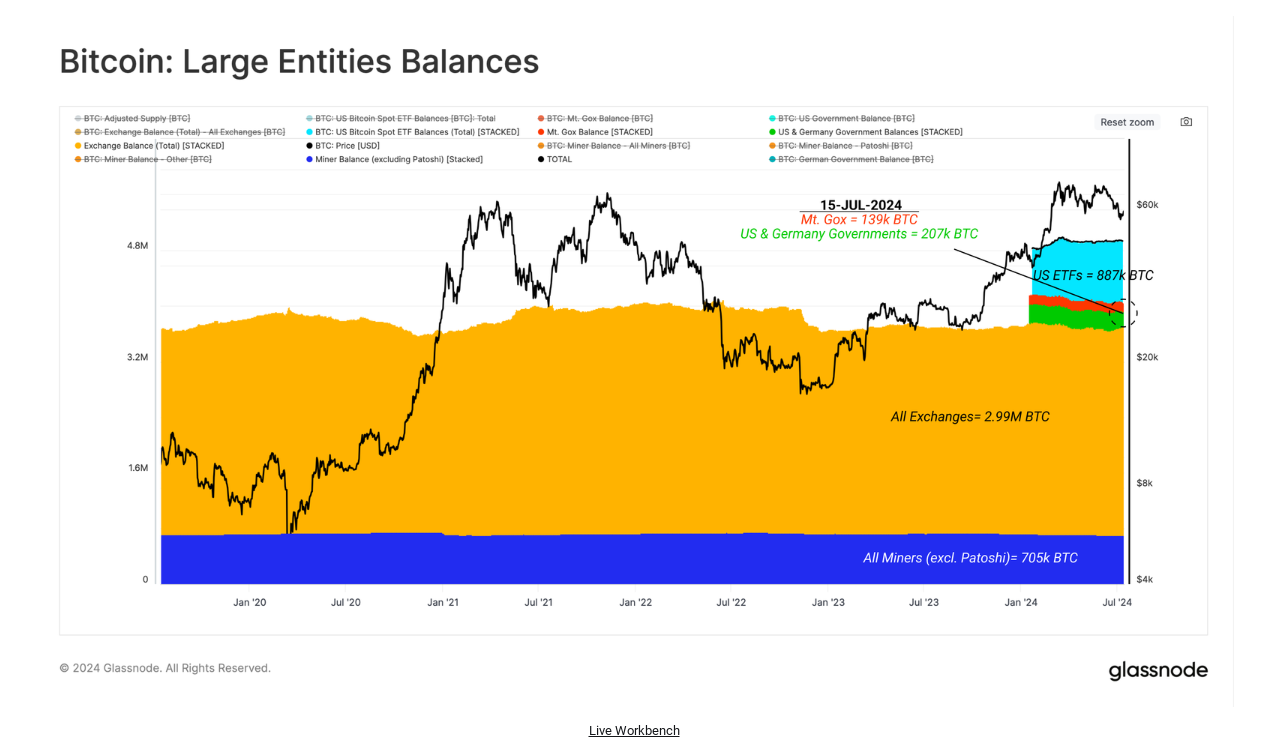

As of July 2024, exchanges still hold over 3 million BTC, while ETFs manage assets totaling 887,000 BTC. In comparison, known miner wallets hold approximately 705,000 BTC.

The report notes, "Historically, significant crypto assets have been held during events like the collapse of Mt. Gox or when large volumes of coins were seized by governments. Recently, institutional custodians and ETFs have become the second-largest Bitcoin pool in the market with substantial influence."

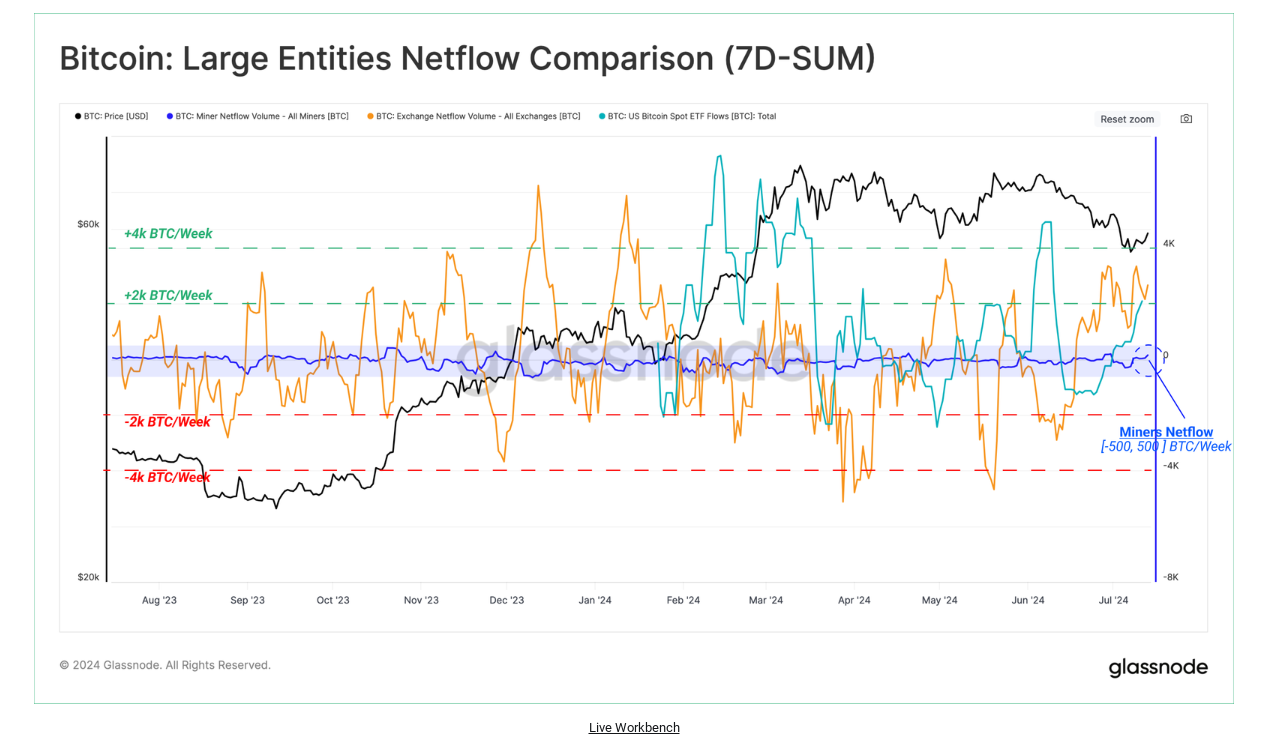

Glassnode reports that miner balances fluctuate by about 500 BTC weekly, which is a relatively small fraction compared to the changes observed in exchanges and ETFs.

The report states, "Miners have historically been viewed as the primary source of selling pressure, but their influence on supply diminishes with each halving."

While exchange and ETF balances vary by approximately 4,000 BTC each week, Glassnode notes that "the impact of flows through these institutions is about 4 to 8 times greater compared to miners."

The recent large-scale Bitcoin sale by the German government has introduced a new competitor for Bitcoin miners. On-chain data shows that the market had already priced in Germany's billions of dollars worth of Bitcoin sales.

Glassnode stated, "The German government successfully sold all the Bitcoin in its wallet. Over the past month, the Bitcoin market absorbed the sale of 48,000 BTC."

"The removal of the German government's selling pressure has eased the market, and signs of renewed demand have led to positive price movements."

For miners, however, the future looks more promising. Hashrate reached all-time highs last week, and Bitcoin's hash ribbons indicator suggests that profitability conditions are gradually improving.

However, indicators measuring the 60-day and 30-day average hash rates show that miners are still in the "capitulation" phase. Capitulation refers to the situation where Bitcoin miners prefer to sell rather than accumulate resources to sustain their operations.

You can keep up-to-date with developments in the cryptocurrency markets and the latest news on Kriptospot.com.