Ripple (Xrp) Could Gain 30% Against Bitcoin

- Posted on July 19, 2024 9:16 AM

- Cryipto News

- 629 Views

XRP lagged behind Bitcoin in 2024, but recent sales in the BTC market from Mt. Gox and the German government could reignite interest in the altcoin.

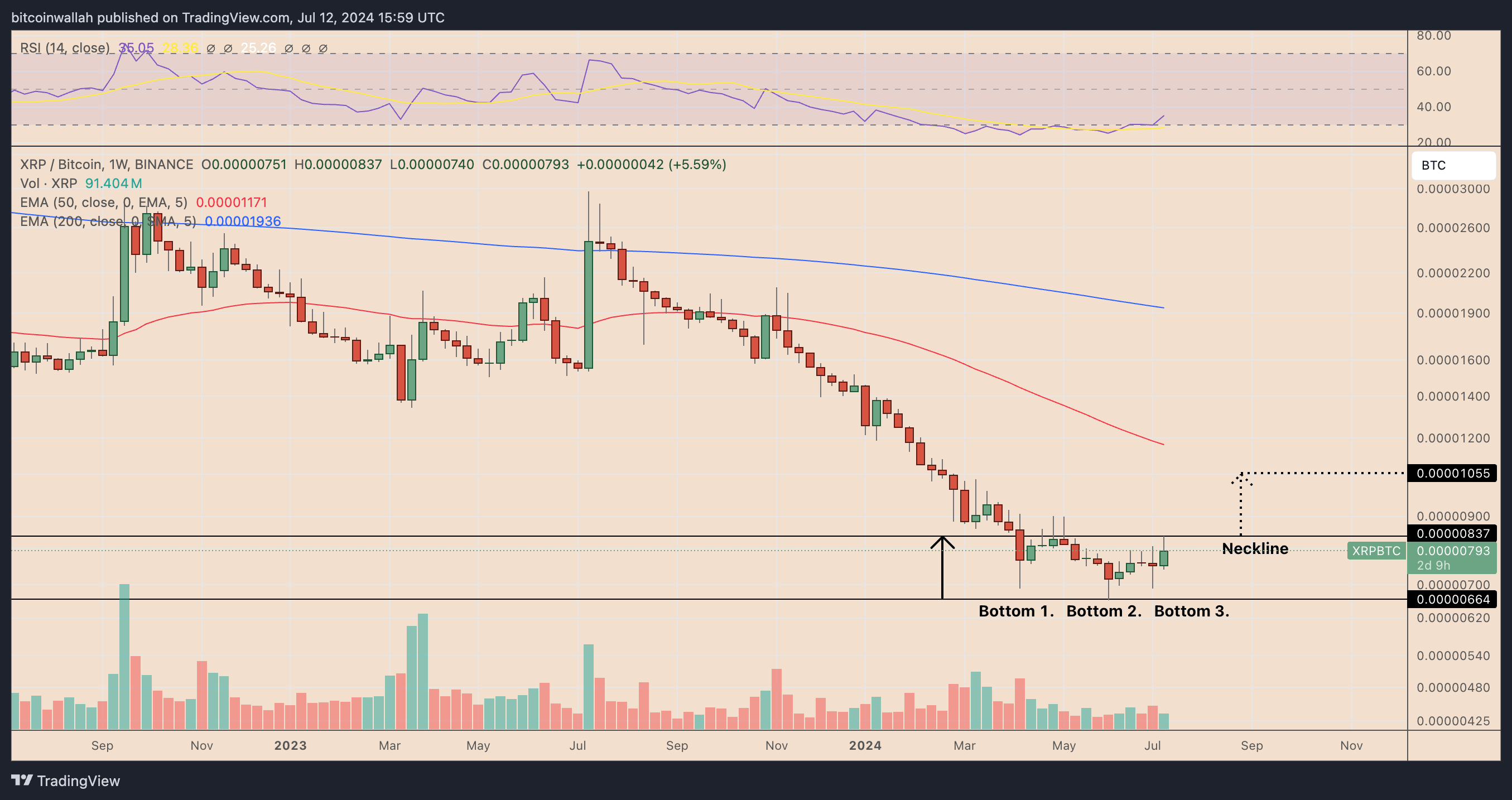

XRP is on the verge of a rebound against Bitcoin after reaching a four-year low. This optimistic outlook is supported by the emergence of a classic bullish pattern known as the triple bottom formation.

The triple bottom formation is characterized by the price creating three distinct lows, each reaching a similar level, which signals a strong support. This pattern suggests that XRP could gain 30% against Bitcoin.

The triple bottom formation occurs when the price forms three distinct lows, each reaching similar levels, which indicates a strong support level. Once the formation is complete and the price breaks above the neckline resistance between the lows, technical analysis suggests that an increase equal to the distance between the lowest point of the formation and the neckline can be expected.

As of July 12, the XRP/BTC pair was testing the neckline support around 793 satoshi, which could signal a potential breakout.

Additionally, the weekly Relative Strength Index (RSI) for the XRP/BTC pair is around 36, indicating that XRP may be undervalued against Bitcoin and suggesting a potential for recovery in the coming weeks. A decisive close above 793 satoshi could help XRP/BTC reach its target of approximately 1,055 satoshi.

However, a possible pullback from the neckline resistance might push XRP/BTC down to the local low of 664 satoshi, representing a potential decline of over 15% in August.

XRP's renewed strength against Bitcoin is largely attributed to the impact of the German government's BTC asset sales in July. Government-associated wallets sold 46,200 BTC starting from mid-June, creating pressure equivalent to approximately $2.69 billion.

The continued repayment of over 140,000 BTC to Mt. Gox creditors has decreased investor interest in Bitcoin. As a result, the XRP/BTC pair experienced a gain of over 20% in July.

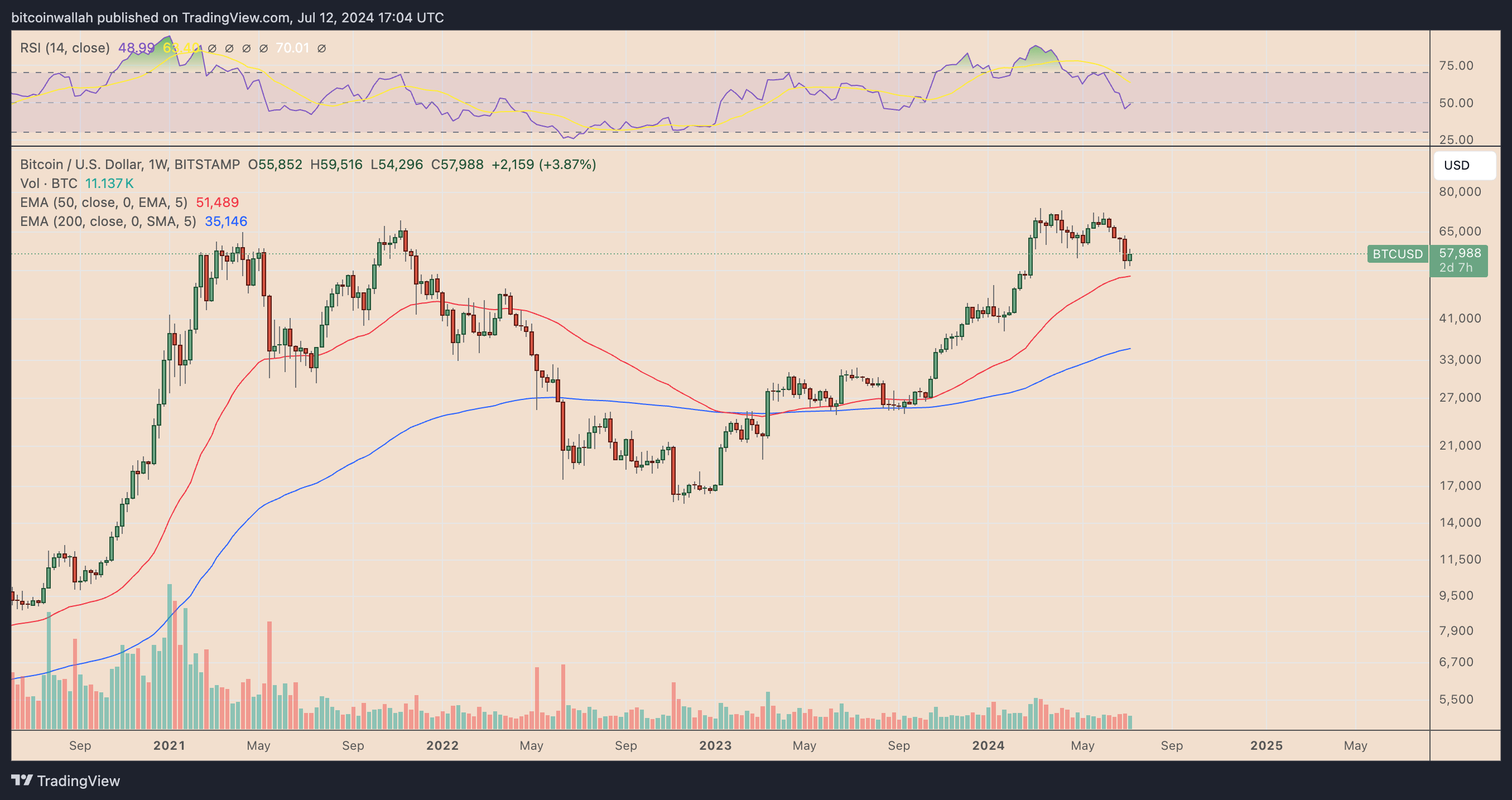

Bitcoin's market dominance fell from 55.46% a week ago to 54.55% on July 12. This decline suggests that, amidst ongoing fluctuations in BTC prices, investors may be shifting their focus towards alternative cryptocurrencies.

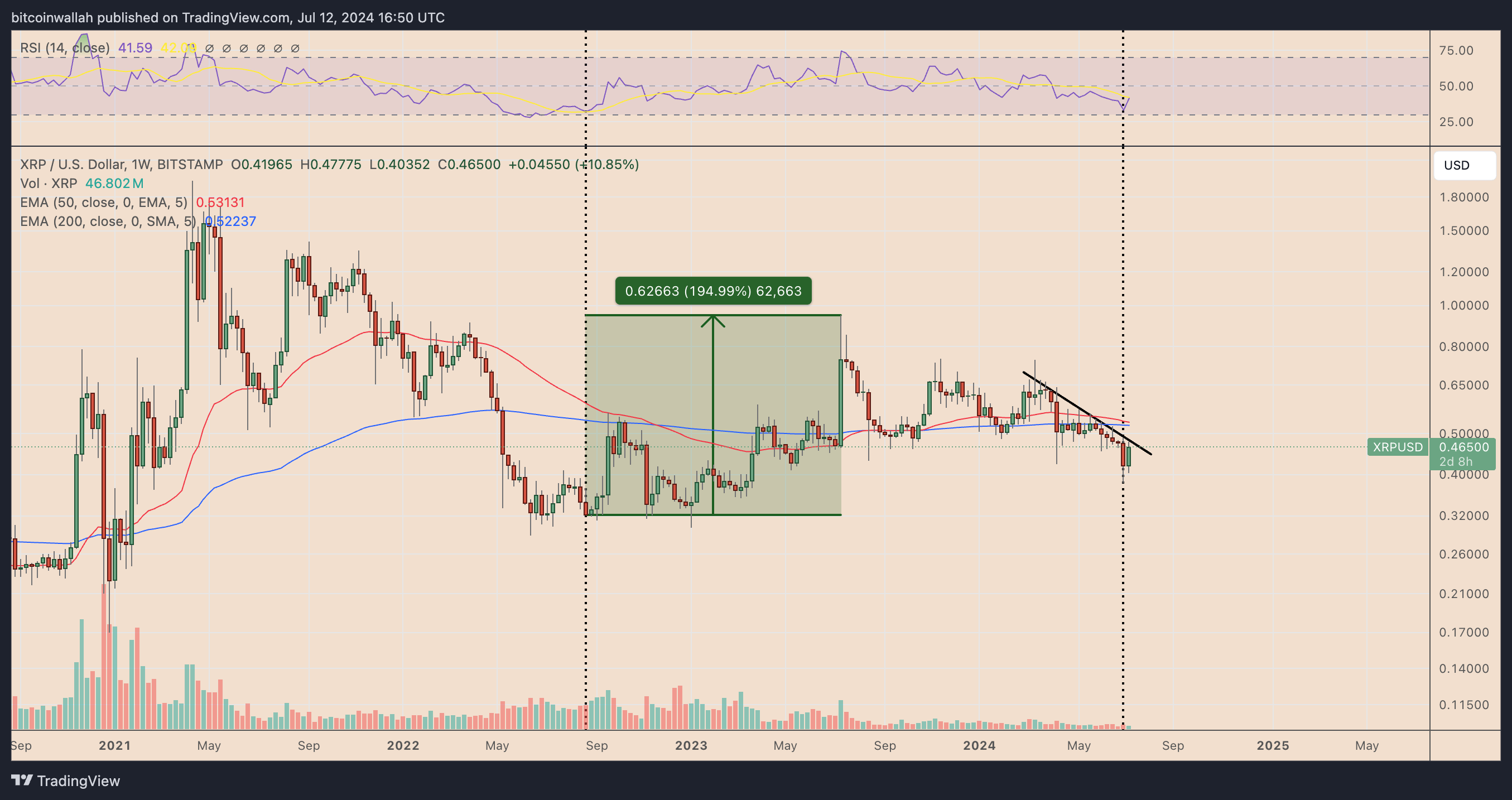

Overall, XRP has seen less demand compared to top-performing cryptocurrencies in 2024, with a year-to-date return of approximately -26.50%.

The weekly Relative Strength Index (RSI) for the XRP/BTC pair has dropped to around 33, just three points above the oversold threshold, marking a two-year low. Historically, when XRP's weekly RSI fell to 33, it was followed by a significant increase of 194%. This suggests that there is potential for a substantial rise in the current scenario as well.

In contrast, Bitcoin's weekly Relative Strength Index (RSI) has declined from an overbought level of 88 in March to a neutral level of 45.50 as of July 12, indicating a correction phase.

This decline indicates a significant weakening of Bitcoin's upward momentum over the past two months. As a result, large-cap altcoins, such as XRP, which have seen limited buying, may benefit in the coming weeks.

Stay updated on developments and the latest news in the cryptocurrency markets with Kriptospot.com.