The Impact Of Us Inflation Data On Bitcoin

- Posted on May 15, 2024 5:41 AM

- Cryipto News

- 838 Views

Bitcoin fiyatı yeni haftada bir miktar yükseliyor. Bu hafta BTC'yi etkileyecek kilit gelişmeler neler?

Bitcoin is maintaining the critical support level of $60,000 as it enters the new week, moving within a narrow trading band. However, this stagnation could be disrupted by several factors this week. Upcoming macroeconomic data from the U.S. and a press conference by Federal Reserve Chairman Jerome Powell could significantly influence market direction. Additionally, on-chain data specific to Bitcoin may also provide crucial insights.

Bitcoin (BTC) starts the week at a price level of $62,000.

According to data from TradingView, there was no significant movement observed in the BTC/USD pair over the weekend.

The $60,000 level continues to be maintained as a critical support where bulls are resisting all selling pressures.

Popular analyst Mark Cullen mentioned in a chart commentary shared on X platform that there is a "bullish block" forming just below the $60,000 level.

"Bitcoin is still holding above the $60,000 level, breaking the downward trend," he said.

"The Critically Blue OB will be important for the short-term; if we lose this level, we may return to lower levels and potentially much lower. Another move may be likely to push liquidity to the highest levels between $64,000 and $67,000."

Cullen added that this week's macroeconomic data, especially the Consumer Price Index (CPI) to be announced on May 14th, could have a significant impact on BTC price movements.

For Bitcoin, the $60,000 zone represents more than just a wall of orders. At this level, key moving averages and other bullish market support trend lines converge.

Popular trader Daan Crypto Trades noted that the "bull market support band" still preserves the price.

The analyst told his followers on the X platform over the weekend, "It moved up exactly from the Bull Market Support Band last week."

"We've seen this band act as strong support during this and previous bull cycles. Let's wait and see what happens next."

The support band includes two exponential moving averages (EMAs).

According to the latest data provided by CoinGlass, a new order block of $65 million was identified at the $60,250 level overnight up to May 13th.

Trader Skew, just a day ago, attributed the lack of testing of the $60,000 support to "passive spot purchases."

"The overall spot order depth has converged between $60,000 and $58,000 due to passive purchases."

Inflation and Powell Week in the US

Macro-economic developments in the United States take center stage this week.

Among discussions on inflation and expectations for interest rate cuts on risky assets, the Consumer Price Index (CPI) continues to be the most significant topic.

On May 14th, the Producer Price Index (PPI) for April will be announced, and Federal Reserve Chairman Jerome Powell will discuss the economic situation in a panel with Klaas Knot, President of the Netherlands Bank, at the annual general meeting of the Foreign Bankers Association in Amsterdam.

Markets are highly sensitive to hints about the Fed's future policy moves from Powell.

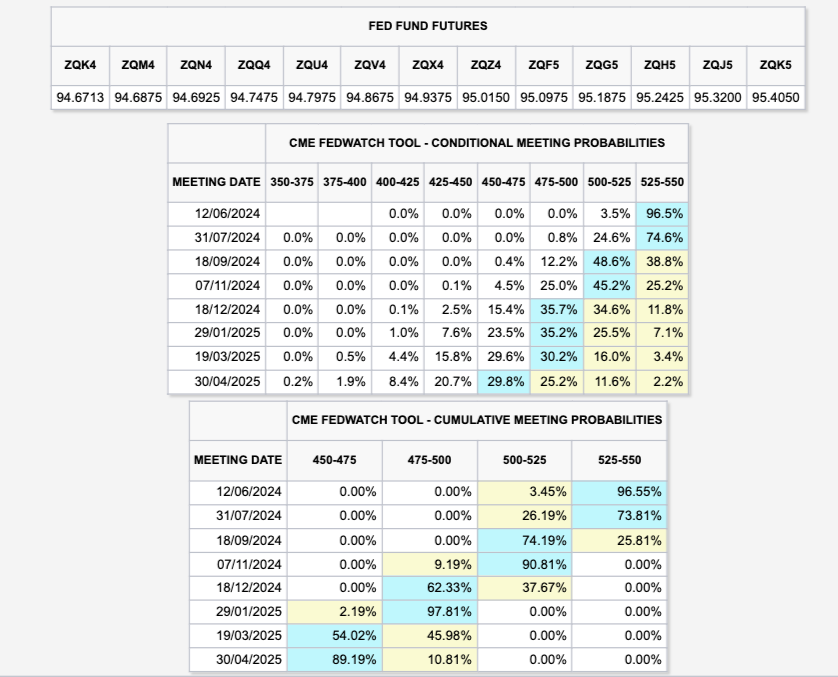

According to the latest data from CME Group's FedWatch Tool, investors see a low probability of the Federal Reserve cutting interest rates at its June meeting; this probability could have increased significantly by September.

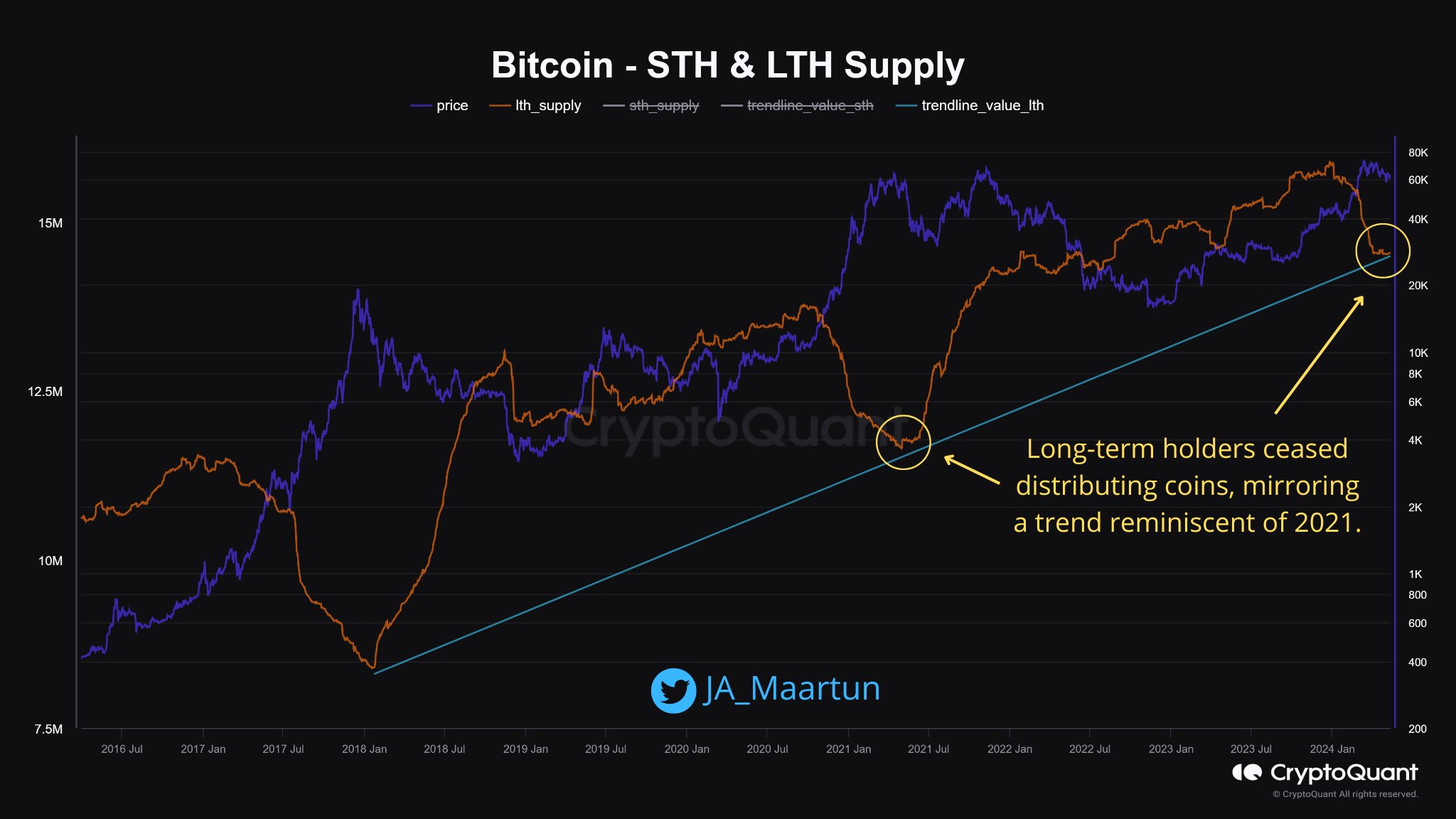

Maartunn, in their recent updates on X, noted that experienced Bitcoin holders strategically navigate low-price periods and market fluctuations by accumulating during these times. On-chain data indicates that these long-term investors (LTHs) are refocusing on Bitcoin investments after market movements throughout 2024.

Strategy of Long-Term Holders

Long-term Bitcoin holders are known to exhibit a trend of buying during bear markets and selling during bull markets, based on a trend line that includes 2018, 2021, and 2024. Maartunn highlighted this cyclical behavior while emphasizing that a significant portion of Bitcoin is increasingly held by long-term holders, and this trend is gaining stability over time.

These data suggest that long-term investors wield significant influence in the market and may exert potential long-term upward pressure on Bitcoin's price. The strategic buying and selling behaviors of long-term holders, particularly at low price points, can determine overall market sentiment and direction.

As mentioned in the Kobeissi Letter, CPI data and other macroeconomic developments can trigger short-term fluctuations in the market. However, the tendencies of long-term holders may be more decisive for the overall health and future of the Bitcoin market. These dynamics continue to be critically important for investors to understand and plan their strategies accordingly.

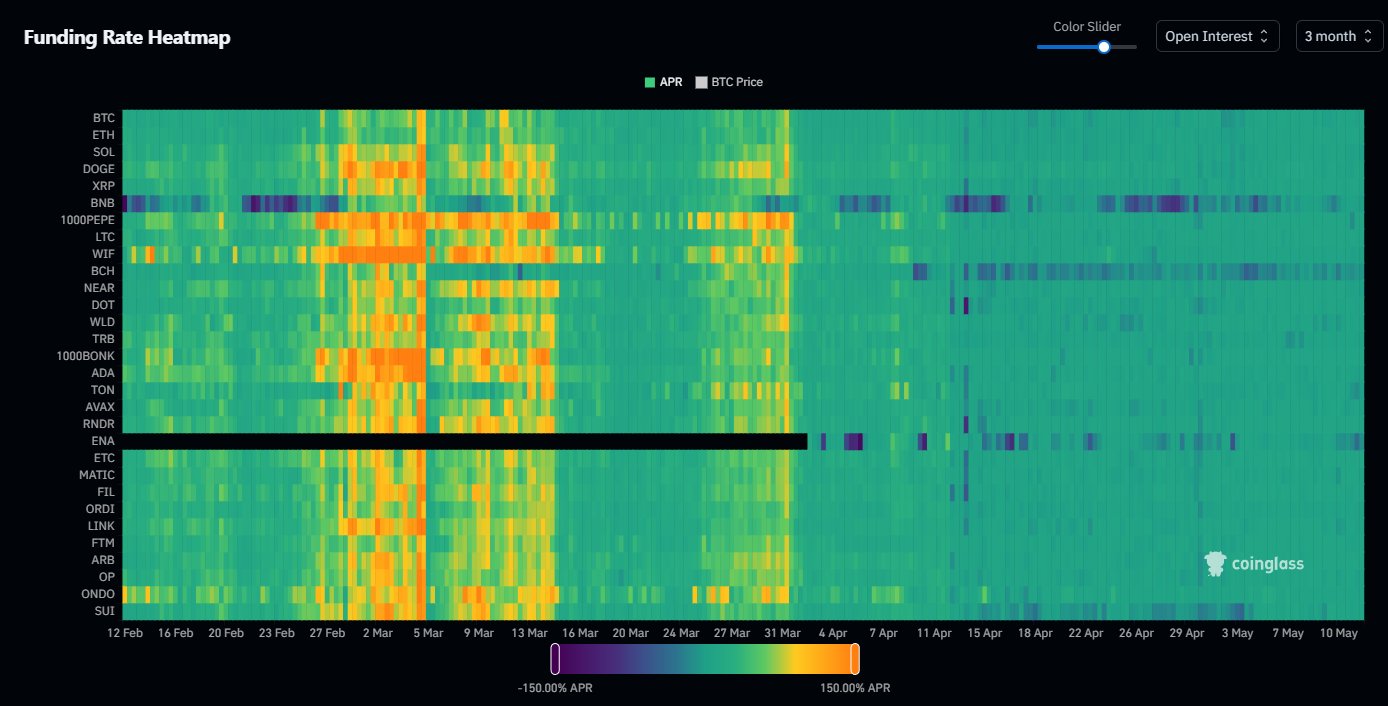

Daan Crypto Trades' assessment suggests that the crypto market is currently in a neutral state, with funding rates in derivative markets remaining independent of short-term price movements.

This indicates that the crypto market is moving towards more balanced and diverse conditions. After periods of overheating in February and March, funding rates have now returned to neutral levels.

Daan Crypto Trades emphasizes the cyclical nature of the market, noting that a slow market period is often followed by a breakout, which then leads to overheating and subsequently a correction phase. Therefore, the current neutrality could potentially signal the beginning of a new cycle or a breakout in future market movements.

This analysis provides a useful perspective for understanding the current state of the crypto market and predicting potential future trends.

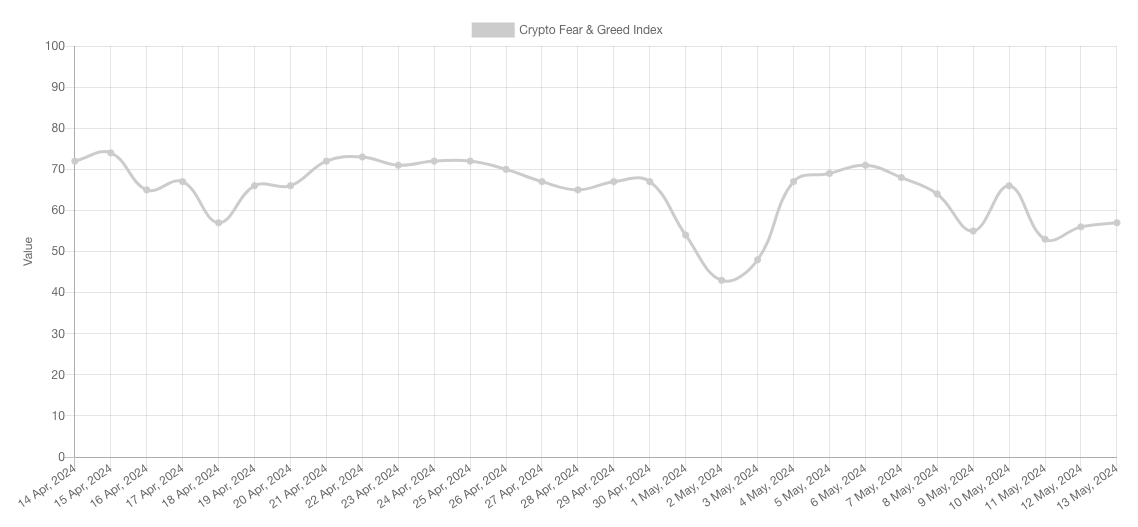

The Crypto Fear & Greed Index, which measures market expectations and sentiments during periods of sideways movement in BTC price, has been showing significant fluctuations.

This index gauges the overall market sentiment by using various factors to determine emotional tendencies among crypto traders. The results provide insights into the general mood of the crypto market.

As of May 13th, the Crypto Fear & Greed Index stands at 57/100, placing it a few points away from the "extreme greed" zone. This may indicate an increase in market uncertainty and fear, but it also suggests that extreme greed has not yet been observed. This situation indicates that investors are cautious and watchful of the current situation, reacting prudently to price movements.

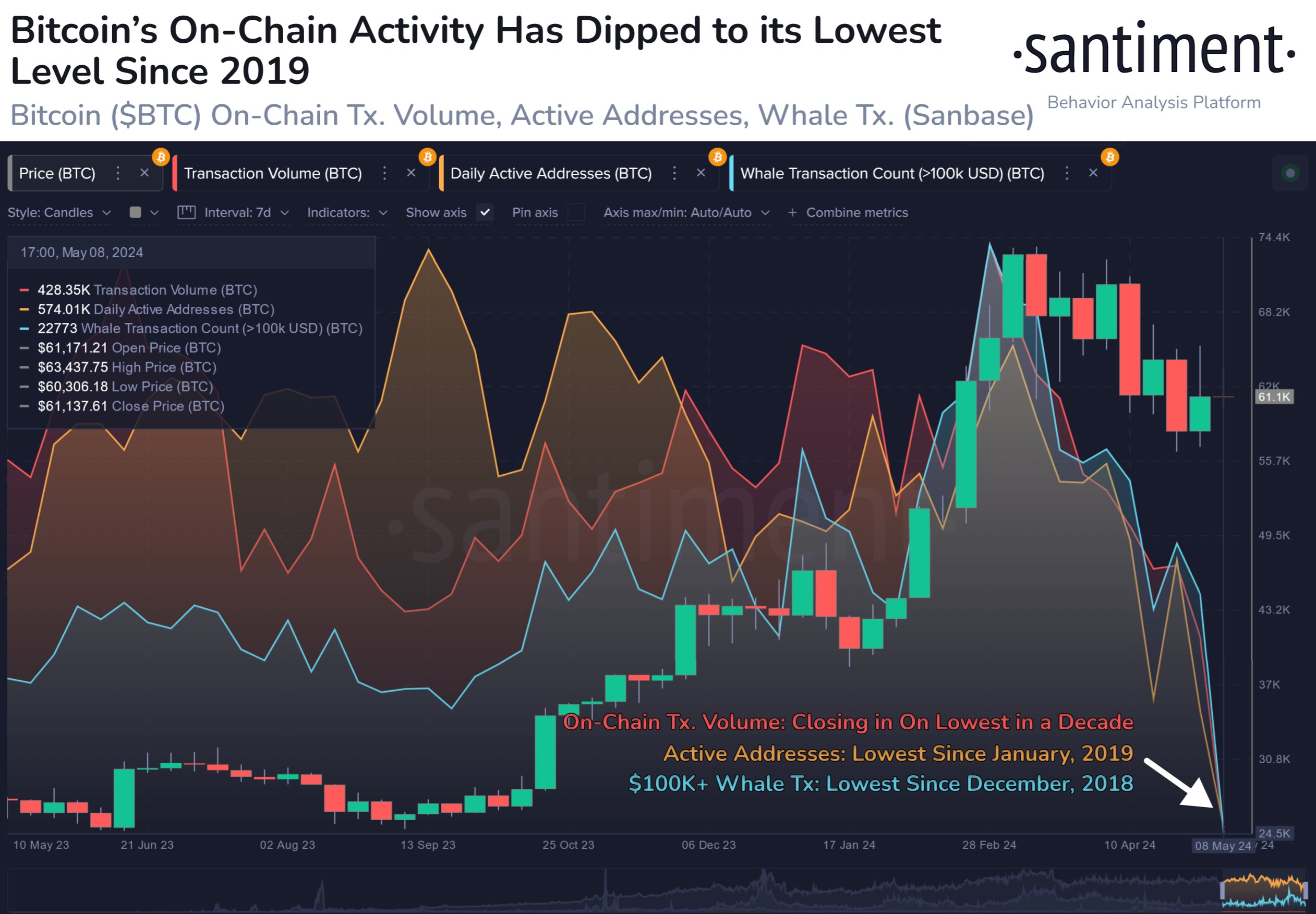

Crypto research firm Santiment has indicated that the decrease in Bitcoin on-chain activities is attributed to investors' growing fear and indecision. According to their recent analysis, these activities have reached historical lows, declining to transaction volumes last seen in 2019. Santiment suggests that rather than signaling a downward trend in the market overall, this situation stems from investors opting for more cautious behavior under current conditions.

This analysis highlights that while the slowdown in Bitcoin transactions may raise concerns about the market's health, it actually indicates investors' preference for taking less risk during periods of high uncertainty. Santiment points out that such market behavior arises from investors struggling to determine a clear direction amidst the current Bitcoin price levels.

You can follow the latest developments and news in the cryptocurrency markets in real-time with Kriptospot.com.