The Transfer Fees Are Increasing On The Bitcoin Network.

- Posted on December 18, 2023 11:57 PM

- Cryipto News

- 580 Views

The data indicates that Bitcoin miners are satisfied with high transaction fees, leaving no time for long-term market participants to complain.

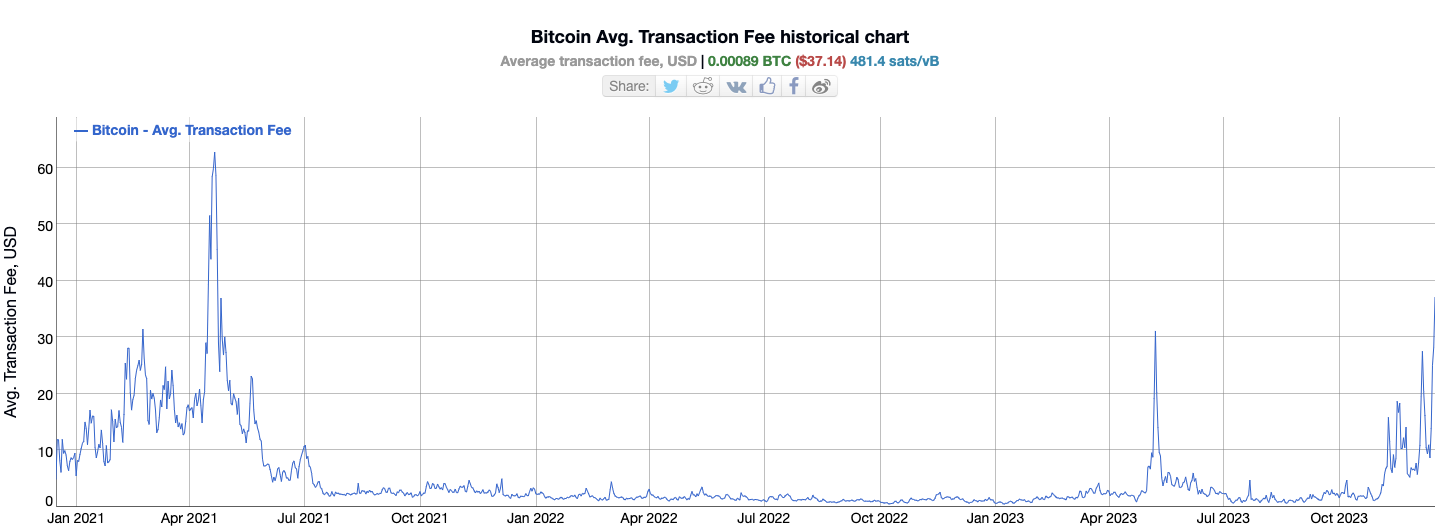

Transaction fees on the Bitcoin network are causing disagreements. As of December 17th, according to data from BitInfoCharts, the average transaction fee has reached approximately $40.

High transaction fees are inevitable. The recent price movement in Bitcoin has led to an increase in transaction fees, and some market participants believe that this fee level will be persistent.

According to BitInfoCharts, the cost of BTC transfer has surpassed $37, reaching its highest level since April 2021.

The soaring on-chain expenditures, rendering them unaffordable for many small investors, has sparked intense debates among Bitcoin advocates.

As of December 17th, according to data from BitInfoCharts, the average transaction fee has reached approximately $40, causing diverse opinions within the Bitcoin community.

While many express displeasure at the impact of Ordinals on fees, leading Bitcoin commentators argue that double-digit transaction costs signal future events. They advocate for users seeking to avoid high transaction fees to embrace layer-2 solutions, such as Lightning Network, designed for mass adoption.

In a Twitter post on December 16th, popular commentator Hodlonaut evaluated the situation, stating, "Fees have temporarily risen due to JPEG manipulation, but this is a sign for the future. Scaling cannot be achieved on Layer 1." Additionally, he argued that demanding low transaction fees on Layer 1 not only reflects ignorance but also fuels criticism against Bitcoin.

Hodlonaut emphasized that Bitcoin, created as a value-gaining, competition-based network due to its proof-of-work mechanism, contradicts the goal of keeping fees low. He expressed skepticism about the value-addition of hard forks aimed at achieving this. Referring to Bitcoin Cash, he questioned the criticality of including someone in Layer 1 with low fees.

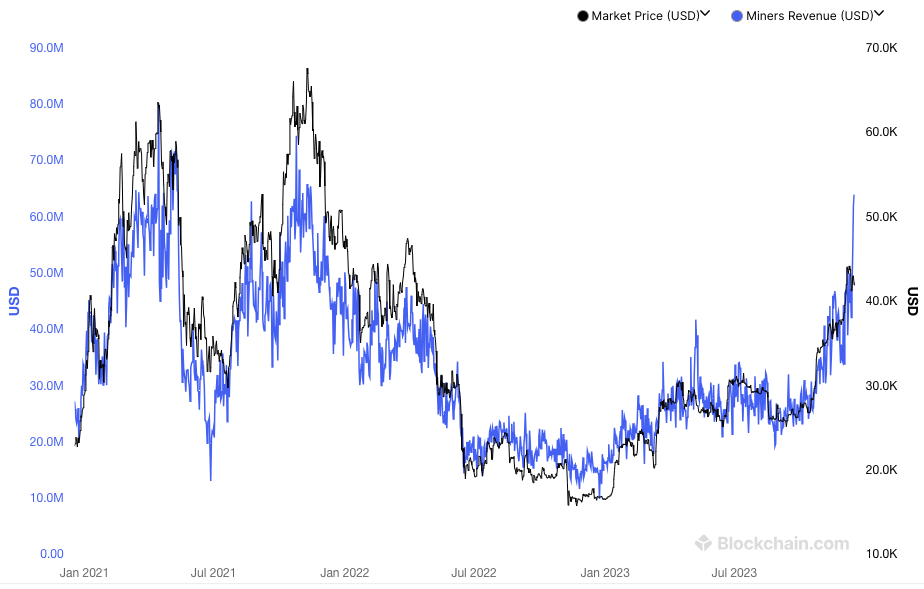

Miners have achieved their best income in the last two years. Renowned commentator Beautyon underscored that Bitcoin functions as intended despite transaction fees. If Ordinals brings high fee levels sooner than expected, he stated that anyone not accepting the Layer 2 solution for the fee issue will suffer losses. He anticipated confusion among users who might consider leaving Bitcoin. However, emphasizing that the network operates under its own system and rules, he stated that there is no recourse for users.

Adam Back, founder of Bitcoin and blockchain technology firm Blockstream, stated that the solution lies in expanding Layer 2 capabilities beyond miner fee incentives. Back, mentioning that "You can't stop JPEGs on the Bitcoin network," asserted that complaining will lead to further action and encourage the adoption of Layer 2 by incentivizing higher fees. Therefore, he recommended relaxing and building something new.

According to data from Blockchain.com, in November 2021, the total sum of miner revenues, block subsidies, and fees in USD reached an all-time high of $69,000. The BTC/USD pair was trading at approximately $42,000 towards the weekly closing on December 17th.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.