Three Main Reasons: Why Ethereum Continues To Stay Below The $3,900 Level

- Posted on May 31, 2024 11:52 PM

- Cryipto News

- 474 Views

Among the primary factors affecting Ethereum's price staying stuck below $3,900 are the ongoing uncertainties surrounding the launch of spot Ethereum ETFs, high open interest rates in the futures market, and a decrease in activity on the Ethereum blockchain.

Three Main Reasons: Why Ethereum Continues to Stay Below $3,900

1. Spot Ethereum ETF Approval Process Didn't Go as Expected

Over the past week, Ether has risen above $3.900 several times but failed to maintain those levels. ETH experienced an uptick in anticipation of the spot Ethereum ETF approval. The market had expected that the SEC-approved spot Ethereum ETFs would continue to drive prices higher.

Investors are still awaiting the necessary Form S-1 approvals for each fund. Eric Balchunas, a senior ETF analyst at Bloomberg, expects Ethereum spot products to start trading by July 4th. Another ETF analyst, James Seyffart, pointed out that BlackRock's updated S-1 filing on May 29 indicates that issuers and the SEC are focused on launching spot Ethereum ETFs.

However, analysts warn that if Grayscale Ethereum Trust (ETHE) is converted into an ETF, potential outflows in the following weeks could pressure ETH prices. A similar situation has occurred with Grayscale's Bitcoin fund (GBTC) due to high fees. Speculations suggest that outflows from Grayscale ETHE could exceed $100 million per day in the first weeks, offsetting inflows from new investors.

2. Ether's Struggle to Break the $3,900 Resistance

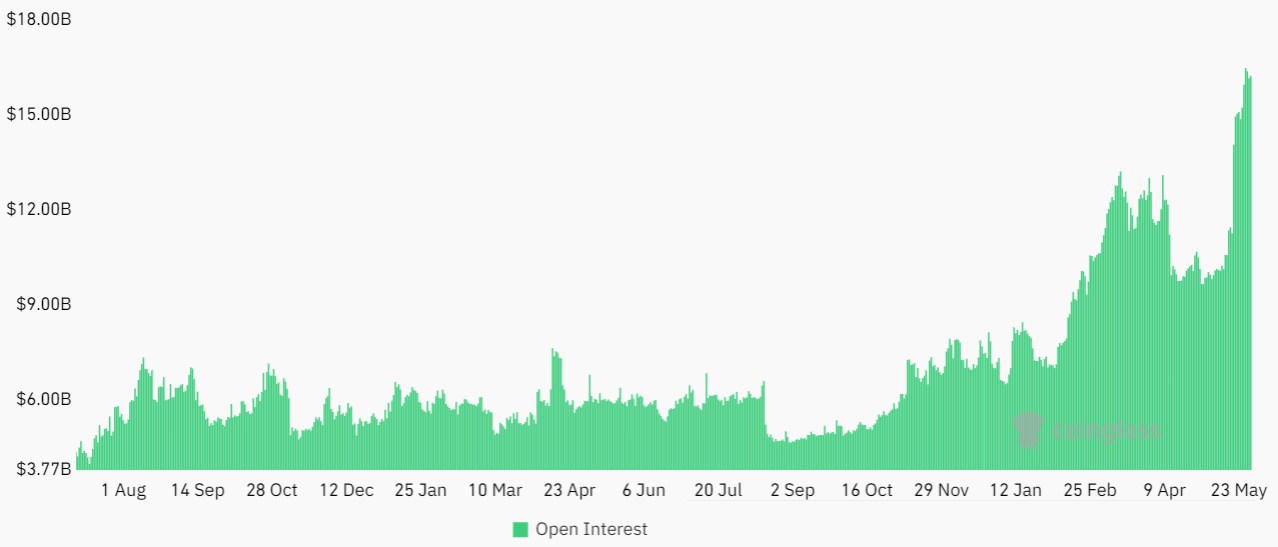

One reason Ether has struggled to break the $3,900 resistance is due to the rally preceding the spot ETF approval. Some investors were disappointed that the active trading would not be prolonged, creating uncertainty and negative price impacts. Additionally, Ether's open interest in futures reaching record levels on May 28 adds to the market pressure.

3. $16.8 Billion in Ether Futures Pose Liquidation Risk

Open interest measures the total number of ETH futures contracts available on derivatives exchanges like Binance, CME, OKX, and Bybit. High open interest implies a significant liquidation risk. For example, if long positions use an average of 10x leverage, a 10% price drop in Ether would liquidate these contracts.

Conversely, if Ether's price suddenly rises, a similar situation could occur where exchanges automatically buy ETH futures to offset risks and close positions lacking sufficient margin liquidity. Consequently, the $16.8 billion in open Ether futures poses a risk for potential buyers and keeps ETH prices below $3,900.

Ethereum Activity and Competition from Rival Networks

Despite Ethereum's strong fundamentals and diverse DApp usage, its blockchain activity has shown signs of stagnation. On May 30, Ethereum had 122,350 daily active addresses interacting with its decentralized applications, a 2% decrease from the previous day. Although the total volume of transactions on the Ethereum network increased by 2% during the same period, this was deemed insufficient.

In contrast, rival networks like BNB Chain have shown more robust activity. BNB Chain, for instance, had 508,610 daily active addresses, significantly outnumbering Ethereum's. Users transacted over $3.5 billion on PancakeSwap alone, with another DApp, Move Stake, attracting 226,350 active addresses in the same period.

In summary, the uncertain spot ETF approval, high open interest in futures, and stagnation in blockchain activity have limited Ethereum's ability to break through the $3,900 barrier in the short term.

While buyers and sellers in ETH futures are always balanced, the high leverage used increases the risk of liquidation. For instance, long positions typically use an average of 10x leverage. In this case, a 10% drop in Ether's price would lead to the liquidation of these contracts.

If prices were to suddenly rise, short positions would be at risk. In such a scenario, exchanges would automatically buy ETH futures to close leveraged positions and terminate trades that fail to meet margin requirements. These operations form the $16.8 billion open interest in ETH futures, which is seen as a potential risk, keeping ETH prices below $3,900.

Competing Networks Outperforming Ethereum in Activity

While Ethereum's high transaction fees are seen as an indicator of constant demand for the network, they also provide an opportunity for rival blockchains that offer higher scalability. Some users and projects operating outside of Ethereum have begun to prefer alternatives like BNB Chain, Solana, or Aptos, which offer lower fees. Despite the shift towards Ethereum layer-2 solutions, this trend could result in Ethereum losing market share to competing networks.

On May 30, the number of daily active addresses interacting with Ethereum's decentralized applications decreased by 2% compared to the previous day, reaching 122,350. Similarly, the total transaction volume on the Ethereum network increased by 2% during the same period. However, this increase was deemed insufficient. These data points suggest that despite Ethereum's strong fundamentals, diverse decentralized application use cases, and various investor profiles, there is a trend towards adopting alternative blockchains.

For example, BNB Chain's daily active addresses are four times higher than Ethereum's, totaling 508,610. In the past seven days, these users have conducted over $3.5 billion in transactions on PancakeSwap, while a single DApp, Move Stake, accumulated over 226,350 active addresses in the same period. This situation indicates that Ethereum's on-chain metrics are not reassuring and limits Ether's potential to surpass $3,900 in the near future.

You can stay updated on the latest developments and news in the cryptocurrency markets with Kriptospot.com.