Warren Buffett's 'Crypto Shares' Now Surpass Apple And Amazon.

- Posted on November 1, 2023 2:14 AM

- Cryptocurrency Exchanges News

- 649 Views

While Warren Buffett's investment in crypto-friendly Nubank saw its shares rise by 106 percent, the growth rate of the tech giants in his portfolio remained relatively lower.

Warren Buffett, despite maintaining a critical stance on cryptocurrencies and especially Bitcoin, managed to achieve significant profits in 2023 through his position in a crypto-friendly bank.

Warren Buffett, often referred to as the "Oracle of Omaha," acquired shares of Nu Holdings, the owner of a Brazil-based financial technology company and crypto-friendly Nubank, through Berkshire Hathaway in two separate transactions in 2021.

In June 2021, Berkshire invested $500 million in Nu Holdings, and later in December 2021, it increased its holdings by an additional $250 million. It is known that Berkshire has not sold any shares from this investment to date.

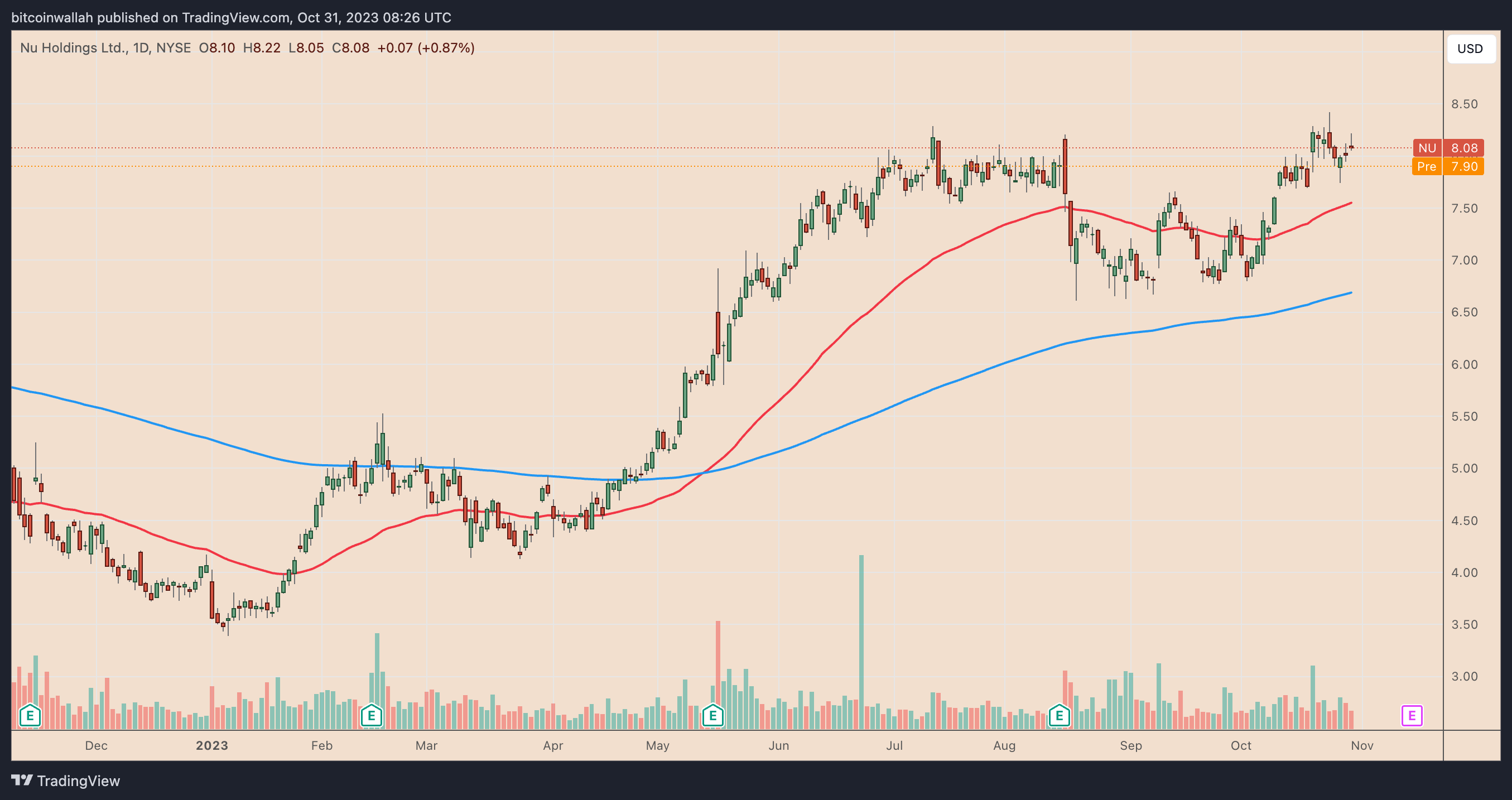

The price of Nu shares has increased by approximately 106 percent year-to-date. Assuming Buffett has not sold any of his Nu shares, his $750 million position is currently worth approximately $879.50 million. At its peak prices in February 2022, this position was valued at over $1 billion.

Are you curious about why Nubank is considered crypto-friendly?

Nubank first gained recognition as a company that offers crypto services to over 1.35 million users. As a result, investing in Nubank has been seen as a way to indirectly establish a connection with the cryptocurrency industry.

Within the company, you'll find Easynvest, a trading platform offering a Bitcoin exchange-traded fund (ETF) product, and Nubank, a digital financial services platform that facilitates the trading of BTC and Ether. Nubank has also created a token on the Polygon blockchain.

Moreover, the company Nu Holdings converted 1% of its cash assets into Bitcoin in May 2022. Nubank described this move as reinforcing its belief in the potential of Bitcoin to transform financial services in the region.

Nubank continues to serve more than 80 million customers as Latin America's largest fintech bank.

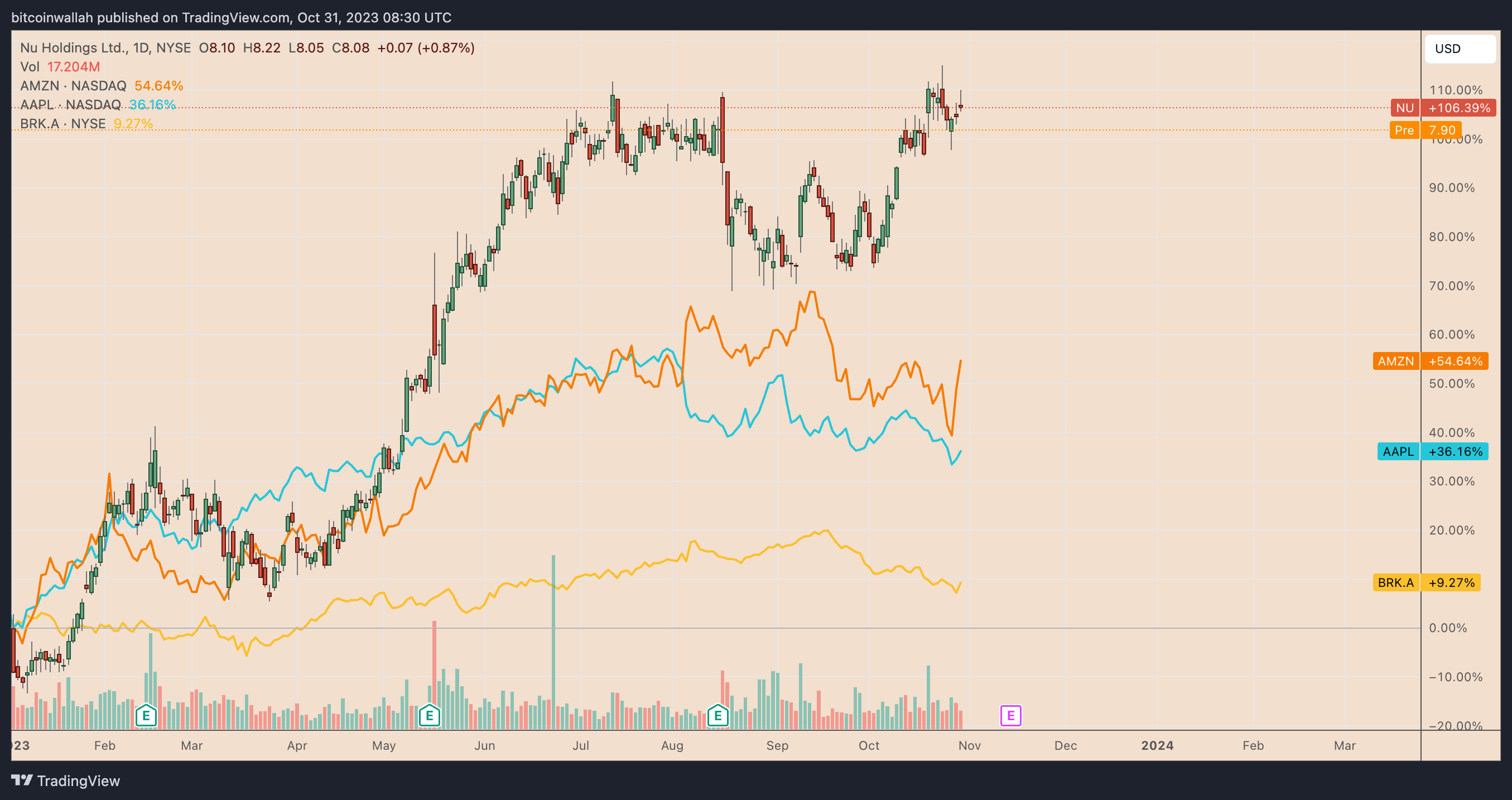

Additionally, Nubank's shares outperformed Buffett's other major investments in Amazon and Apple. Amazon and Apple shares increased by 54.65% and 36% respectively. Apple, with its $354 billion investment portfolio accounting for about 45% of Berkshire Hathaway's total holdings, remained the largest holding in the company's portfolio as of September 2023. In this context, Nu shares exhibited better performance than Berkshire Hathaway shares, which saw a 9.25% annual increase.

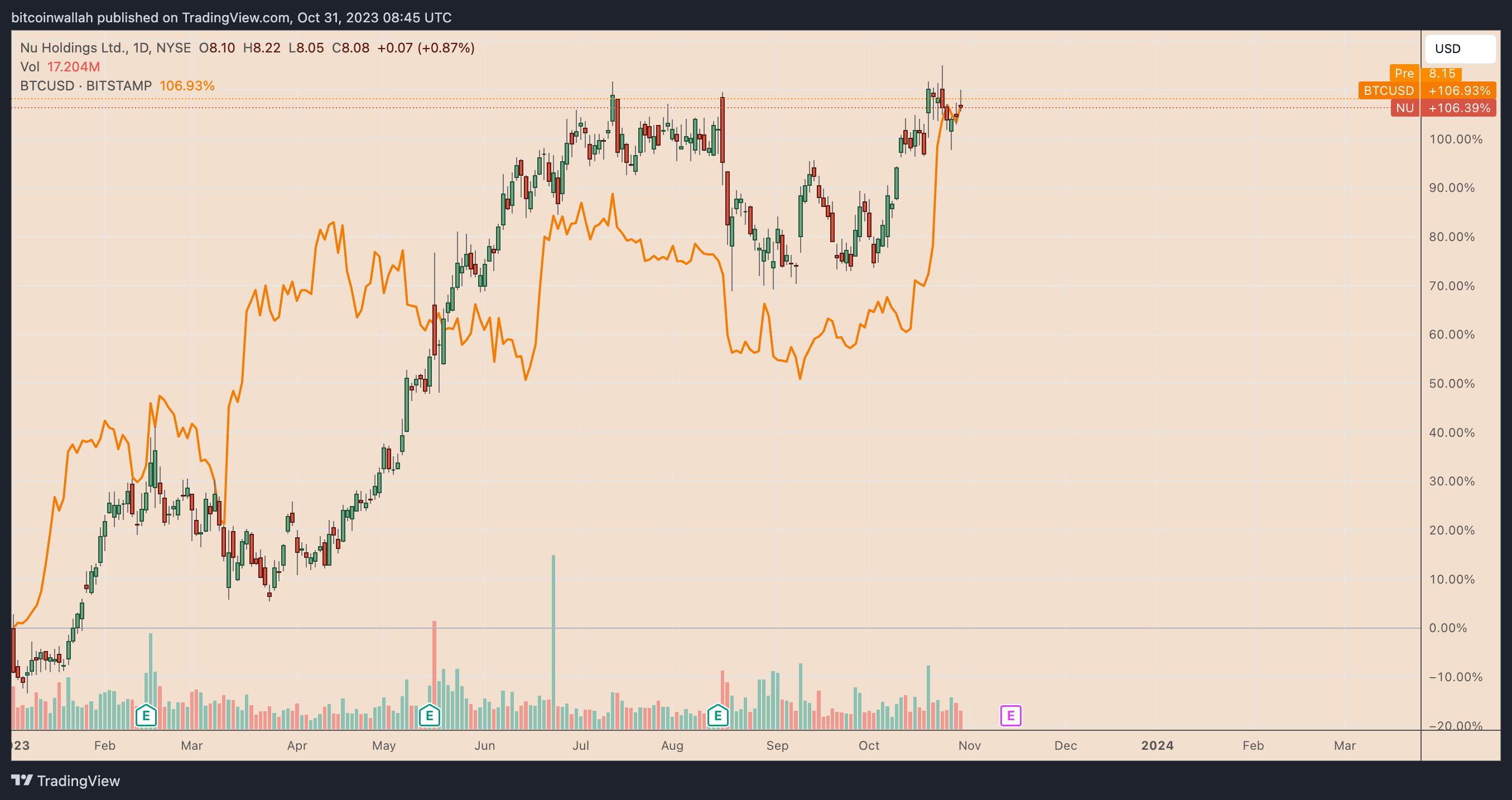

Interestingly, Bitcoin managed to catch up with Nubank's stock performance towards the end of 2023. BTC's price surged by 106% since mid-year, driven by the "Uptober" rally and excitement around Bitcoin ETFs.

Interestingly, Bitcoin's rapid surge in recent weeks coincided with its loss of correlation with the stock market in October. Such situations are typically seen as a bullish sign, but some analysts suggested that the current boost in Bitcoin's price may be attributed to the hope for Bitcoin ETFs.

It will soon

— XO (@Trader_XO) October 25, 2023

Source: TradingView ve Cointelegraph