What Are The Factors Supporting Ethereum's (Eth) Value Appreciation?

- Posted on February 10, 2024 10:59 PM

- Cryipto News

- 870 Views

Macro-economic and network activities are propelling Ethereum upwards

The price of Ether surged by over 10% in the first nine days of February, reaching above $2,450 for the first time in three weeks. This rise was in line with the overall upward trend in the cryptocurrency market and was also supported by macroeconomic data.

Investors believe that this momentum is driven by activity on the Ethereum network. However, there is uncertainty whether this momentum will be sufficient to push the asset's value above $2,800.

Impact of Data from China and the US

Federal Reserve Chairman Jerome Powell emphasized the need for sustainable public debt. It is estimated that the country's debt service costs represent 2.4% of GDP in 2023, and this figure could rise to 3.9% by 2034. Axios Macro writer Neil Irwin indicated that these forecasts suggest the Federal Reserve is considering lowering policy interest rates.

Traditional finance investors are also concerned about data from China, as the Purchasing Managers' Index (PMI) showed a fourth consecutive month of contraction in manufacturing activity in January. According to AP News, the Chinese government took additional measures to support the real estate market following the largest cut in mandatory cash reserves for banks by the People's Bank of China. Investors exiting some fixed-income positions caused the yield on the two-year US Treasury bond to rise from 4.21% on February 1 to 4.48%, the highest level in the last two months. On February 9, the S&P 500 index also rose, indicating that at least in the short term, there are no concerns about an economic crisis. The Federal Reserve chairman's comments on debt provide a positive environment for assets like Ether.

The stock markets continue to attract more inflows compared to risky assets, creating a challenging environment for cryptocurrencies. However, some stocks, such as NVIDIA and Amazon, are currently trading at levels 33 times higher than the S&P 500's 22-time average, paving the way for alternative investments.

Ethereum Network Activity Supporting Ether Price

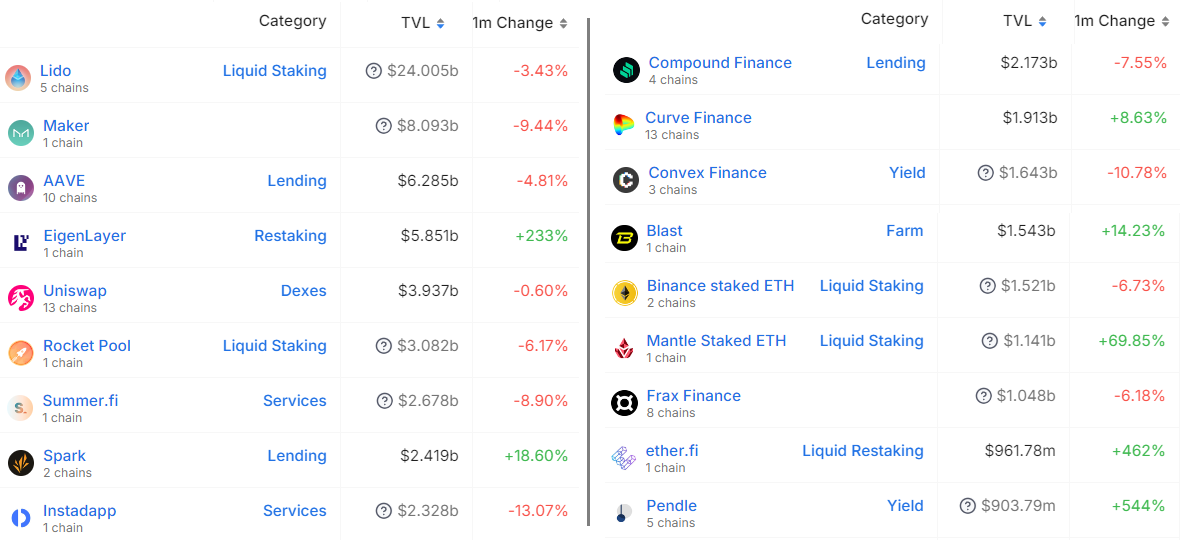

To assess whether Ether's increase in February is based on sustainable fundamentals, activity on the Ethereum network needs to be monitored. The Total Value Locked (TVL) in smart contract deposits on the network reached its highest level in 11 months on February 9, with 16 million ETFs, representing a 19% increase from the previous month. However, much of this increase occurred in the EigenLayer staking solution, which rose from $1.15 billion to $5.85 billion on February 9 compared to the previous month.

Among other notable developments, liquid staking applications such as Mantle Staked ETH and ether.fi, along with the yield farming service Pendle, stand out. Additionally, the Ethereum network holds an absolute leadership position in transaction fees. For example, Ethereum's transaction fee of $10.4 million in the last 24 hours is eight times higher than Tron's and twelve times higher than BNB Chain's.

Another positive development for Ether lies in the potential new NFT format called ERC-404. This format could increase demand for Ether by introducing new features within the existing ERC-721 standard. While still in its early stages, this promising development could boost activity in the sector.

The upcoming London upgrade for Ethereum scheduled for March 13 is also noteworthy. This upgrade aims to improve the efficiency and user experience of the network.

While Ether attracts the interest of investors seeking alternatives to traditional stocks, Ether investors are not worried about the $2,650 resistance level. The price movement appears stronger compared to January 11.

You can stay updated with the latest developments and news in the cryptocurrency markets by following Kriptospot.com in real-time.