Will Bitcoin Reach A New Peak After The Halving?

- Posted on April 26, 2024 4:04 PM

- Cryipto News

- 751 Views

Despite the decrease in ETF inflows, if the next wave of institutional investors flows into Bitcoin, BTC could potentially continue its ascent towards all-time highs.

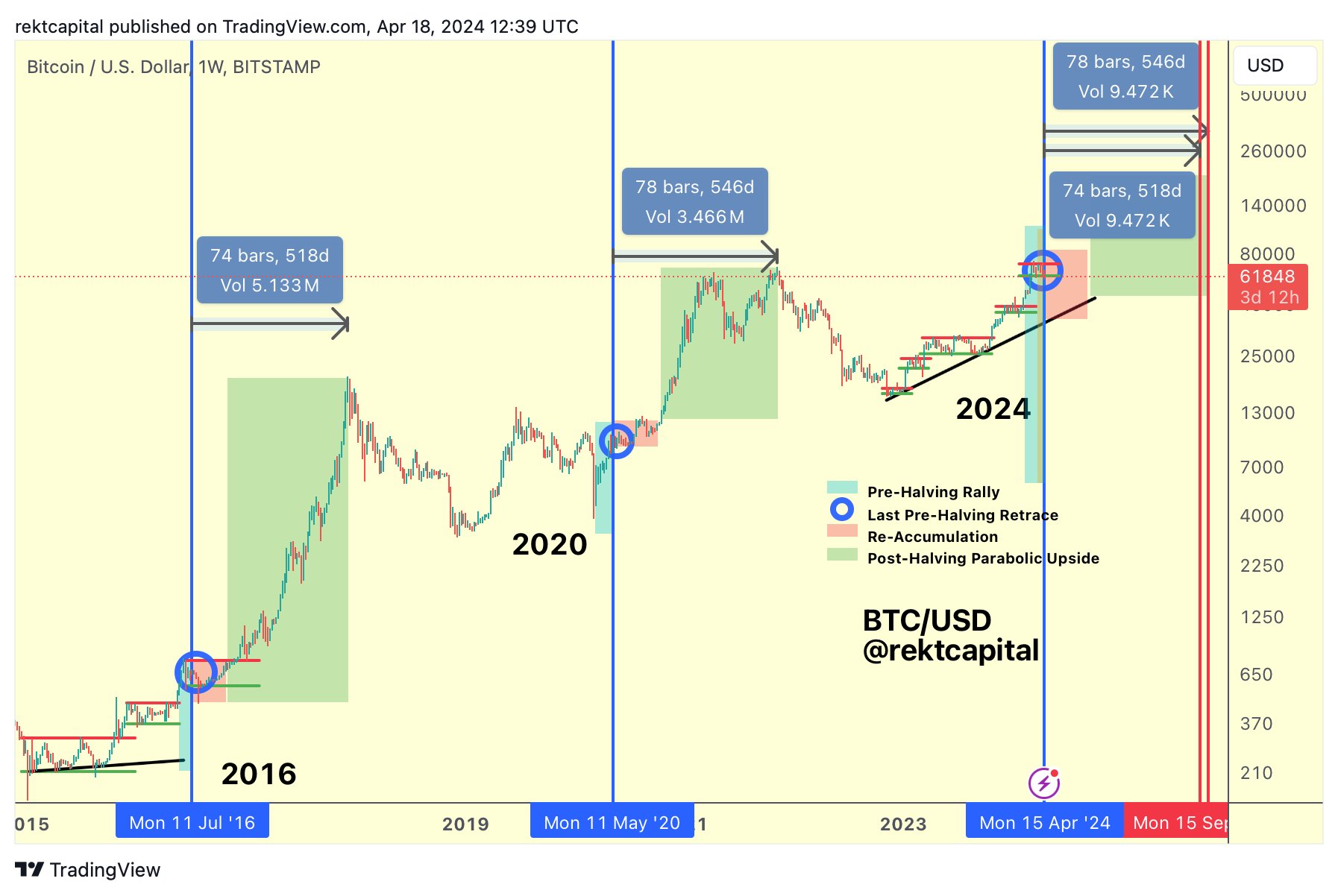

The fourth Bitcoin halving, which took place on April 20th, could potentially lead to new price increases for BTC when considering historical chart patterns and the presence of spot Bitcoin exchange-traded funds (ETFs).

For the first time in crypto history, Bitcoin's price reached an all-time high of $73,600 on March 13th, prior to the halving event. Historically, Bitcoin’s price has seen new peaks within 518 to 546 days following previous halving events.

According to Sukhveer Sanghera, founder and CEO of Earth Wallet, the all-time high combined with institutional inflows from the ten US-listed spot Bitcoin ETFs has created a "bullish scenario" for Bitcoin. Sanghera told Cointelegraph:

“The fact that almost all BTC has been issued, combined with early investor inflows through ETFs, increased demand for inflation protection, and added utility - all fundamental aspects of Bitcoin are stronger than ever.”

According to TradingView data, the price of Bitcoin dropped by 5.6% on the weekly chart and traded above $63,600 as of 12:58 this morning. The world's first cryptocurrency saw a modest 2.85% increase over the past month. However, since the beginning of 2024, the leading cryptocurrency has gained over 50% in value.

Bitcoin's price movement is expected to turn bullish in the long term, but historically, short-term corrections have been observed before halving events.

Temujin Louie, the CEO of Wanchain, noted that if the price of Bitcoin surpasses the $65,000 resistance level, the current downward trend could come to an end. In an interview with Cointelegraph, Louie stated, "Historically, Bitcoin halvings have often been followed by a correction. We expect consolidation to continue as long as the $58,000 support level holds. If BTC surpasses recent highs, investors anticipate a rapid rise to round numbers, such as $80,000, $90,000, and even $100,000."

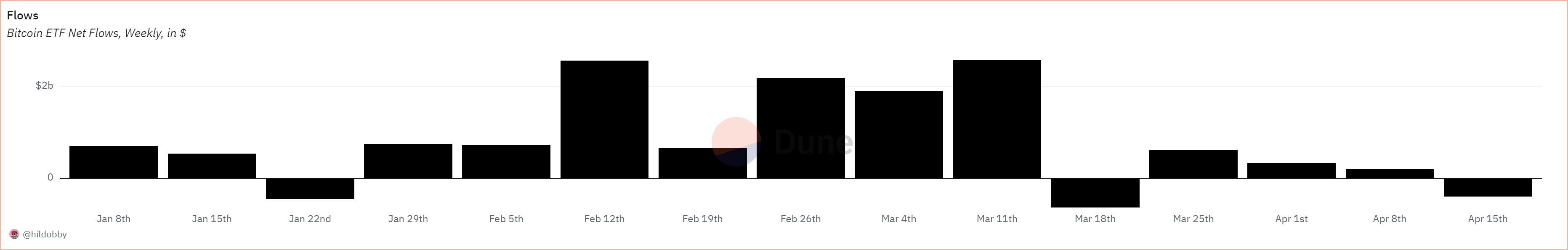

Temporary decrease in Bitcoin ETF entries observed prior to halving Before the halving, a temporary decrease in Bitcoin ETF entries was observed, attributed to the stagnant price movement last month, particularly in the ten spot Bitcoin ETFs in the United States. In the week of the halving, net entries turned negative.

According to Dune data, spot Bitcoin ETFs in the United States experienced a net negative outflow of $398 million during halving week, compared to a net positive inflow of over $199 million in the previous week.

Despite the temporary decline, the ten Bitcoin ETFs collectively amassed 835,000 BTC, amounting to a value of $53.5 billion, which represents 4.24% of the current Bitcoin supply.

According to Jonas Simanavicius, the co-founder and CTO of Syntropy, despite the temporary decrease in ETF entries, the narrative surrounding Bitcoin's price movement remains positive, signaling to new investors preparing to enter the BTC market:

"With the entry of major capital institutions, early adopters have taken their positions, and it takes time to await the entries of the next institutional wave. While major banks anticipate a slight dip in Bitcoin post-halving, I observe a strong position in Bitcoin due to potential new inflows and positioning as a hedge against inflation." Simanavicius added that amidst increasing global tensions, Bitcoin is seen as a "protection against political tensions," which could strengthen its status as a safe haven asset.

You can stay updated with developments and the latest news in the cryptocurrency markets by following Kriptospot.com.