Analysts Voiced Concerns About The Btc Price: 'Something Is Not Right.'

- Posted on November 9, 2023 11:57 PM

- Cryipto News

- 564 Views

The decreasing trading volume of Bitcoin has been a significant factor in investors' surprise.

Bitcoin surpassing $37,000 for the first time in 18 months has raised doubts among investors.

Bitcoin, attempting to break the $40,000 resistance level after overnight rapid gains.

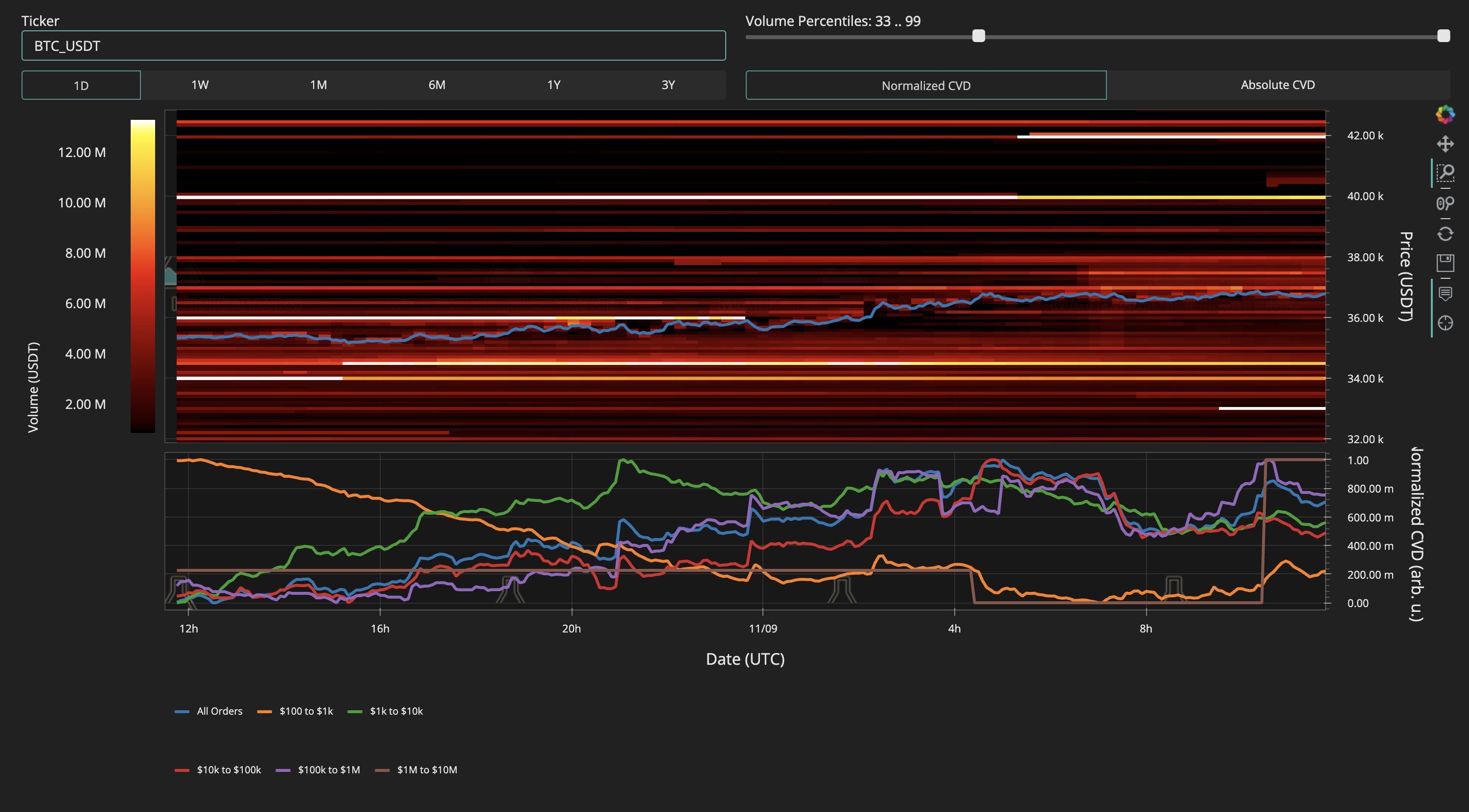

According to the data obtained, BTC/USD closed at $37,000 after the first break before the Wall Street opening. The leading cryptocurrency, which increased by 6.6% in November, surprised some investors. According to the on-chain monitoring source Material Indicators, the problem is related to the trading volume. According to the latest post, although the upward movement continues, there is no strong volume support.

Material Indicators stated: "Support has been fixed at $33,000 by protecting the new decline. However, the $40,000 resistance has risen to the $42,000 range." In addition, a graph showing the BTC/USD order book liquidity on Binance is attached.

Material Indicators continued, "It is impossible to deny that the price has challenged a series of signals, but it is also impossible to deny that something is not right in this movement."

"The most obvious danger indicator for me is the appreciation of prices with decreasing volume. This usually does not end well, but we need to watch to see if this rally is different."

$BTC

— Skew Δ (@52kskew) November 9, 2023

bear whale aka gigantic seller has been selling into price for past few days

they're dumping again here

$38K - $40K is probably where they get carried out of the market

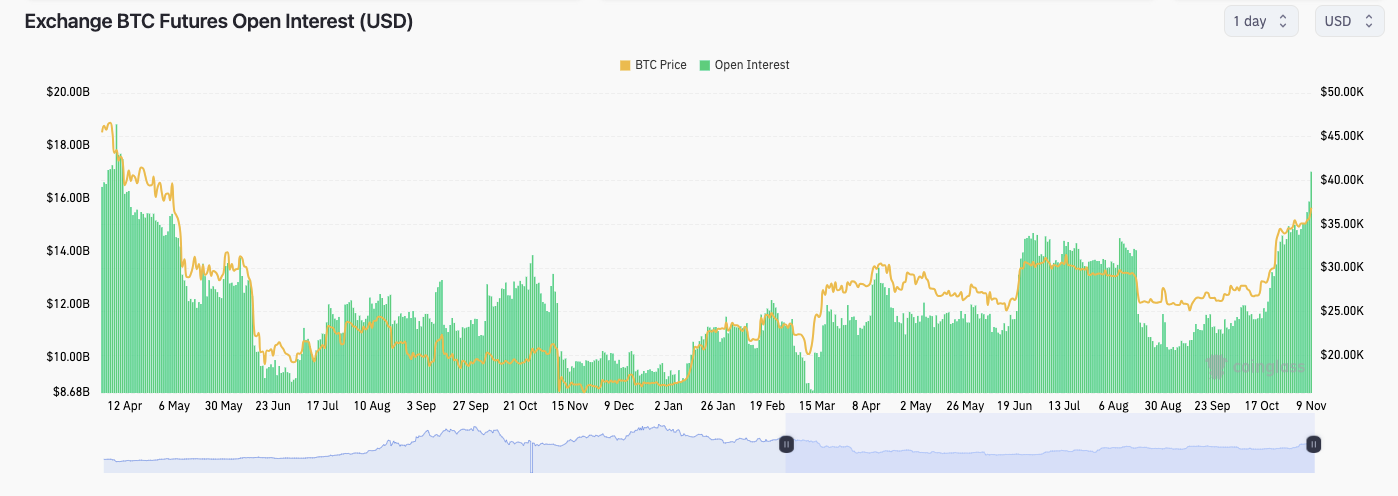

Open Positions at Seven-Month High

Financial analyst Tedtalksmacro emphasized the increasing open positions (OI). This situation forms the backbone of the sudden upward movements in recent weeks and months.

Market heating up again.

— tedtalksmacro (@tedtalksmacro) November 9, 2023

~15k BTC in open interest added in the past 10 hours.

That's about $525MM USD worth... the vibes are slowly returning. pic.twitter.com/aSMbZxrySO

According to the data, the total value of the current Bitcoin futures open positions was over $17 billion at the time of writing this article. This indicates the highest level reached since mid-April.

Tedtalksmacro mentioned that bear markets weaken open positions in markets. "When the market ignores this and open positions increase further, we will understand that it is a bull market. There are many factors to follow."