Today's Events In The Crypto Market.

- Posted on August 23, 2024 6:18 AM

- Cryptocurrency Exchanges News

- 1169 Views

Curious about what’s happening in the crypto market today? Get the latest details on Bitcoin prices, blockchain developments, DeFi, NFTs, Web3, and trends and events affecting crypto regulations in our report.

Ether exchange-traded funds (ETFs) have experienced their longest streak of outflows since their launch. During this period, scammers hacked McDonald’s official Instagram account to promote a memecoin called Grimace, making $700,000. Meanwhile, BlackRock’s iShares Ethereum Trust is rapidly approaching $1 billion in net inflows.

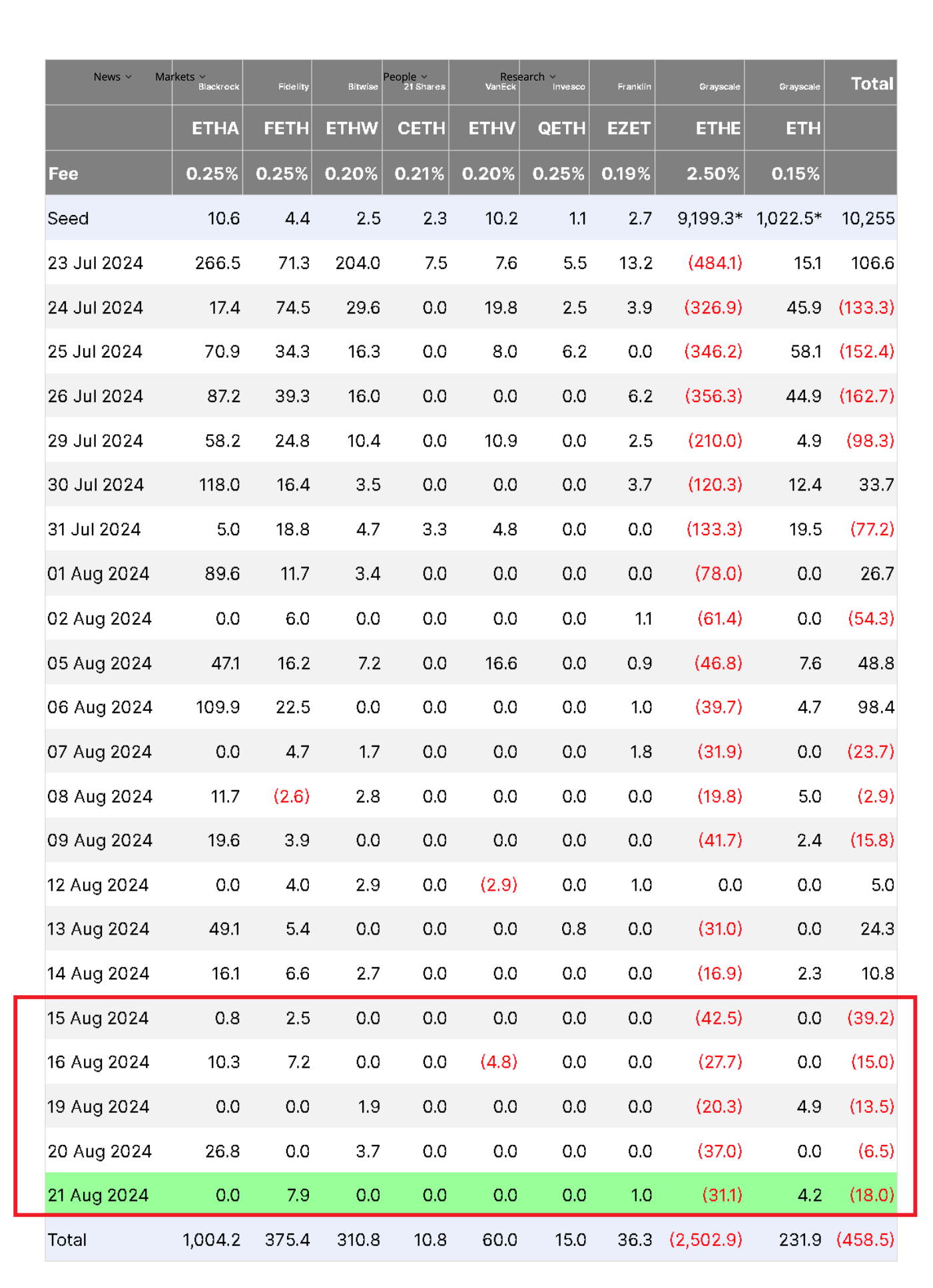

In the United States, spot Ethereum ETFs have seen continuous outflows for five days since July 23. Investments in the newly approved nine spot Ether ETFs have been overshadowed by the outflows from Grayscale Ethereum Trust (ETHE), which exceeded $2.5 billion as of August 21. According to Farside Investors, outflows from ETHE occurred every trading day except August 12.

Spot Ether ETFs experienced their longest streak of outflows, losing a total of $92.2 million over five days from August 15 to August 21.

Scammers who hacked McDonald’s Instagram account earned $700,000 with a memecoin

On August 21, scammers took over McDonald's official Instagram account to promote and sell a memecoin called Grimace. This scam resulted in a theft of over $700,000 on the Solana network.

According to screenshots shared on X (formerly Twitter), McDonald's Instagram account posted a series of updates promoting a fake token featuring the brand's purple mascot, Grimace.

According to blockchain analysis service Bubblemaps, the hacker initially used Solana memecoin distributor pump.fun to acquire 75% of the circulating supply of the Grimace token. The hacker then distributed these assets across approximately 100 different wallets.

Following the posts from McDonald’s official account, the market value of the GRIMACE memecoin surged from a few thousand dollars to $25 million in just 30 minutes, according to DexScreener data.

BlackRock’s ETH ETF is set to surpass $1 billion in net inflows

BlackRock is approaching $1 billion in net inflows with its iShares Ethereum Trust (ETHA). The asset management giant continues to maintain its dominance in the spot cryptocurrency ETF market.

According to Morningstar, ETHA has accumulated approximately $992 million in net inflows and is expected to exceed $1 billion soon. Bryan Armour, Director of Passive Strategies Research at Morningstar, told Cointelegraph that this milestone could be reached by the end of August 21 transactions.

"There are two factors affecting net assets: net flows and performance. Poor performance can negatively impact the growth of net assets."

Although Ether's price has struggled to gain momentum since the launch of ETFs, fund managers indicate strong interest in Ethereum from institutional investors. Kyle DaCruz, VanEck’s Digital Assets Product Manager, noted that Ether is easier for clients to understand and value compared to Bitcoin.

Stay updated with the latest developments and news in the cryptocurrency market with Kriptospot.com.