What Happened In The Crypto Market Today?

- Posted on August 7, 2024 3:50 AM

- Cryptocurrency Exchanges News

- 976 Views

What Happened in the Crypto Market Today? Find out in our news report covering daily trends and events impacting Bitcoin prices, blockchain, DeFi, NFTs, Web3, and crypto regulations.

Ronin Network Becomes Latest Victim of Attack, Evidence Suggests Possible White Hat Hack

Ronin Network recently fell victim to an attack, losing 9.8 million dollars worth of ETH. However, evidence suggests that this might have been a white hat hack. The trading volumes of Bitcoin exchange-traded funds (ETFs) surged early on August 5th as global sell-offs intensified with the opening of the US markets. Crypto hackers took advantage of the market dip, using stolen funds to purchase Ether that had dropped in value.

Ronin Network Loses $9.8 Million in ETH, Suspected White Hat Hacker

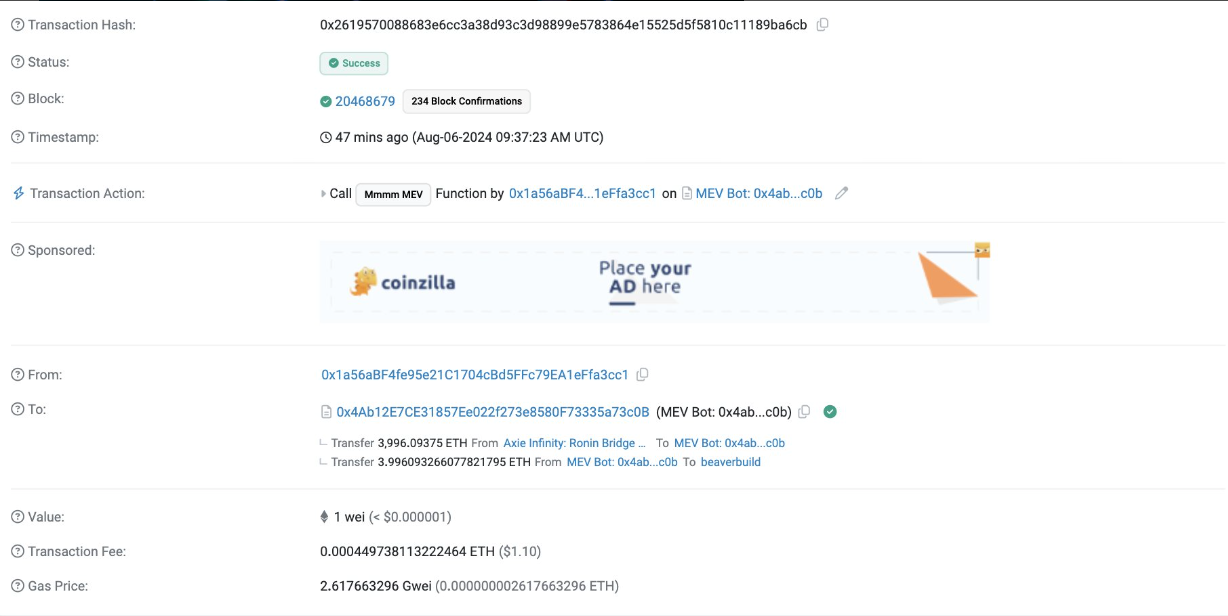

Ronin Network lost 9.8 million dollars worth of Ether in a recent attack, adding to the growing list of cryptocurrency hacks in 2024. One of the most popular gaming blockchains, the network lost 3,996 Ether valued at over $9.8 million. However, according to a post by PeckShield on August 6th, the attack might have been carried out by a white hat hacker or an ethical hacker aiming to uncover vulnerabilities in a crypto protocol.

White Hat Hackers and the Ronin Network Attack

White hat hackers, after discovering a security vulnerability and proving the code is flawed, return the stolen funds. If the Ronin attacker is revealed to be an ethical hacker, the funds could be safely returned soon.

The attack appears to have originated from a maximum extractable value (MEV) bot, a software tool used by validators to analyze arbitrage opportunities in decentralized finance (DeFi).

According to a post by Cyvers on August 6th and a message sent by the Axie contract deployer to the address, the attack was confirmed to have originated from an MEV bot: "Hey, thank you very much for white hat recovering user funds today. Can we chat over Blockscan?"

Increase in Bitcoin ETF Volumes

According to Galaxy Digital, trading volumes in Bitcoin ETFs surpassed $1 billion on August 5th as the downturn in global markets stirred activity in the digital asset space.

Galaxy noted that Bitcoin (BTC) ETF trading volumes exceeded $1.3 billion in the first 20 minutes of trading, with iShares Bitcoin Trust seeing a volume of $875 million.

Galaxy Research Director Alex Thorn expects ETFs to see inflows as investors buy the dip. According to Thorn, "Macro outlook worsened following poor U.S. unemployment data last Friday. Also, significant relaxations across all assets led to a sharp increase in volatility."

10x Research founder Markus Thielen said he expects new crypto investments to slow as the market recovers from macroeconomic risks. "The market structure has been weak for months, including the transition from fiat currencies to crypto. Major players are unlikely to invest amid high volatility and unpredictable prices. Many still need to exit their positions and reduce their portfolios."

Crypto Hackers Buy the Dip in Ethereum Using Stolen Funds

Crypto hackers took advantage of the ongoing market crash, using stolen funds to purchase Ether at low prices.

On August 5th, 16,892 Ether, linked to stolen crypto funds from an August 2022 hack of the Nomad crypto bridge, were bought. Data shows that Ether lost over 20% of its value within 12 hours, dropping from approximately $2,760 to $2,172.

Crypto hackers use crypto mixer services like Tornado Cash to cover their tracks.

You can follow the latest developments and news in the cryptocurrency markets in real-time with Kriptospot.com.