Arthur Hayes Made A Statement Regarding Memecoins: Be Patient, Don't Rush.

- Posted on April 1, 2024 11:03 PM

- Cryipto News

- 394 Views

BitMEX co-founder Arthur Hayes emphasizes that quickly labeling memecoins as "meaningless and worthless" may be a hasty decision for the crypto world.

BitMEX co-founder Arthur Hayes emphasizes the importance of not underestimating memecoins and argues that such projects can contribute positively to blockchain networks.

During an interview with Real Vision CEO Raoul Pal on March 30th, Hayes states that memecoins play a valuable role in attracting attention to the crypto ecosystem and drawing in new users and developers to blockchain platforms.

Hayes says, "While some may find these projects simplistic and meaningless, if they are drawing interest to the sector and encouraging the participation of new engineers, then it has a positive impact on that blockchain," adding, "Chains that support this kind of culture are the ones with real value." He notes that networks like Solana and Ethereum are particularly well-positioned to attract attention from memecoins.

Last year, following the memecoin frenzy in November, activity on the Solana network significantly increased, leading to the launch of many non-memecoin projects in the following months.

Similarly, during the same period, network and development activity on Bitcoin saw a substantial rise following events like the introduction of BRC-20 tokens and the Ordinals surge.

Real Vision CEO Raoul Pal believes memecoins will become increasingly popular among younger crypto investors, capitalizing on the "gaming mentality" prevalent among Gen Z and Millennials.

"It's just about playing with money," he stated.

Pal and Arthur Hayes think the interest in memecoins will continue for some time. Notably, plans are underway to project dogwifhat (WIF), a Solana-based memecoin, onto the Las Vegas Sphere in the coming months.

Dog-themed memecoins recently surpassed the Ethereum layer-2 network Arbitrum (ARB) in total market value, a significant achievement. WIF's market value exceeded $4.5 billion, while ARB's was around $4.4 billion.

However, industry leaders also highlight many risks associated with memecoins. In an investor note dated March 14, the US investment firm Franklin Templeton mentioned that memecoins could offer "quick profit" opportunities but are prone to risks due to a lack of inherent "value or utility."

Ethereum co-founder Vitalik Buterin expressed his general disinterest in memecoins in a blog post on March 29. Nevertheless, Buterin urged crypto investors and memecoin developers to find ways to make these tokens useful or charitable rather than just criticizing them.

"I value people's desire to have fun, and I would prefer the crypto space to swim with this current rather than against it," he said.

Despite the risks, memecoins were the best-performing asset class within the crypto sector last month, according to CoinGecko's data.

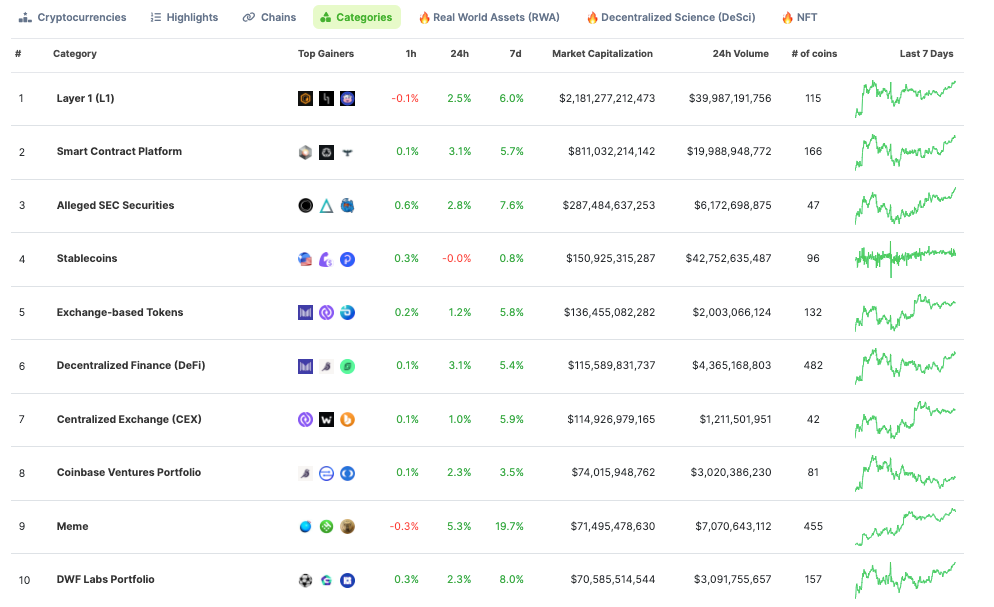

Last week, meme coins listed on CoinGecko showed a significant increase in value compared to other categories of crypto assets. While layer-1 network tokens saw a 6% increase and decentralized finance (DeFi) tokens gained 5.4%, meme coins saw an overall increase of 20%. This indicates that meme coins have a higher potential for returns compared to other asset classes within the general crypto market, and it demonstrates the growing interest of investors in this area.

You can keep up with the latest developments and news in the cryptocurrency markets by following Kriptospot.com in real-time.