As Bitcoin Continues To Break Records, Major Whales Seem Reluctant To Sell.

- Posted on March 10, 2024 8:44 PM

- Cryipto News

- 567 Views

As Bitcoin reaches its all-time high, there is no observed activity among whales holding significant amounts of BTC.

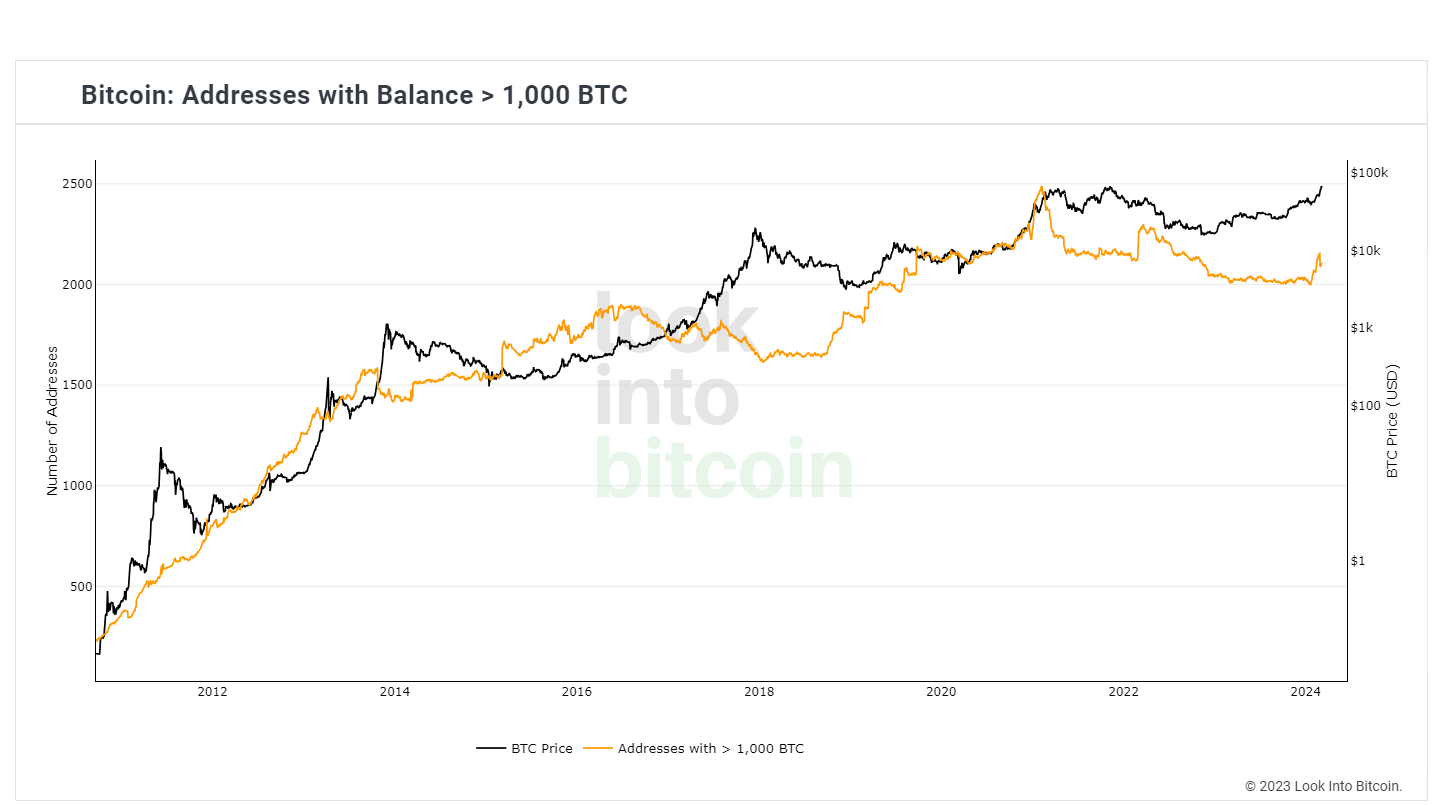

According to on-chain data, even during Bitcoin's current surge surpassing $70,000, Bitcoin whales, referring to unique wallet addresses holding at least 1,000 Bitcoins, seem reluctant to sell. Despite reaching record prices, the number of Bitcoin whales continues to increase. As of March 7th, the number of such major players reached 2,104 addresses. However, this figure is lower compared to the peak of 2,489 addresses recorded during the period when Bitcoin traded above $46,000 in February 2021.

The increase in the number of large Bitcoin holders, known as whales, could be associated with the spot Bitcoin exchange-traded funds (ETFs) in the United States, which surpassed a total transaction volume of $52.5 billion on March 4th. The fact that owners of these wallets are refraining from selling Bitcoin at current price levels suggests they anticipate further price increases in the future. The actions of Bitcoin whales can have a significant impact on the market because their transactions can cause significant price fluctuations.

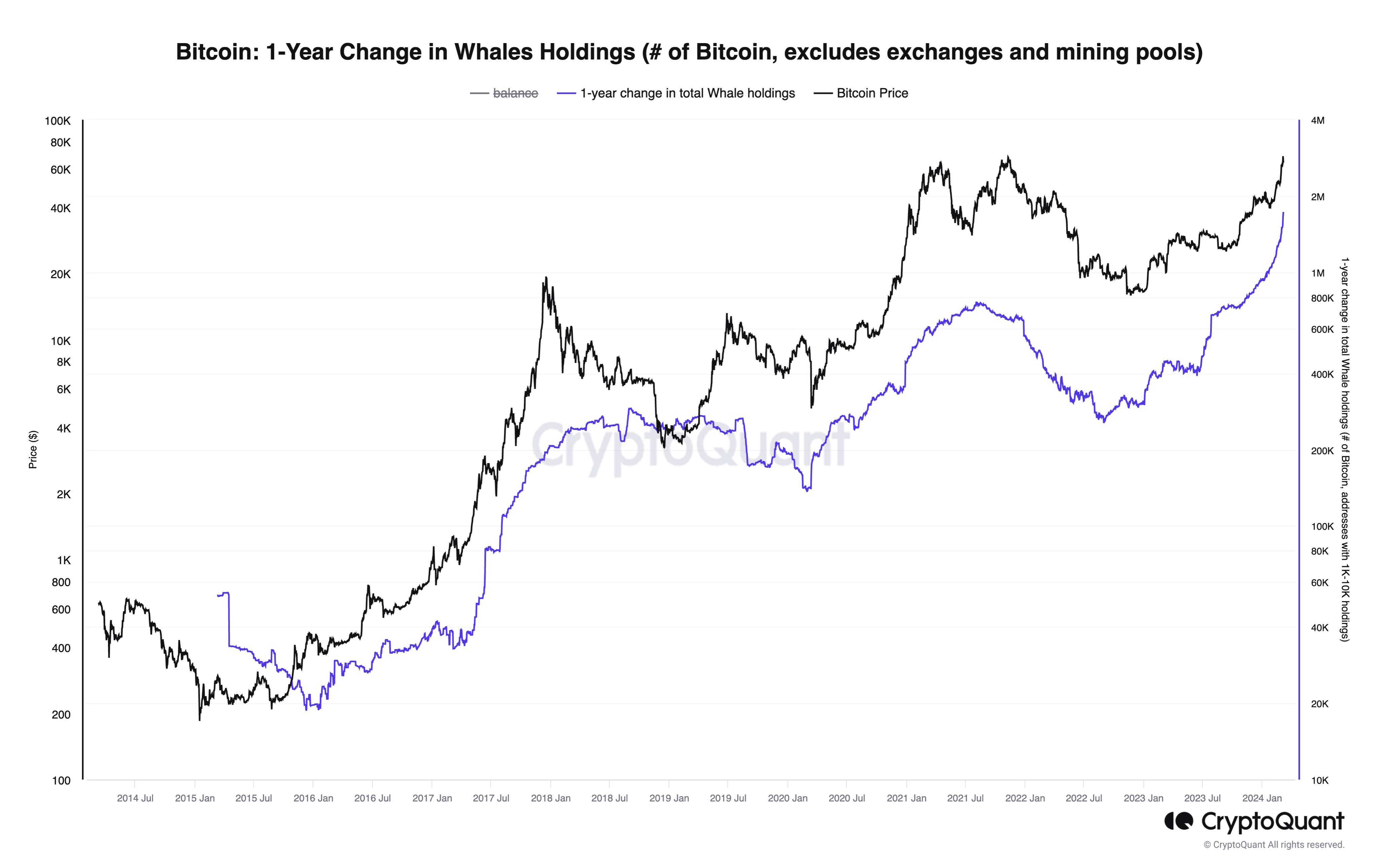

Julio Moreno, the research director of on-chain analysis firm CryptoQuant, highlighted on March 7th on the social media platform X that the increase in Bitcoin holdings of whales is growing parabolically. As Moreno emphasized, this growth trend can provide important clues about the future movements of the market.

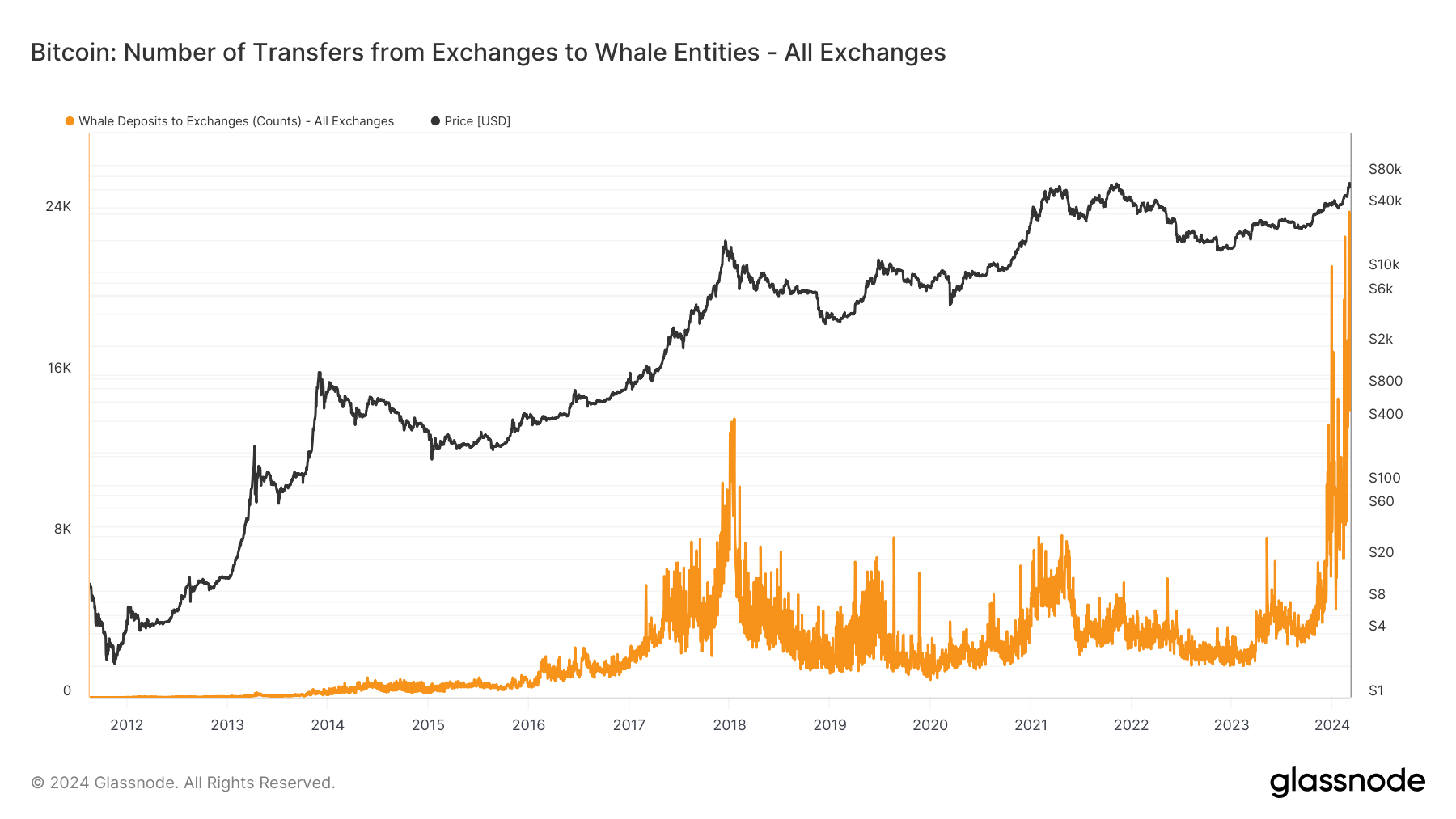

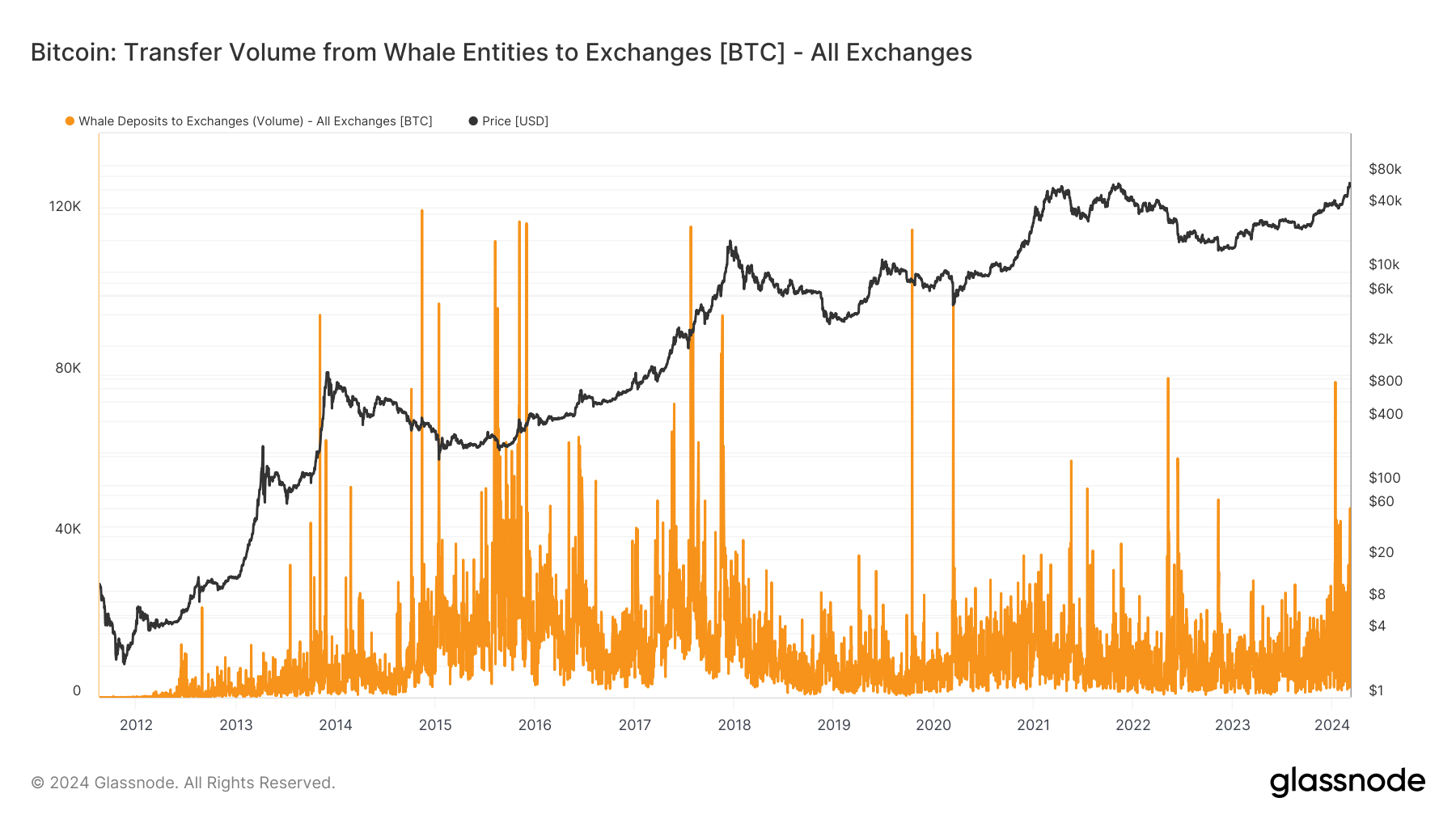

Meanwhile, another indication that Bitcoin whales are not hastily selling their assets comes from various metrics measuring the transaction volume between whales and exchanges.

According to data from Glassnode, transfers from exchanges to whales have reached new record levels "parabolically" this month.

Moreover, the volume of transfers from whales to exchanges has shown only a slight increase compared to previous bull and bear market periods.

Taken together, these metrics do not suggest a significant influx of new major investors into Bitcoin and indicate that wealthy investors are not rushing to take profits even as BTC prices are at record levels.

The popularity of spot Bitcoin ETFs in the United States continues to fuel interest in Bitcoin. Funds like BlackRock iShares Bitcoin Trust (IBIT) recorded a strong indication of this demand with record daily inflows of $788 million on March 5th. The next major target for Bitcoin could be around $92,500, based on a combination of technical analysis, on-chain data, and fundamental analysis. In particular, Bitcoin price charts show bullish signs, such as triangle formations, which are often interpreted as continuations of the bull market.

You can stay updated on the latest developments and news in the cryptocurrency markets by following Kriptospot.com in real-time.