At The Heart Of The Discussions Surrounding Kucoin Is The Current Status Of The Platform's Reserves.

- Posted on March 28, 2024 3:45 AM

- Cryptocurrency Exchanges News

- 638 Views

Following the legal proceedings against the founders of the KuCoin exchange and significant withdrawals from the platform, Ki Young Ju, the CEO of CryptoQuant, claims that there is no reason to be concerned.

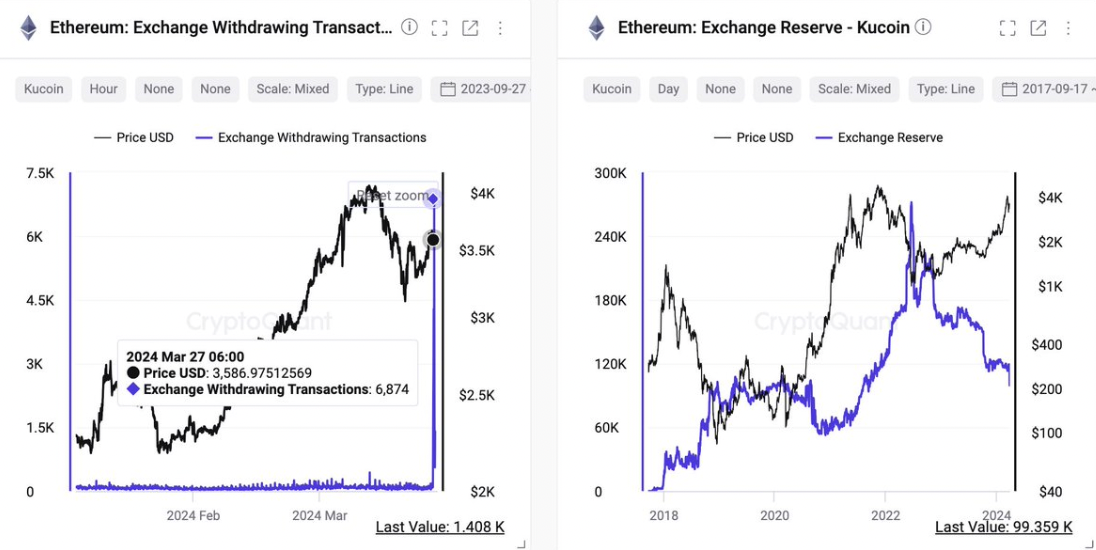

Ki Young Ju, the founder and CEO of the crypto analysis firm CryptoQuant, has given a positive assessment of the Seychelles-based cryptocurrency exchange KuCoin, despite allegations and growing concerns among users regarding its reserves. In a post on the X platform, Ju stated, "Withdrawals in BTC and ETH, primarily carried out by retail users, have only created a minor impact on the total reserves." Ju further noted, "The exchange appears to manage customer funds appropriately and seems to have sufficient reserves to meet withdrawal requests," emphasizing that, based on blockchain data, KuCoin is in a robust state.

According to data from Scopescan, KuCoin's total portfolio balance across multiple blockchains is recorded as $4.889 billion. This information holds significance in light of the allegations brought by the U.S. Department of Justice against KuCoin's founders, Chun Gan and Ke Tang. The Justice Department has accused Gan and Tang of failing to implement an adequate Anti-Money Laundering (AML) program on the exchange and of using the platform for "money laundering and terrorist financing" purposes.

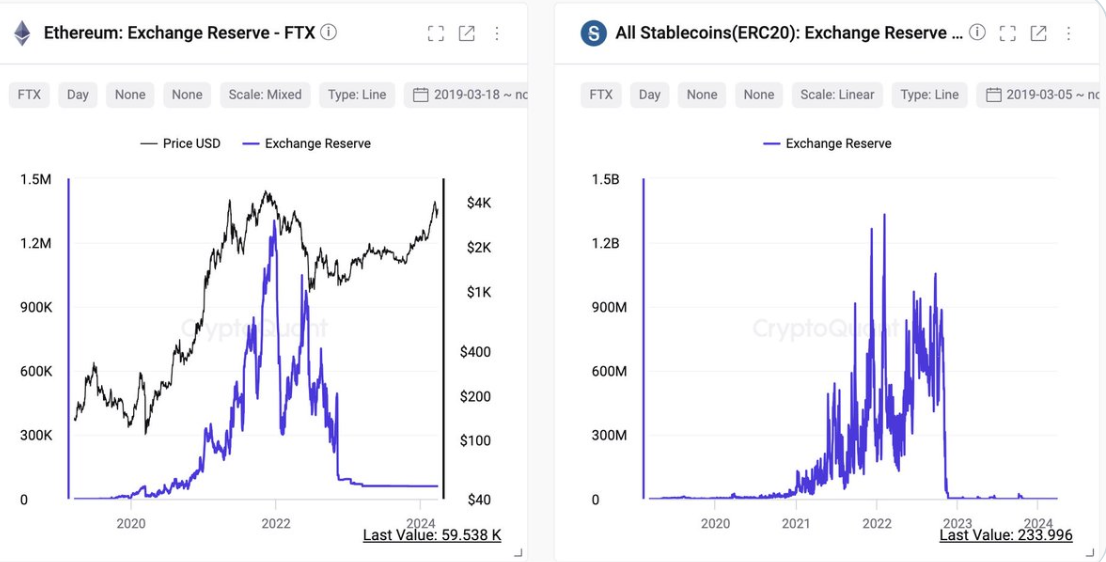

While analyzing KuCoin's current situation, Ki Young Ju, the CEO of CryptoQuant, compared the platform's reserves to the situation of the now-defunct cryptocurrency exchange FTX in the past. According to Ju's assessment, KuCoin appears not to have mixed customer funds with its own reserves, which can be interpreted as a positive indication of the exchange's financial health. This evaluation indicates that KuCoin has a strong management approach to safeguarding customer assets and remains financially stable despite the current allegations.

Crypto investors can be highly sensitive to issues such as legal uncertainties or concerns about the financial status of an exchange. When such news spreads, it's common for investors to start withdrawing their funds rapidly. For instance, a tweet from Binance's former CEO Changpeng "CZ" Zhao announcing the liquidation of all holdings in FTX's native token FTT led to users withdrawing billions of dollars from FTX. This can lead to a domino effect commonly seen in markets, as the loss of confidence among investors spreads quickly, leading to a broader market withdrawal.

The collapse of FTX caused significant market fluctuations, like a more than 20% drop in Bitcoin price within a week. Such events highlight the volatility of the crypto markets and the potent impact news can have on market dynamics.

Despite legal actions initiated against the founders of KuCoin, the market's overall sentiment, measured by the Crypto Fear and Greed Index, still indicates an extreme greed level at 83 points. This suggests that investors still have a positive outlook, seeing investment opportunities despite concerns about legal issues or the financial conditions of exchanges. It points to the market participants' continued confidence in the market, despite potential worries. However, it's important to remember that such indices reflect the current state and that market conditions can change rapidly.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.