Bears Are No Longer As Effective In The Bitcoin Market As They Used To Be.

- Posted on April 5, 2024 11:03 PM

- Cryipto News

- 669 Views

Sellers are struggling to pull down the BTC price from its all-time highs, making Bitcoin in 2024 increasingly different from previous cycles.

According to a new analysis, Bitcoin sellers have failed to trigger a traditional bull market correction in this cycle.

Analyst Checkmate shared Glassnode-based analyses on X (formerly known as Twitter) on April 5. In the post, he indicated that the declines in BTC price reached 20 percent.

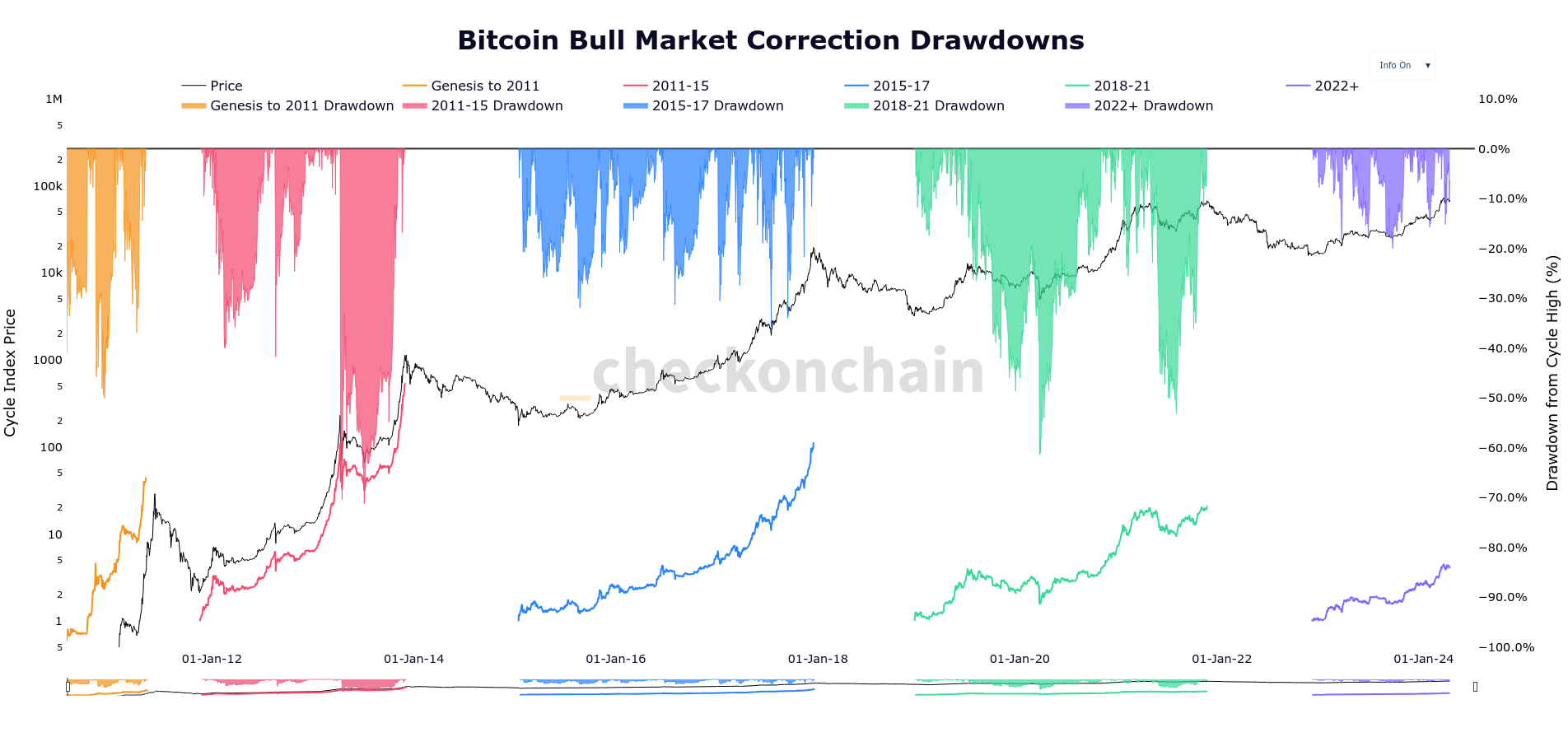

Although Bitcoin has retreated from its all-time high of $74,000, the downturns have been relatively mild when viewed as a percentage. As emphasized by Checkmate, this becomes more pronounced when compared to historical bull markets.

Data uploaded from the Checkonchain chart set by Checkmate shows that sellers have only been able to push the market down by a maximum of 20 percent. This occurred only once, in September of last year, and subsequent declines did not exceed 15.8 percent.

Checkmate commented on this, saying, "This is still my favorite Bitcoin chart in this cycle," and added, "The market is absorbing millions of dollars in sales and yet bears still can't achieve a 20 percent drop."

On the other hand, during the previous bull market cycle between 2019 and the end of 2021, there were two pullbacks of over 50 percent, and the downturn during the COVID-19 outbreak in March 2020 reached 61.4 percent.

Checkmate's assessment of the data showed that historically, the statistics indicated more severe declines.

"The point to be surprised about is not that we should buy, but that we haven't bought yet," he said.

Bitcoin market dynamics have undergone significant changes in 2024.

Foremost among these changes is the emergence of spot Bitcoin exchange-traded funds (ETFs) in the United States, which began in January. These ETFs injected more than 500,000 BTC into the market.

..webp)

The support from buyers, combined with factors like the reduction of BTC balances on exchanges to their lowest levels in recent years, enhances the bullish sentiment towards price discovery.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, cautioned observers not to get carried away while commenting on this week's ETF performance.

In a post on X, he stated, "The inflows were so epic that, without ETFs, BTC would have been at $30,000, take note of that."

Balchunas also mentioned that ETF products could experience days of net outflows, which is a standard behavior among investors.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Stay up to date with the latest developments and news in the cryptocurrency markets with Kriptospot.com.