"Bitcoin Bull Market Is Far From Over"

- Posted on March 22, 2024 12:34 AM

- Cryipto News

- 537 Views

Even as the market enters a correction phase approaching Bitcoin's halving, analysts at CryptoQuant believe that the crypto rally is still in its early stages.

In the last 48 hours, the price of Bitcoin fell to around $60,000, a 13% drop from its all-time high of $73,835. This pullback has been described by analysts as a "pre-halving correction," attributed to an overheated market in anticipation of the Bitcoin halving occurring in approximately 30 days.

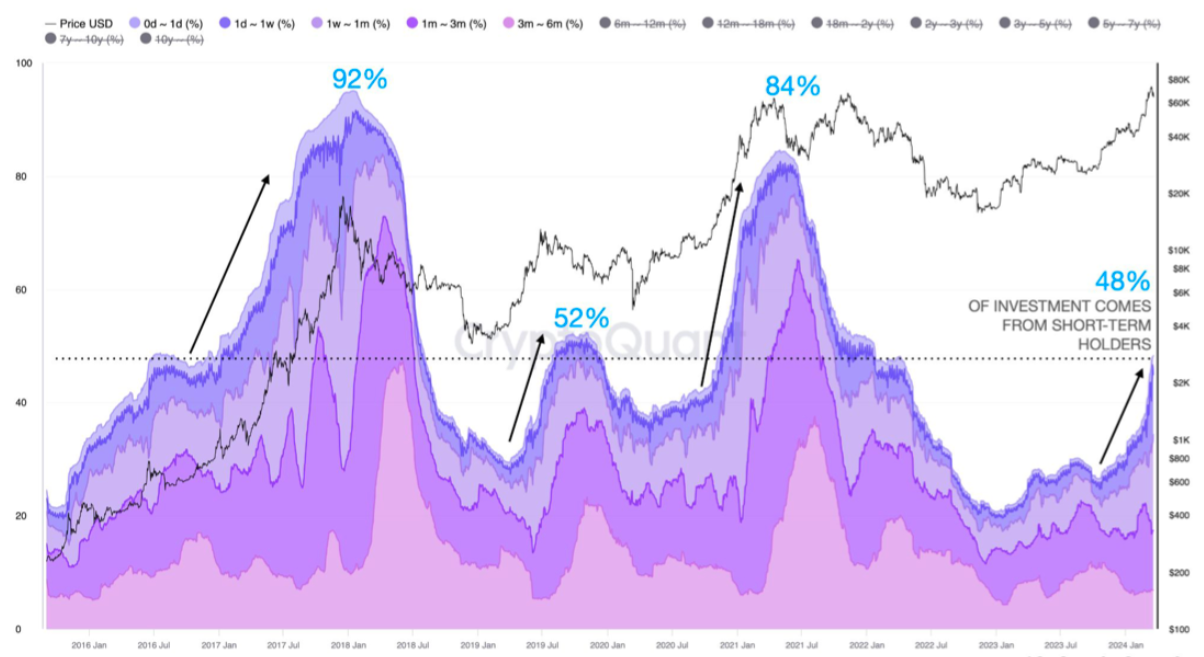

According to an analysis by CryptoQuant, the relatively low level of investment inflow from new investors, combined with valuation metrics still below those seen at previous market peaks, indicates that Bitcoin's bull market has not ended. The company's weekly report, based on on-chain data, reveals that 48% of Bitcoin investments come from short-term investors. CryptoQuant analysts note that "towards the end of a bull market, the contribution from new investors typically ranges between 84% and 92%."

The report emphasizes, "The relatively low level of new investment flows suggests that the Bitcoin bull market is far from over."

The above graph also indicates that this metric has reached a level similar to a significant correction level experienced by Bitcoin in mid-2019 (52%). This is a point that short-term investors should pay attention to.

The CryptoQuant report also emphasizes that valuation metrics are still below levels consistent with past market peaks.

"The CryptoQuant P&L Index remains outside of the market's upper range (red area) and above the index's 1-year moving average."

CryptoQuant's PnL Index is based on three on-chain indicators showing Bitcoin's profitability. The index had predicted that the crypto market would enter a bull cycle in 2024. However, the graph above indicates that the current level is slightly below those observed during the bull runs of 2013, 2017, and 2021.

Bitcoin's halving event is just a month away. Alongside the metrics discussed above, the upcoming Bitcoin halving event is expected to be a significant catalyst that could support the BTC price and initiate a parabolic uptrend.

According to CoinMarketCap's halving countdown, there is less than a month left until the next Bitcoin halving event.

With approximately 4,450 blocks remaining, Bitcoin's fourth halving is set to occur on April 20th, with miner block rewards decreasing by 50% from 6.25 BTC to 3.125 BTC.

Historically, the halving of Bitcoin's supply has been associated with an increase in BTC price. The halving event has always preceded a significant bull run in the Bitcoin market.

Standard Chartered Bank made a bold prediction by raising its BTC price forecast from $100,000 to $150,000 for 2024.

In an investment note sent to clients on Monday, March 18th, bank analysts wrote:

"For 2024, given sharper price increases than previously anticipated, we see the potential for the price to reach $150,000 by year-end, which is higher than our previous forecast of $100,000." The bank also forecasted that BTC price would consolidate around $200,000 before reaching a cycle peak of $250,000 in 2025.

While the bank's analysis is not solely based on the halving event, it highlights the impressive performance of spot Bitcoin ETFs since they began trading on January 11th and the different dynamics they bring to this halving cycle.

You can follow developments and the latest news in the cryptocurrency markets in real-time on Kriptospot.com.