Bitcoin Inflows To Exchanges Have Hit Their Lowest Levels In A Decade.

- Posted on May 9, 2024 4:46 AM

- Cryptocurrency Exchanges News

- 754 Views

Recently, there has been a significant decrease in the amount of Bitcoin transferred to exchanges.

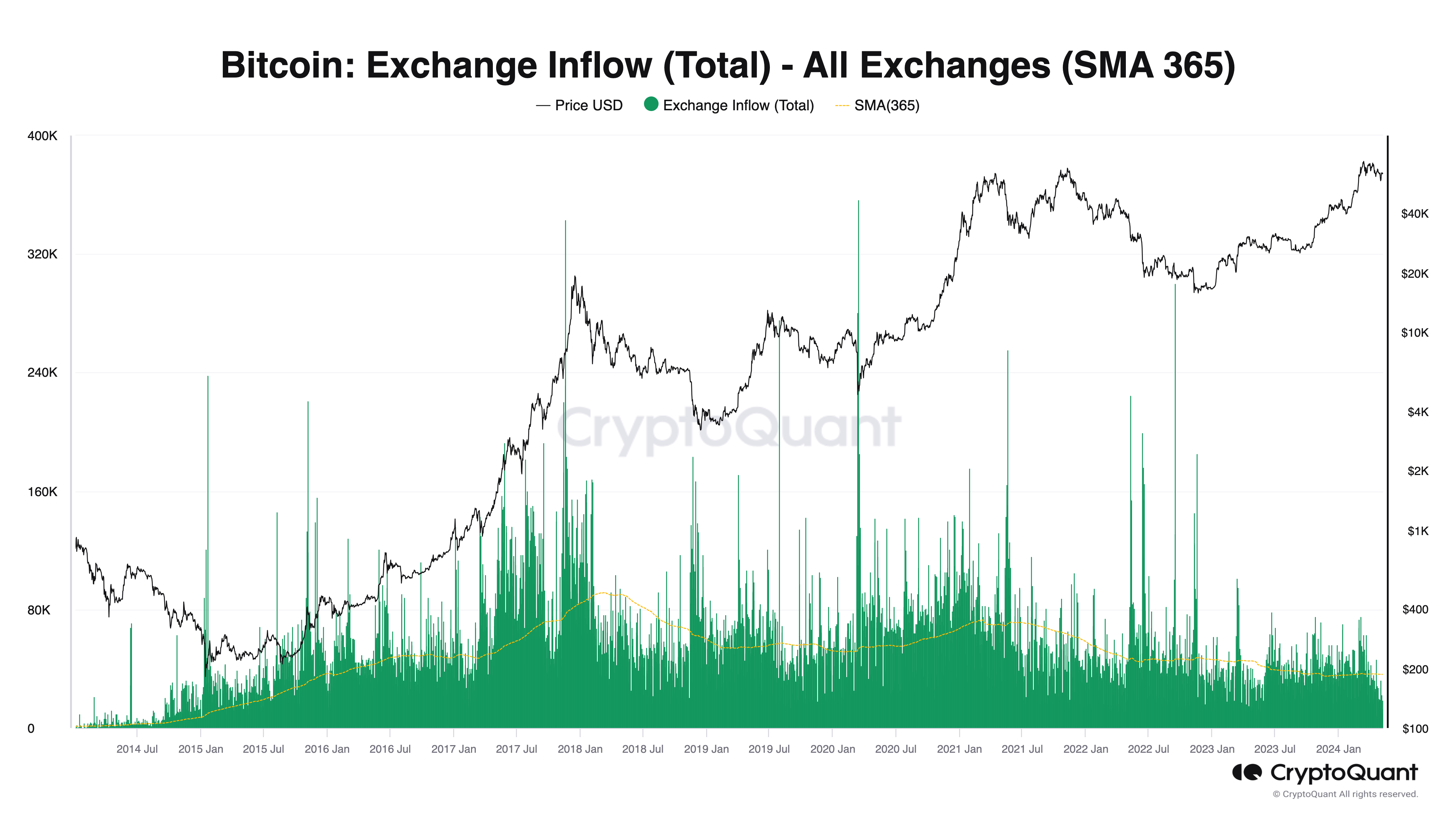

According to recent data, the amount of Bitcoin moving into exchanges has dropped to its lowest level in a decade.

Data from the on-chain analysis platform CryptoQuant indicates a significant decline in daily Bitcoin inflows since the cryptocurrency reached its all-time high of $73,800.

It appears that Bitcoin investors are hesitant to keep their coins on exchanges for quick sales. April and May 2024 have been recorded as some of the periods with the lowest daily inflows to major exchange accounts in the last ten years.

For instance, on a day when BTC/USD was at levels seen on April 20, only 8,400 BTC entered exchanges. Such low figures had not been seen even when Bitcoin was trading below $1,000.

CryptoQuant tracks various spot and derivative exchanges to compile these data.

This year, the increasing institutional investments in Bitcoin reflect a significant shift in the approach of hodlers (those who hold Bitcoin).

The growing demand for investments in BTC has created noticeable volatility in the price of Bitcoin.

Analysts are drawing attention to Bitcoin whales' positive movements and sharing them with investors.

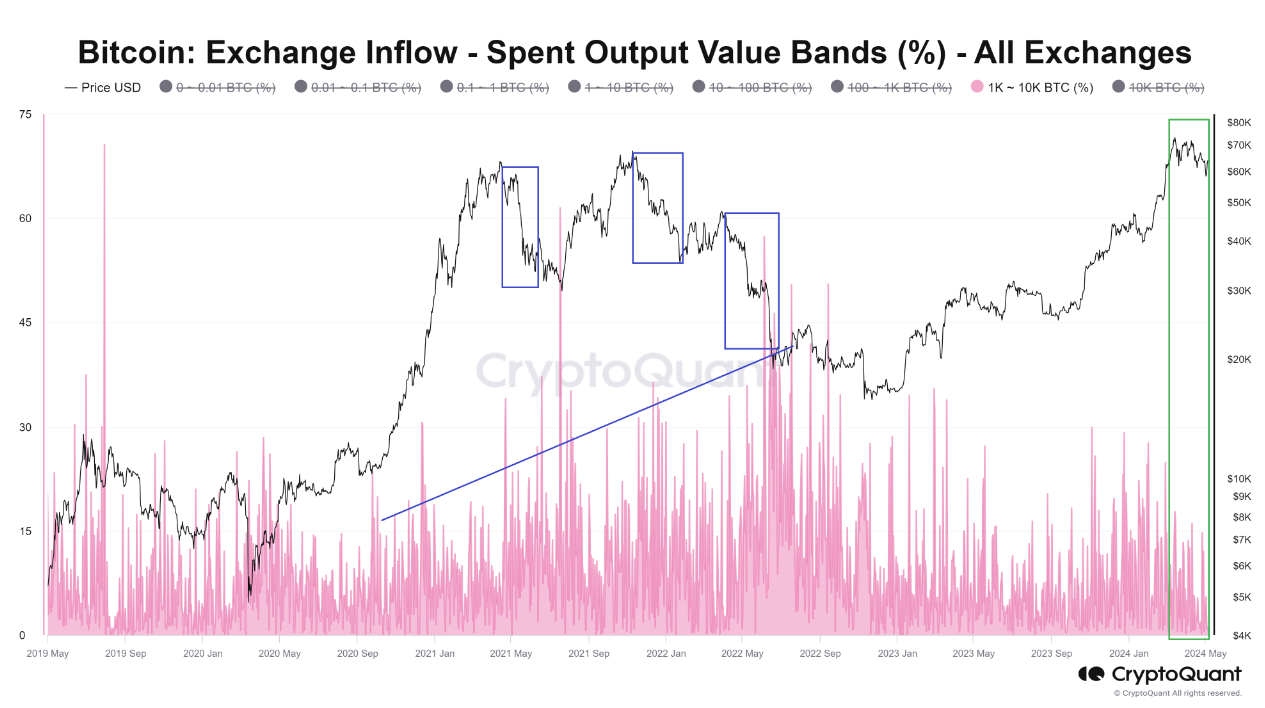

Mignolet from CryptoQuant, in a Quicktake research update this week, mentioned, "Whales holding between 1,000 and 10,000 Bitcoins, typically a source of significant downward volatility in the market, are not consistently participating in this current upward cycle."

Mignolet referred to whale holdings that range from 1,000 BTC to 10,000 BTC. The accompanying graphic displayed the age bands of spent outputs of transactions on the blockchain.

The article noted that whales may not be willing to sell yet because "the cycle has not ended."

Mignolet also added, "Outside of exchanges, particularly in the over-the-counter (OTC) market, even though money might not be flowing into exchanges post-ETF approval, there could be demand capable of absorbing large volumes of sales."

Analyst Checkmate from Glassnode noted that the introduction of new spot Bitcoin ETFs has had significant impacts on the market. In a post on X (formerly Twitter), he told followers, "Data regarding these assets can be quite intricate, and I can almost guarantee that the large 'whale' wallets you're tracking are likely ETFs and exchanges."

Checkmate added, "There are real whales, of course... but they operate as both buyers and sellers. I've never seen anyone truly profit from whale watching."

You can follow developments in the cryptocurrency markets and the latest news in real-time on Kriptospot.com.