Bitcoin (Btc) On The Rise: Can Bulls Surpass The $100 Million Threshold?

- Posted on July 19, 2024 10:13 AM

- Cryipto News

- 521 Views

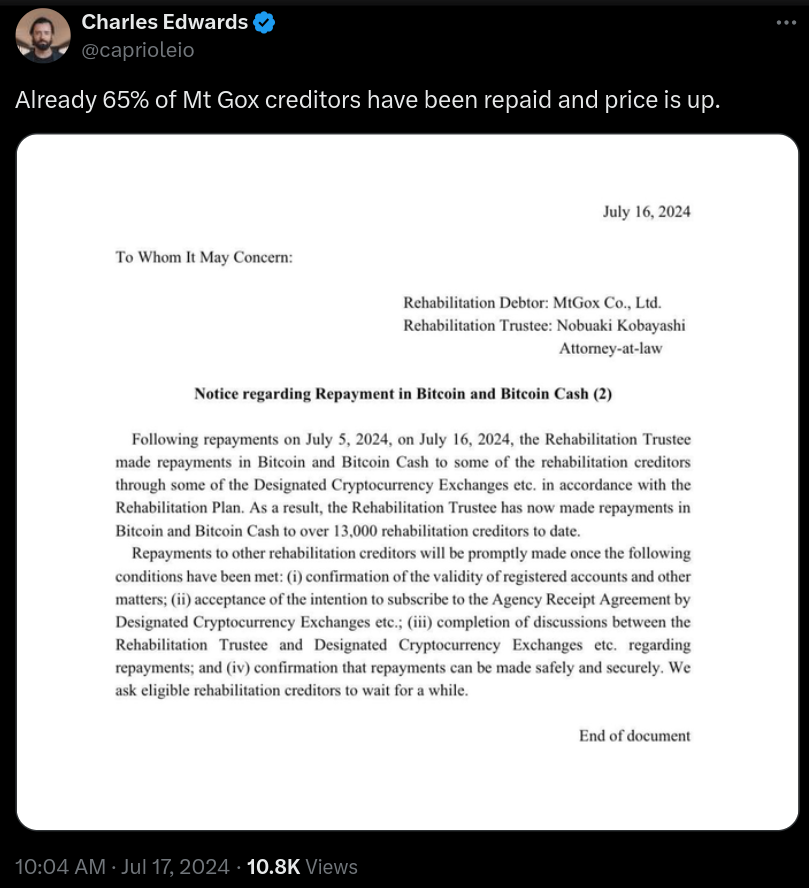

Following the selling pressure caused by the movement of Mt. Gox-related coins, Bitcoin (BTC) has gained 15% since the start of the uptrend on July 12.

On July 17, Bitcoin reached $66,000, marking its highest level in the past four weeks.

Bitcoin (BTC) has gained 15% over the past week. Following the most recent daily close, Bitcoin reached $66,129 on Bitstamp, reflecting the increase since the start of the upward trend on July 12.

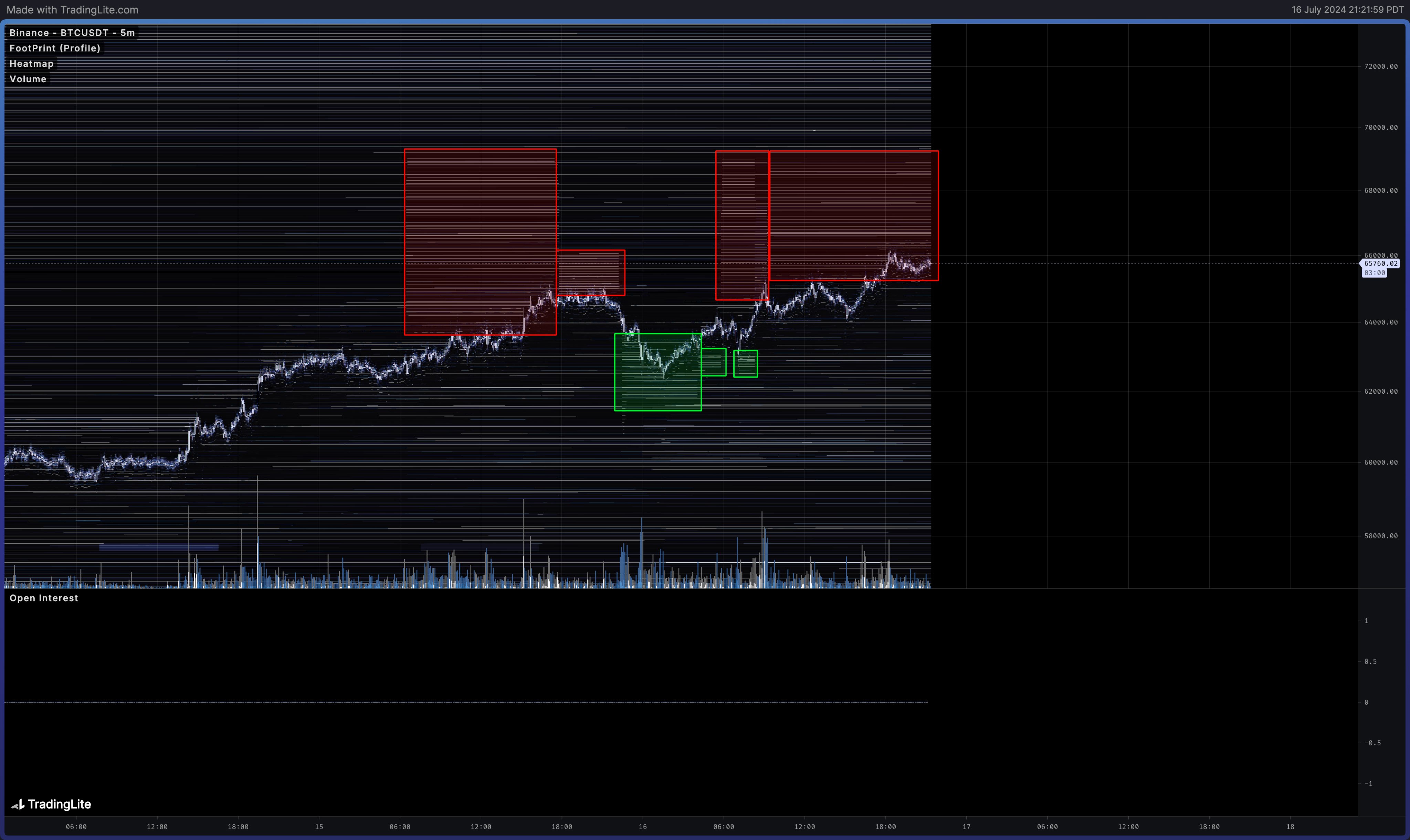

Despite the selling pressure from the movement of Mt. Gox-related coins, Bitcoin has shown significant growth. Popular trader Daan Crypto Trades summarized this rapid increase in a recent X (formerly Twitter) post, stating, "This happened quickly."

Daan Crypto Trades also noted, "It's crucial to maintain the green zone moving forward. If we do, I am quite confident that we will return to an upward trajectory and surpass this range before summer ends."

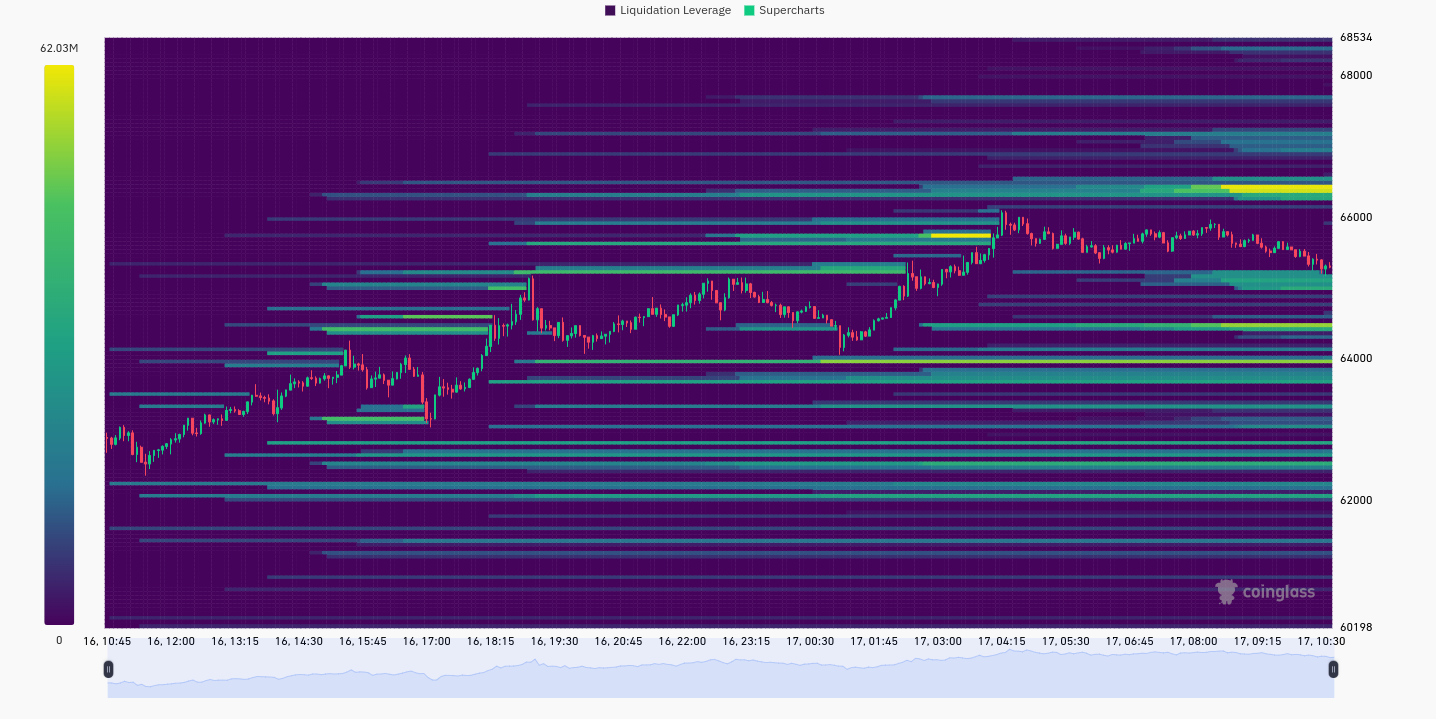

According to recent data from CoinGlass, the resistances in exchange order books do not pose an obstacle to upward movement.

Other popular traders share similar views. However, the resistance levels approaching all-time highs, along with the increased open interest, are in a different category.

Credible Crypto stated in a recent X analysis: "There are approximately 1,500 BTC ($100 million) worth of sell orders available on Binance up to $70,000."

Credible Crypto also noted that to push the market further up, buyers need to step in: "The depth on the order books is twice as thick as the order depth; we need some significant buyers to break through this level."

Other traders, including Skew, noted that "limit buyers during declines" will characterize short-term price movements and help maintain weekly gains.

Referring to Binance spot order book data on X, Skew commented, "So far, we are seeing limit orders rise with the price, which is something you want to see in an early uptrend."

Charles Edwards, founder of Capriole Investments, highlighted that with 65% of Mt. Gox funds already released and Bitcoin prices still rising, customers have not rushed to sell.

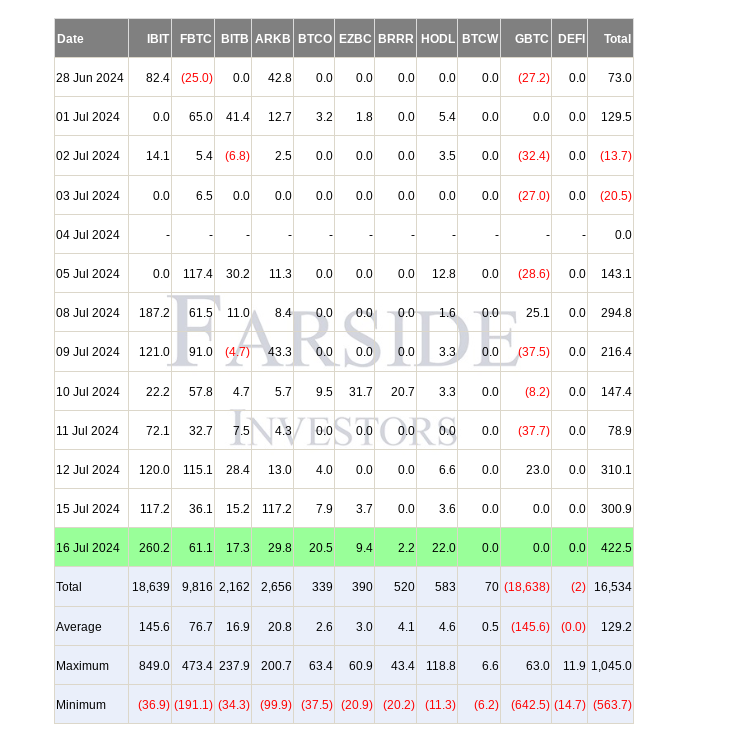

Bitcoin ETFs Leave Negative Days Behind

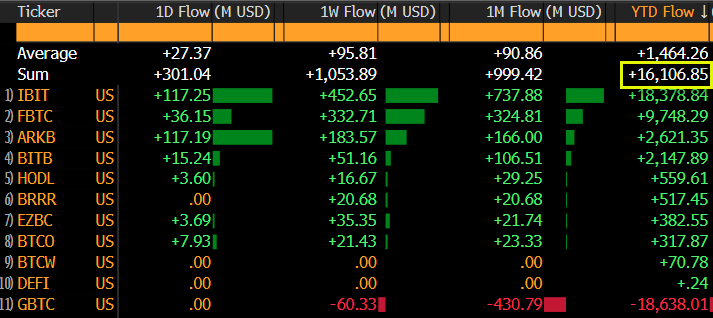

The rise in BTC prices has been accompanied by increasing interest in spot Bitcoin exchange-traded funds (ETFs) in the United States. According to sources including Farside Investors, a net inflow of $422 million was recorded on July 16.

Bloomberg ETF analyst Eric Balchunas commented, "Bitcoin ETFs have moved into 'two steps forward' mode with a net inflow of $300 million yesterday and $1 billion over the week, following a setback in June."

"Year-to-date net totals have surpassed $16 billion for the first time. Our initial forecast for the first 12 months was $12-15 billion, so we have already exceeded that amount with six months still to go."

You can stay updated with the latest developments and news in the cryptocurrency market on Kriptospot.com.