Where Will Bitcoin (Btc) Plant Its Flag At The Peak?

- Posted on April 30, 2024 10:21 PM

- Cryipto News

- 726 Views

Master trader Peter Brandt's comment suggesting that Bitcoin has currently reached its peak has sparked debates.

According to the "exponential decay" model proposed by veteran trader Peter Brandt, it seems likely that Bitcoin has set its peak for this cycle around the $70,000 level.

However, many different price models and analyses claim that Bitcoin has not yet reached the cycle peak and could reach $210,000 before the bull rally ends.

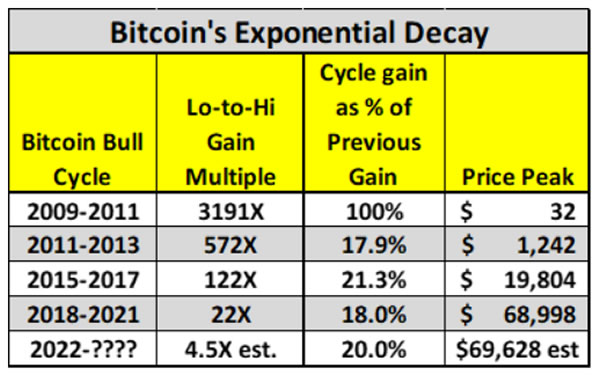

Peter Brandt published an analysis on April 27, stating that Bitcoin follows an "exponential decay" model in bull market cycles. This model predicts that the peak price of each new cycle corresponds to only about 20% of the peak price of the previous cycle. Current data supports this pattern occurring in the last three Bitcoin market cycles.

According to Brandt's explanation, "In other words, each successful bull market cycle loses approximately 80% of the energy of the previous cycle."

Based on Peter Brandt's "exponential decay" model, his prediction for the current cycle is that Bitcoin will only see a 4.5-fold increase from a bottom level of $15,500, peaking around $70,000. This level has already been reached in March.

However, Brandt is not fully confident in his theory and estimates a 25% chance that Bitcoin has already peaked in this cycle. His theory is also being debated by other analysts.

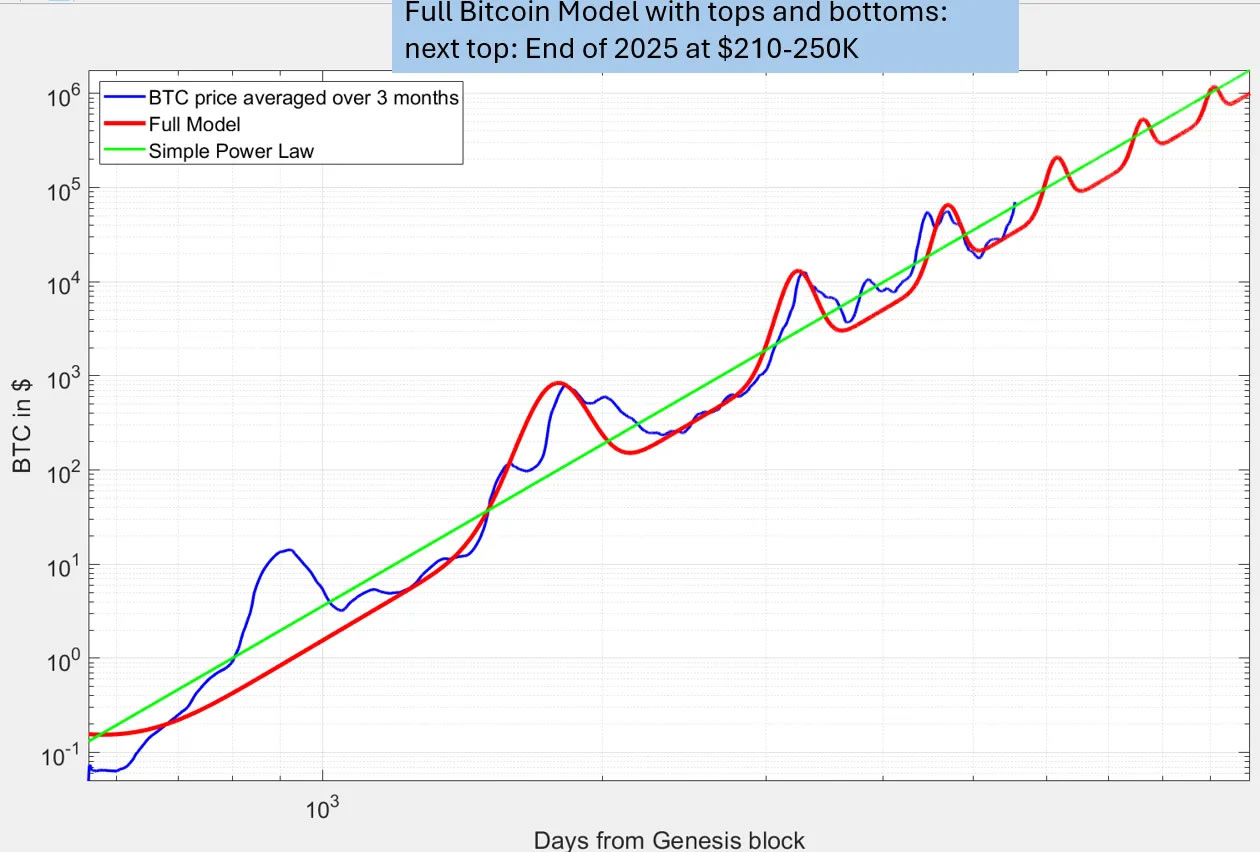

For example, Giovanni Santostasi, CEO and Research Director of Quantonomy, criticized the exponential decay model on April 29. He argued that the number of data points Brandt's theory relies on is too small, thus insufficient for drawing statistically robust conclusions.

Using a model based on long-term power law behavior, Santostasi predicted a fourth cycle peak for Bitcoin around $210,000 by December 2025. He also forecasted the next cycle's bottom to be approximately $83,000. This prediction uses the power law, which is a historical data-based model that illustrates how Bitcoin's price changes over time.

The analysis integrates trends in the power law, four-year halving cycles, exponentially decreasing peak heights, and other factors into a comprehensive model for predicting Bitcoin prices.

Many experts have made predictions about Bitcoin's peak during this cycle. Pav Hundal, the lead analyst at Swyftx, predicts that Bitcoin will at least double by the next halving in 2028, reaching around $120,000.

Another expert, Laurent Benayoun, CEO of Acheron Trading and a specialist in quantitative trading strategies, forecasts a cycle peak of $180,000.

Fidelity Digital Assets revised its medium-term outlook for Bitcoin on April 22, noting that it is no longer "cheap."

According to CoinGecko, at the time this article was written, BTC was trading at $62,528, a 15% decrease from its mid-March all-time high.

For ongoing updates on developments and the latest news in the cryptocurrency markets, you can follow Kriptospot.com in real-time.