Bitcoin Etfs Continue Their Rise

- Posted on January 17, 2024 11:40 PM

- Cryipto News

- 694 Views

On January 16, spot Bitcoin ETFs reached a volume of 1.8 billion dollars, tripling the total trading volume of 500 ETFs launched in 2023 on the same day.

Recently approved 10 spot Bitcoin ETFs reached a volume of $1.8 billion on January 16th, with funds offered by companies such as Grayscale, BlackRock, and Fidelity accounting for a total volume of $1.6 billion. However, according to Bloomberg ETF analyst Eric Balchunas, the total trading volume of the 500 ETFs launched in the United States last year was recorded at only $450 million on January 16th.

Let me put into context how insane $10b in volume is in first 3 days. There were 500 ETFs launched in 2023. Today, they did a COMBINDED $450m in volume. The best one did $45m. And many have had months to get going. $IBIT alone is seeing more activity than the entire '23 Freshman… https://t.co/wV1zQFtPW1

— Eric Balchunas (@EricBalchunas) January 16, 2024

BlackRock iShares Bitcoin Trust has taken a commanding lead by receiving over $497 million in net inflows in the last three days. According to figures provided by Bloomberg ETF analyst James Seyffart and compiled by Yahoo Finance via Cointelegraph, the total volume in the new spot Bitcoin ETF products reached around $10 billion in the first three days of trading. Grayscale Bitcoin ETF, on the other hand, surpassed $5.1 billion in trading volume, maintaining its leadership in total trading volume. However, there has been a significant outflow from the fund as investors opt for risk reduction. Since its debut on January 11th, Grayscale Bitcoin Trust (GBTC) has witnessed total outflows exceeding $579 million. Balchunas added that BlackRock's product is likely to continue receiving the most inflows, with a high probability of surpassing GBTC as the "liquidity king."

LATEST: Day Three volume so far half a billion for the Newborn Nine which is healthy, about the same pattern dropoff rate as $BITO (which again was the most successful organic launch in ETF history). $IBIT keeping lead to be one most likely to overtake $GBTC as Liquidity King. pic.twitter.com/hoatfSmNpN

— Eric Balchunas (@EricBalchunas) January 16, 2024

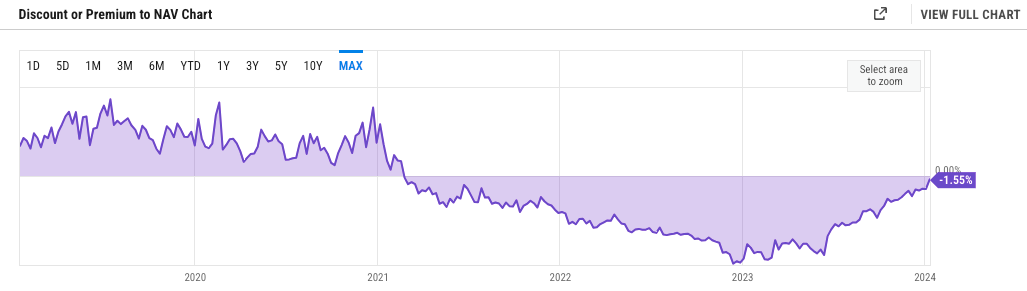

GBTC was once a boon for investors who entered the fund with borrowed money and then profited from the Grayscale premium. The product served as an indicator for Bitcoin demand in years when spot ETF products were not available. However, this arbitrage opportunity quickly led to significant losses when the premium suddenly turned into a discount. This situation trapped many investors who did not want to sell their assets at a steep discount.

Following the successful transformation of GBTC into a spot ETF, the discount rate dropped to 1.55%, providing an exit opportunity for investors who had held their assets locked up for an extended period.

Stay updated on developments in the cryptocurrency markets and the latest news through Kriptospot.com for real-time tracking.