Entries Into Bitcoin Etfs Have Slowed Down.

- Posted on April 3, 2024 12:51 AM

- Cryipto News

- 853 Views

While the overall trend remains positive in the crypto market, the demand for spot Bitcoin ETFs, which peaked in the first week of March, has been declining since then.

Last week, digital asset inflows made a positive turnaround with a net entry of $862 million, following a net outflow of $931 million the previous week. Nonetheless, the allure of spot Bitcoin ETFs seems to be diminishing. Compared to the record trading volume of $9.5 billion reached in the first week of March, the daily trading volume of ETFs dropped by 36% to $5.4 billion.

Bitcoin (BTC) stood out in digital asset inflows with $863 million, while spot BTC ETFs recorded an entry of $1.8 billion, alongside an outflow of $965 million compared to Grayscale Bitcoin Trust (GBTC).

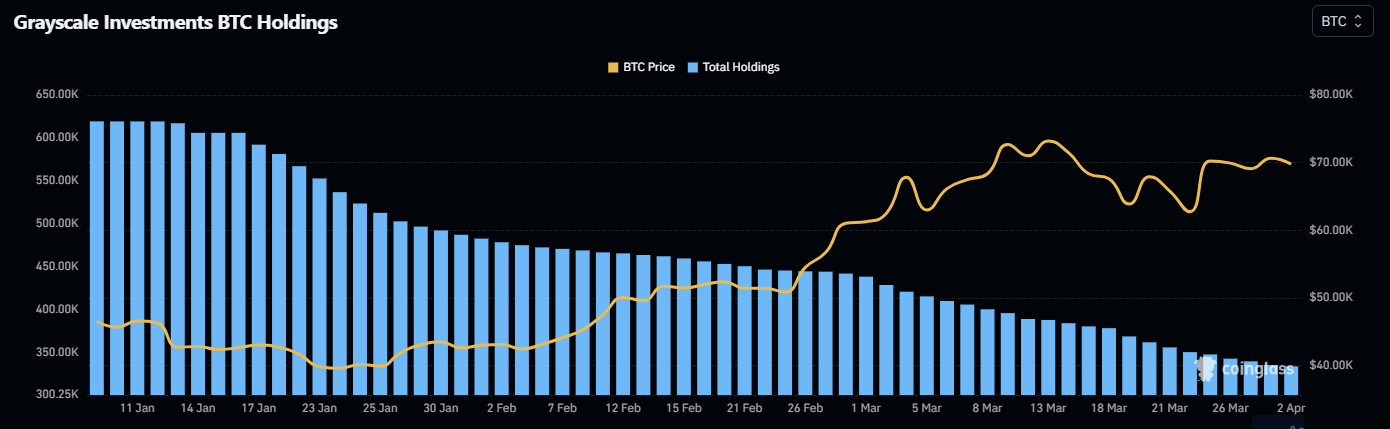

Grayscale's ETF continues to experience ongoing outflows even about three months after its approval in the US. These continuous outflows from GBTC have created a significant selling pressure on BTC prices over the past three weeks.

Market analysts had anticipated that the outflows from Grayscale Bitcoin Trust (GBTC) would gradually decrease and eventually cease, leading to an unprecedented demand for ETFs in contrast. However, current investor behavior shows that exits from GBTC are far from over and GBTC still dominates the ETF flows.

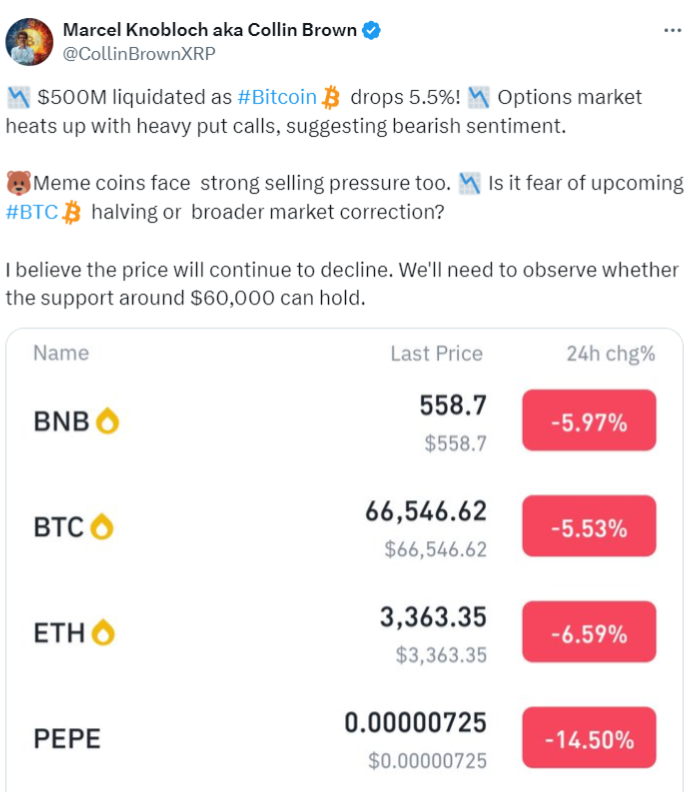

The selling pressure originating from ETFs is distinctly felt as Bitcoin, the world's largest cryptocurrency, has lost $4,000 in value over the last 24 hours, trading around $66,000 at the time of writing.

Many market experts consider this drop, occurring before the expected Bitcoin halving event on April 20, as a routine market correction.

The decline in Bitcoin prices led to the liquidation of positions worth approximately $500 million, while the options market showed a concentration in put options, indicating a bearish sentiment among traders.

Ether stood out with an outflow of $19 million for the fourth consecutive week. On the other hand, the altcoin market witnessed net inflows of $18.3 million last week, with a significant portion, $6.1 million, coming from the Solana (SOL) token.

The United States experienced the most significant capital outflow last week, amounting to approximately $897 million. Europe and Canada followed with a total outflow of $49 million.

Stay updated with the latest developments and news in the crypto markets with Kriptospot.com.