Bitcoin Fell To The Lowest Levels In The Last Two Months.

- Posted on January 24, 2024 6:30 PM

- Cryipto News

- 648 Views

With FTX joining in, the selling pressure has made the situation more challenging for Bitcoin.

Bitcoin fell to the lowest levels since early December 2023 on January 23rd, following the increased market response to the selling pressure after the opening of Wall Street.

FTX's Negative Impact

According to the data obtained, the price of BTC dropped to $38,505 on Bitstamp.

Bitcoin has partially recovered after a challenging period.

Attention has turned to GBTC, which still holds assets of over $20 billion, despite billions of dollars worth of BTC being sold this month.

According to data from Arkham Crypto, on January 23rd, 15,200 BTC (590 million dollars) were transferred from GBTC's assets to Coinbase.

Grayscale deposited 15,222 $BTC($588.5M) to #CoinbasePrime again 10 mins ago.#Grayscale has deposited 79,213 $BTC($3.27B) to #CoinbasePrime since the #ETF was passed, .

— Lookonchain (@lookonchain) January 23, 2024

According to Arkham, #Grayscale currently holds 535,755 $BTC ($20.68B).https://t.co/CdjVrnKSYx pic.twitter.com/Oq9RglF7Fz

This figure, although slightly lower compared to the previous day, continues to raise suspicions as the exact numbers are yet to be confirmed.

Renowned trader Daan Crypto Trades, in a post on the X platform, stated, "At least there was a relatively smaller decrease compared to yesterday."

"The previous day, although the net flows in all ETFs were slightly negative, ETFs are still performing well." Daan Crypto Trades discussed the performance of newly launched ETFs in the U.S., noting that the influx into new funds balanced out the outflows from GBTC.

Instead of blaming Grayscale, the issuer of GBTC, some individuals pointed fingers at FTX, which sold a significant amount of GBTC.

The CEO of Bitcoin technology firm Blockstream stated, "Selling GBTC in exchange for Bitcoin does not pull down the BTC price. Selling for dollars and holding dollars does."

"People who sell dollars do so due to mandatory liquidations and bankruptcy, like FTX. So, I'm not sure how much is left in net dollar sales after FTX's $1 billion sale."

Will the "sell the news" reaction regarding Bitcoin ETFs fade away?

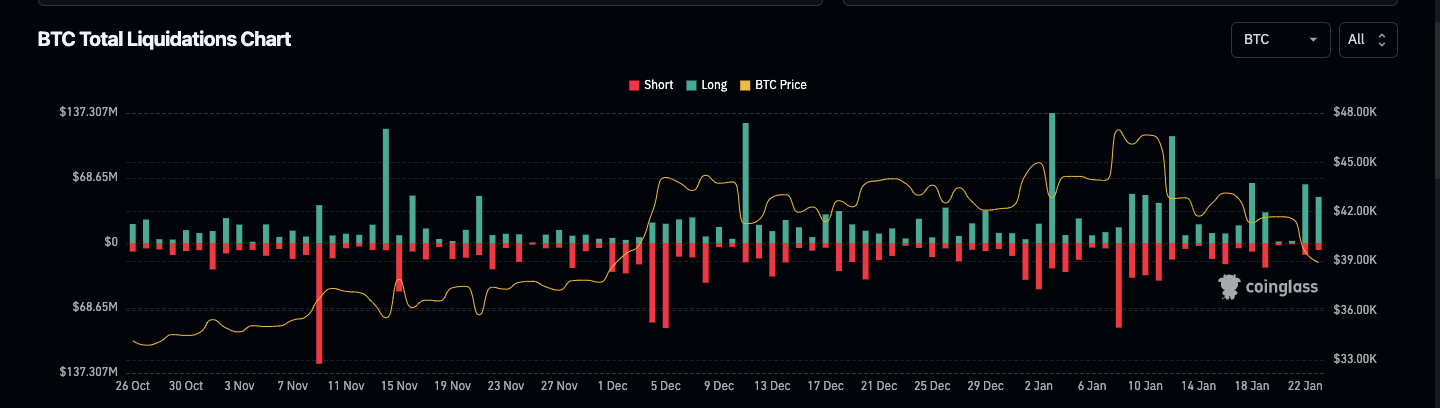

BTC long positions again had a tough day concerning spot liquidations.

According to the latest data from the statistic source CoinGlass, the closed long positions in the two days leading up to January 23rd amounted to around $110 million at the time of this broadcast.

Those with an optimistic perspective state that the selling pressure will not continue indefinitely.

We’re progressing now towards the celebration of the sell the news, but still not there yet.

— Cold Blooded Shiller (@ColdBloodShill) January 22, 2024

Noticeable shift in psychology today, bears celebrating, bulls angry at bears celebrating.

I’m still just relaxing and waiting for lower prices, as I have been for a while. https://t.co/RU4IJ3oyCk

Bloomberg ETF analyst Eric Balchunas highlighted the performance of BTC in 2023.

BTC recorded a 75% increase in the past 12 months, outperforming most stocks.