Bitcoin Chart And Etf Similarities: Will History Repeat Itself?

- Posted on May 5, 2024 1:05 AM

- Cryipto News

- 673 Views

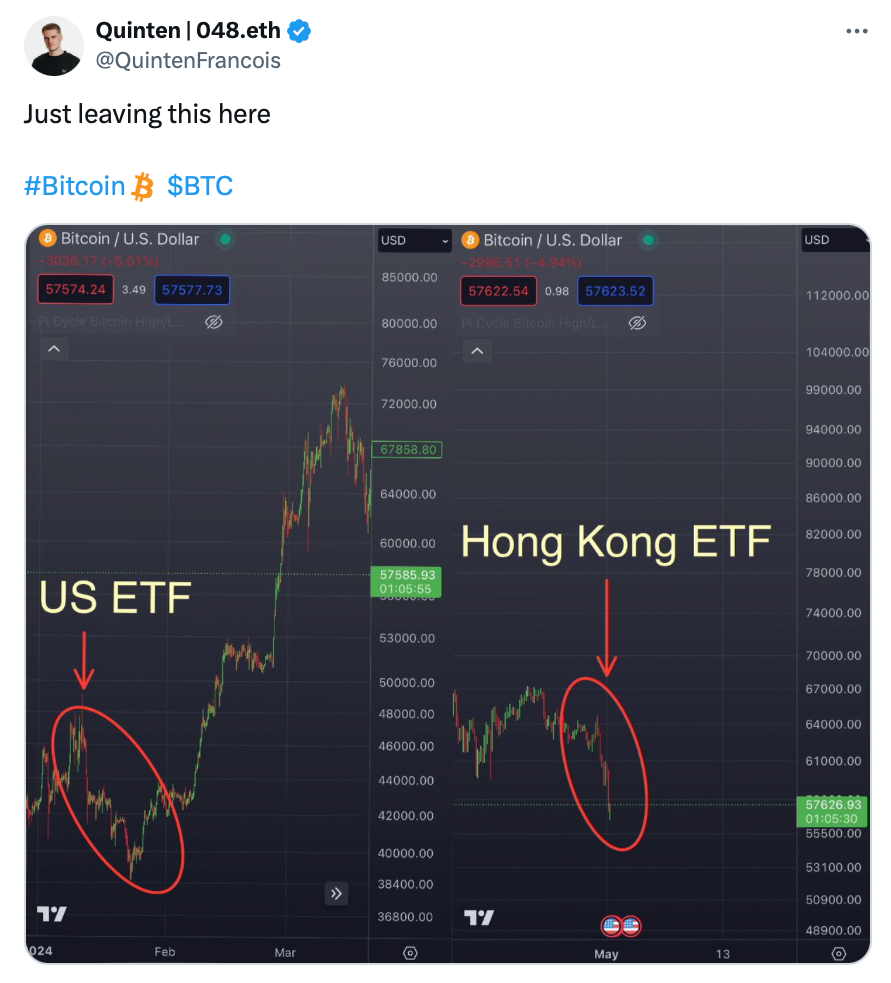

The Bitcoin price chart closely resembles the period when spot Bitcoin ETFs were launched in the US.

The recent decline in Bitcoin price bears similarities to the movement observed after the launch of spot Bitcoin exchange-traded funds (ETFs) in the US in January. An investor suggests that this situation could indicate a price increase in the near future.

Since the launch of spot Bitcoin ETFs in Hong Kong on April 30, there has been approximately $217 million in net inflows. However, according to CoinMarketCap data, Bitcoin price has declined by 7% since the introduction of these products.

Quinten Francois, co-founder of WhereAt Social and a crypto investor, noted that this trend resembles the launch of spot Bitcoin ETFs in the US. Francois shared that following the launch of ETFs, BTC price dropped by 14% within the first 12 days but then recovered by 7% in the subsequent seven days.

In a post on X platform on May 1, Francois expressed expectation for a price increase "within the next week" if Bitcoin follows a similar trend.

Another crypto analyst, StockLizard, supported this view by stating, "There's no straight path to the top. The price correction has been excessive."

While the launch of Bitcoin ETFs in Hong Kong and the US shows similarities, there are significant differences between them. Since their introduction, Hong Kong Bitcoin ETFs have seen a net inflow of $217 million, whereas ETFs in the US experienced a net outflow of $794 million during the same period.

Additionally, the trading volume of Hong Kong-based ETFs in the initial days was only $12.4 million, which is significantly lower than the $4.6 billion first-day trading volume of the US spot Bitcoin ETFs.

The ETF launches in Hong Kong also coincided with the post-Bitcoin halving period, and were accompanied by rising tensions in the Middle East and the Federal Reserve maintaining high interest rates, contributing to a "sideways" market trend.

However, Bloomberg ETF analyst Eric Balchunas argued in an article published on X on April 30 that considering Hong Kong's market size is approximately "1/168th of the US," this figure is quite high.

Some traders are concerned that the inflows from Hong Kong may not be sufficient to offset the recent large outflows from the US and could prevent a similar breakout pattern.

The crypto trading team TOBTC stated in a post on X on May 2 that "Hong Kong Bitcoin ETFs are not sufficient to absorb the selling pressure from US ETFs."

On the other hand, some traders believe that the recent price drop is a healthy market correction for Bitcoin.

Crypto trader Titan of Crypto said in a post on X, "The longer the consolidation of Bitcoin, the higher it will meet the price trend line."

Crypto commentator CryptoCon expressed, "The latest correction in Bitcoin was much needed for forward price stability."

Handre van Heerden, the founder of AirBtc, stated, "What Bitcoin critics don't understand is that it doesn't matter whether the price goes up or down."

Stay updated with the latest developments and news in the cryptocurrency markets with Kriptospot.com.