What Will Happen After The Bitcoin Halving?

- Posted on April 8, 2024 1:41 AM

- Cryipto News

- 781 Views

Coinbase has reported a slowdown in total cryptocurrency transaction volumes due to the market's "search for the next big move."

According to Coinbase, many cryptocurrency investors see Bitcoin's halving event as the main driving force behind a potential price increase. However, the timing of the year could be a hindrance.

According to Coinbase's market commentary report dated April 5th, the cryptocurrency market may need to find another story to further boost prices.

The exchange stated, "The BTC halving event, scheduled for April 20th or 21st, may be a catalyst for higher prices, but cryptocurrency markets and other risk assets typically struggle during the weak time of the year."

According to data from Brave New Coin, Bitcoin has provided an average monthly return of 2.7% between June and September since 2011, while it has averaged a return of 19.3% in the other eight months.

Coinbase also noted that overall crypto volumes continued to slow down "as the market looks for the next story to propel it higher."

According to CoinMarketCap data, the total cryptocurrency market volume decreased by 33.25% over the past 24 hours to $61.78 billion.

However, the crypto exchange sees signs indicating a potential increase in new investors entering the crypto market in the near future:

"In our view, the increasing acceptance of Bitcoin as 'digital gold' could lead to demand from a new subset of investors in this market regime."

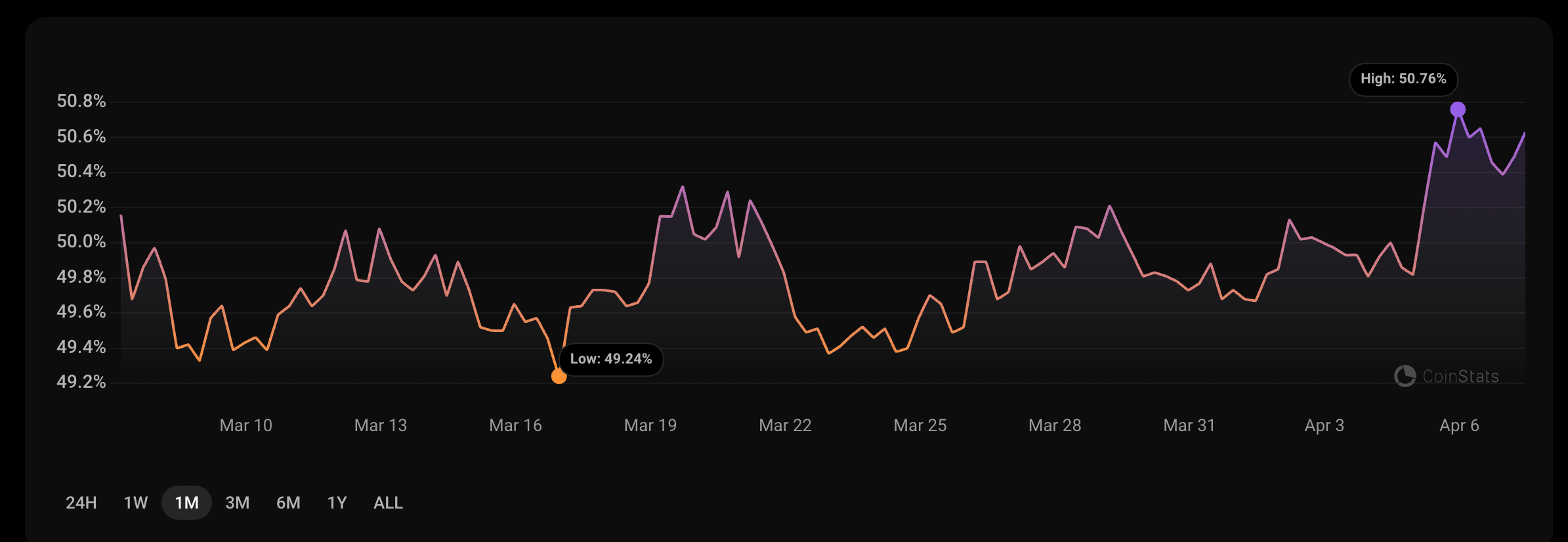

According to CoinStats data, Bitcoin's dominance in the overall cryptocurrency market is 50.6%. This ratio represents Bitcoin's market value relative to the overall cryptocurrency market.

The report also mentioned that if investors anticipate buying during price dips, the decreasing frequency of dips could occur as more investors enter the market.

Coinbase stated, "As a result, although volatility may persist during price discovery, we believe dips will be bought more aggressively compared to previous cycles."

Halving events are often associated with increases in Bitcoin's price.

After the previous halving event in May 2020, the price of Bitcoin surged. The cryptocurrency started the halving event at $8,787, and by November 2021, it reached approximately $69,000.

The United States Second Circuit Court of Appeals ruled in favor of Coinbase, affirming that the secondary sales of cryptocurrencies on its platform did not violate the Securities Exchange Act.

Plaintiffs alleged that Coinbase offered and sold unregistered securities. Additionally, they accused the exchange of violating various provisions of securities laws.

However, Coinbase argued that secondary sales of crypto assets did not meet the criteria for securities transactions, thus claiming compliance with securities regulations.

You can follow developments and the latest news in the cryptocurrency markets in real-time on Kriptospot.com.