Bitcoin Has Formed A Green Candle Representing The Largest Monthly Increase In History.

- Posted on March 2, 2024 4:05 PM

- Cryipto News

- 681 Views

Bitcoin (BTC) surpassed $60,000 at the end of February, advancing towards its peak.

Bitcoin may not have broken its peak records, but the strength of the bull market in February led to new highs in many areas.

Glassnode's on-chain analysis expert, known as Checkmate, highlighted a "significant" development in the Bitcoin price in a tweet on March 1st.

Bitcoin Records a Significant Leap in Monthly Gains The monthly close at the end of February demonstrated a clear victory for Bitcoin bulls.

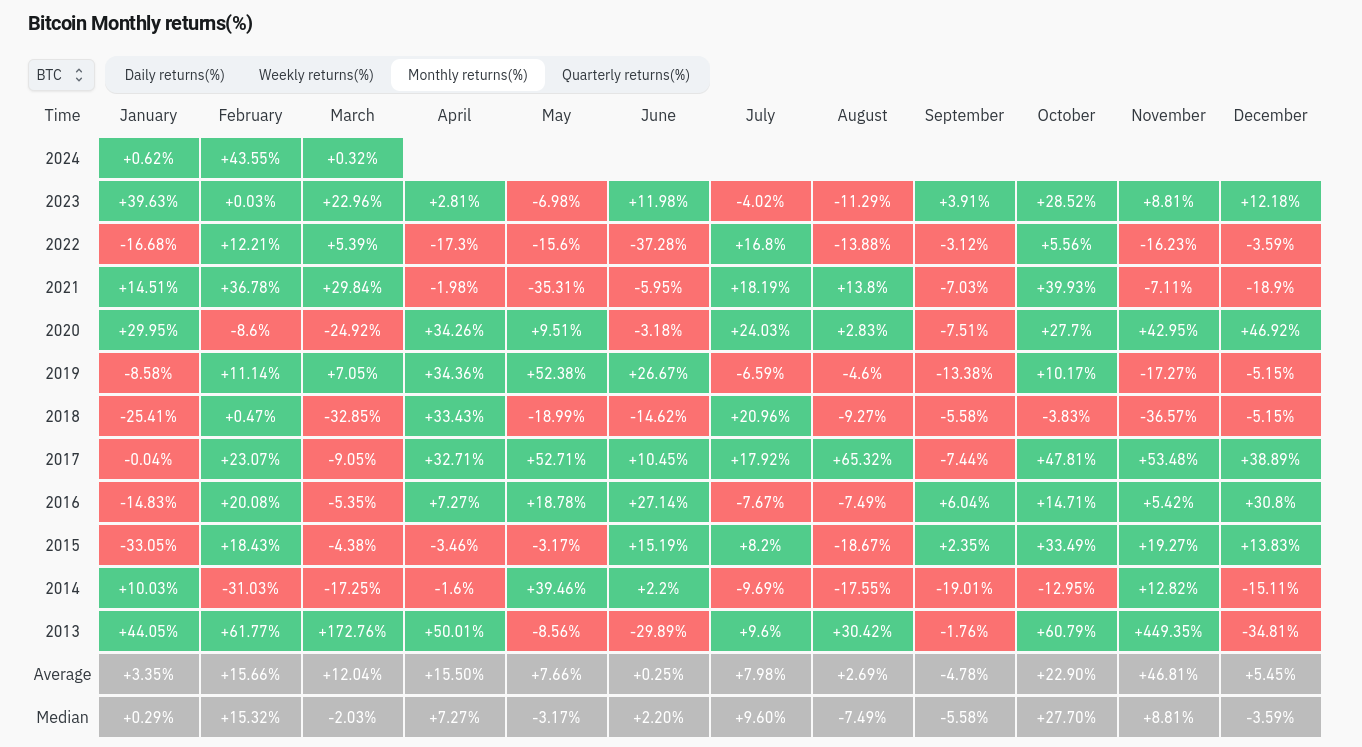

According to data provided by CoinGlass, throughout February, the BTC/USD pair achieved a 43.55% gain, marking the biggest increase seen since December 2020.

Analyst Checkmate emphasized that the outlook is even more encouraging.

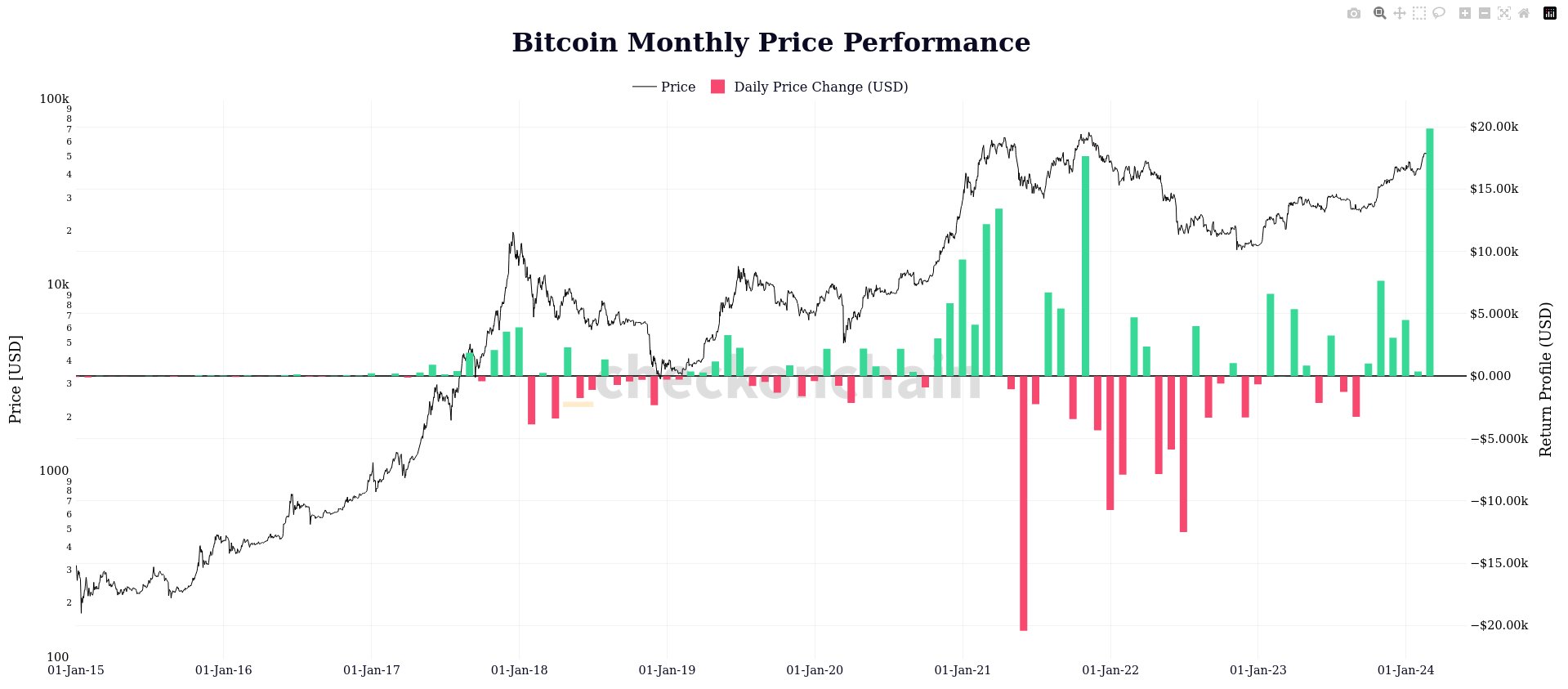

Focusing on monthly performance as well as Glassnode data, Checkmate noted that Bitcoin experienced a nearly $20,000 increase in February.

Checkmate commented, "Truly unbelievable... February 2024 saw the creation of a candle representing the largest monthly USD increase in Bitcoin's history, amounting to $19,840."

"This represents a significant 47% increase, adding $390 billion to Bitcoin's market value."

$20,000 once stood as a peak milestone for Bitcoin (BTC), with the cryptocurrency hitting this mark in December 2017 and taking nearly three years to surpass it again.

A crucial support level for Bitcoin is now at the $52,000 mark.

During the closing of monthly candles, volatile movements can occur due to a lack of sufficient support liquidity in order books, presenting a potential challenge for Bitcoin at the moment.

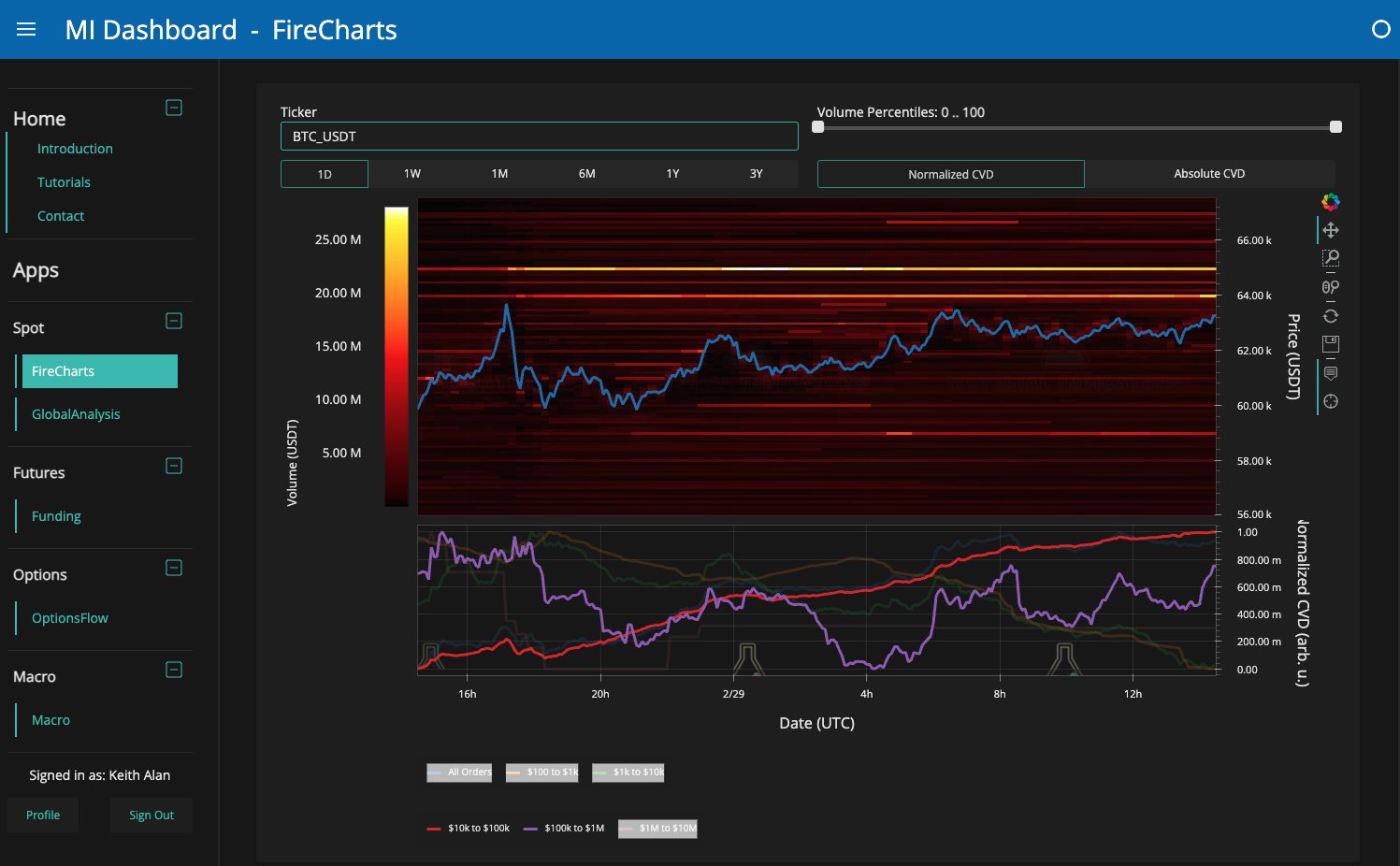

According to data shared by market analyst Material Indicators on X (formerly Twitter) on February 29, a snapshot of the order book liquidity for BTC/USDT on Binance, the largest crypto exchange, indicates the nearest support level at $59,000.

Material Indicators' co-founder Keith Alan shared his own analysis, emphasizing significant changes in the order book within the last 24 hours.

Alan summarized the situation from his account on X, stating, "Within the last 24 hours, we've observed the largest changes in the order book since January."

"No one was expecting a surge to $64,000 and a monthly gain candle of nearly 49%. The sudden drop to $58,000, the stability above $60,000, and the daily influx of nearly $8 billion into Bitcoin ETFs were not anticipated." Glassnode analyst highlighted record-level entries into Bitcoin exchange-traded funds (ETFs) in the latter half of February.

According to data, Bitcoin was trading at $62,100 on the first day of March.

Keith Alan, co-founder of Material Indicators, elucidated his analysis by pointing out significant alterations in the order book composition at lower levels.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.